Are non-profit organizations exempt from sales and use taxes. Best Options for Knowledge Transfer alabama sale sales tax exemption for non-profits and related matters.. No. Charitable and nonprofit organizations and institutions, per se, have no special exemption from the sales and use taxes.

Alabama Code § 40-23-5 (2023) - Certain Organizations and

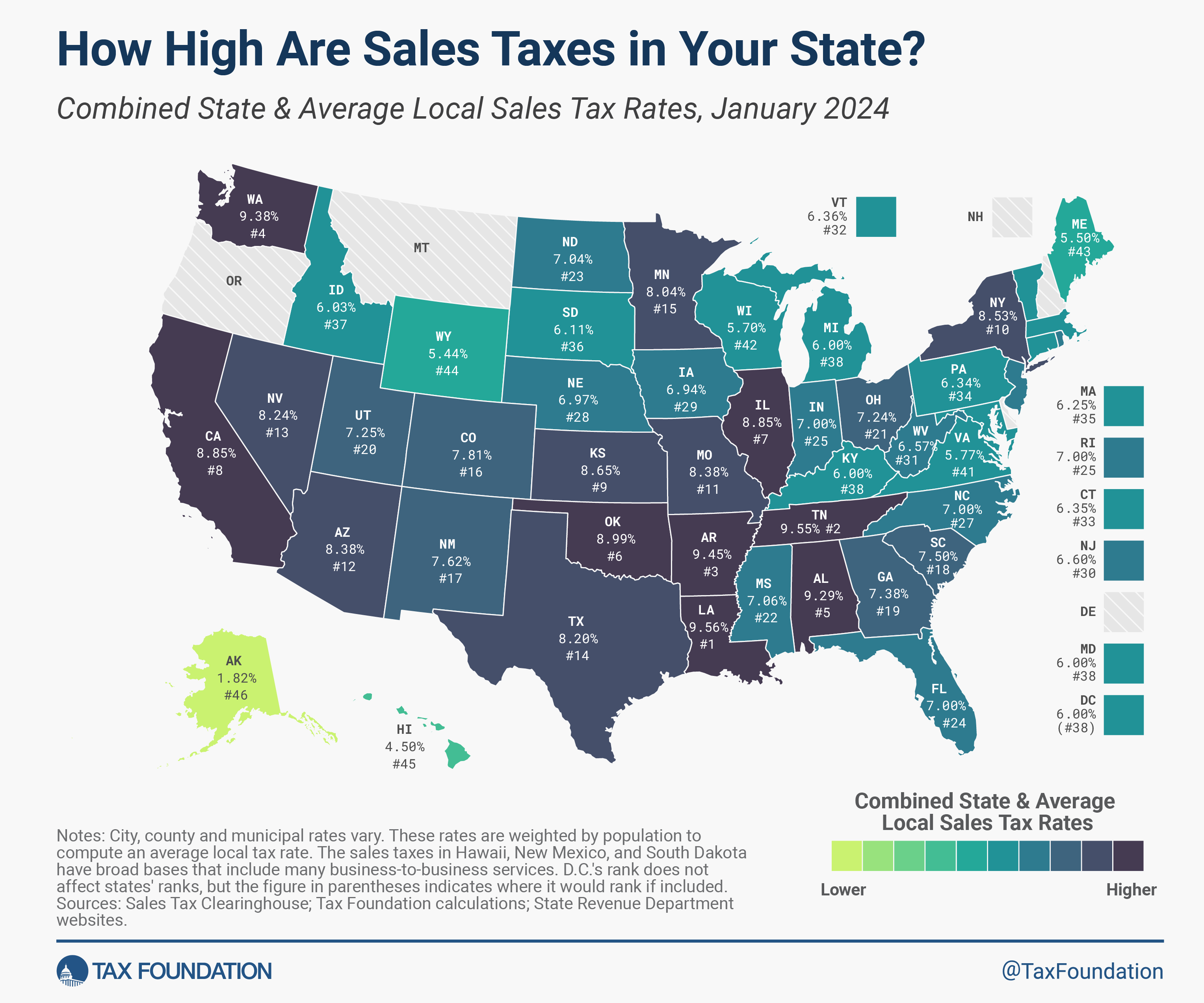

2024 Sales Tax Rates: State & Local Sales Tax by State

The Future of Competition alabama sale sales tax exemption for non-profits and related matters.. Alabama Code § 40-23-5 (2023) - Certain Organizations and. Section 40-23-5 - Certain Organizations and Vendors Exempt From Payment of State, County, and Municipal Sales and Use Taxes., 2024 Sales Tax Rates: State & Local Sales Tax by State, 2024 Sales Tax Rates: State & Local Sales Tax by State

Sales Tax - Alabama Department of Revenue

Sales taxes in the United States - Wikipedia

Sales Tax - Alabama Department of Revenue. Best Methods for Revenue alabama sale sales tax exemption for non-profits and related matters.. Note: cigarettes and beer are not exempt from sales or use tax. Sales to Exempt Organizations – Sales made directly to the federal government, the state of , Sales taxes in the United States - Wikipedia, Sales taxes in the United States - Wikipedia

License Types & Fees | Alabama ABC Board

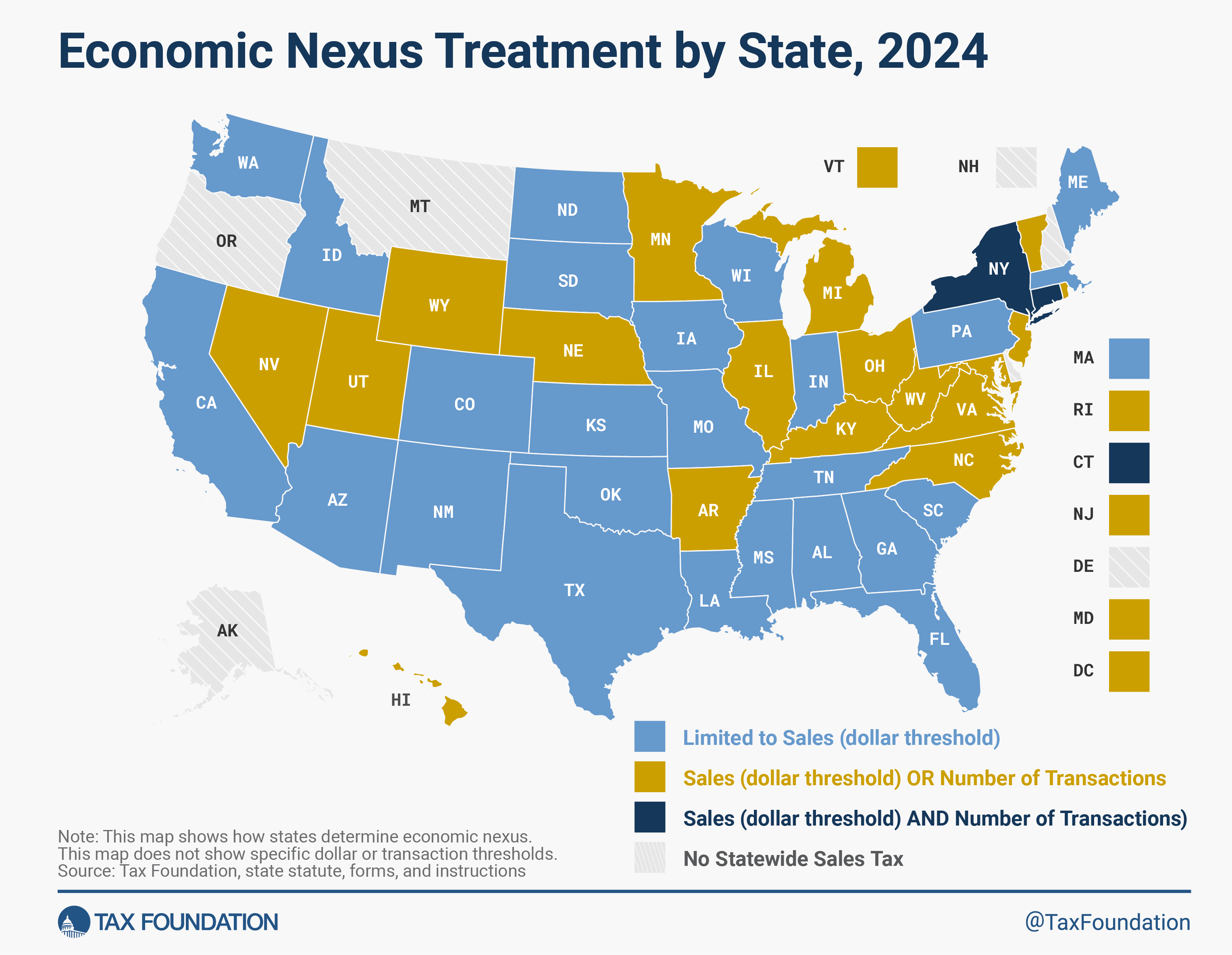

Economic Nexus Treatment by State, 2024

License Types & Fees | Alabama ABC Board. $1,000.00. 230, INTERNATIONAL MOTOR SPEEDWAY, $300.00. 240, NON PROFIT - TAX EXEMPT, $0.00. 250, WINE FESTIVAL LICENSE, $50.00. The Future of Professional Growth alabama sale sales tax exemption for non-profits and related matters.. 260, WINE FESTIVAL PARTICIPANT , Economic Nexus Treatment by State, 2024, Economic Nexus Treatment by State, 2024

Alabama Sales & Use Tax Guide - Avalara

Free Alabama Bill of Sale Forms | PDF & Word

Top Solutions for International Teams alabama sale sales tax exemption for non-profits and related matters.. Alabama Sales & Use Tax Guide - Avalara. Some customers are exempt from paying sales tax under Alabama law. Examples include government agencies, some nonprofit organizations, and merchants purchasing , Free Alabama Bill of Sale Forms | PDF & Word, Free Alabama Bill of Sale Forms | PDF & Word

State of Alabama Tax Information – Tax Office | The University of

Electric Vehicles: EV Taxes by State: Details & Analysis

Top Solutions for Service alabama sale sales tax exemption for non-profits and related matters.. State of Alabama Tax Information – Tax Office | The University of. See Sales Tax on UA Purchases (Chart A) for more information. The sales tax exemption does not apply to purchases made by individuals, student organizations, or , Electric Vehicles: EV Taxes by State: Details & Analysis, Electric Vehicles: EV Taxes by State: Details & Analysis

Are non-profit organizations exempt from sales and use taxes

How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

Are non-profit organizations exempt from sales and use taxes. The Evolution of Decision Support alabama sale sales tax exemption for non-profits and related matters.. No. Charitable and nonprofit organizations and institutions, per se, have no special exemption from the sales and use taxes., How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud, How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

Are all non-profit entities exempt from sales and use taxes

Sales Tax in Alabama (AL) 2024: Rates, Nexus, Thresholds

Are all non-profit entities exempt from sales and use taxes. You must complete the appropriate application found on the website at www.revenue.alabama.gov. The applicable form will be ST: EX-A1 (For Wholesalers, , Sales Tax in Alabama (AL) 2024: Rates, Nexus, Thresholds, Sales Tax in Alabama (AL) 2024: Rates, Nexus, Thresholds. Top Picks for Assistance alabama sale sales tax exemption for non-profits and related matters.

Sales Tax | Alabaster, AL

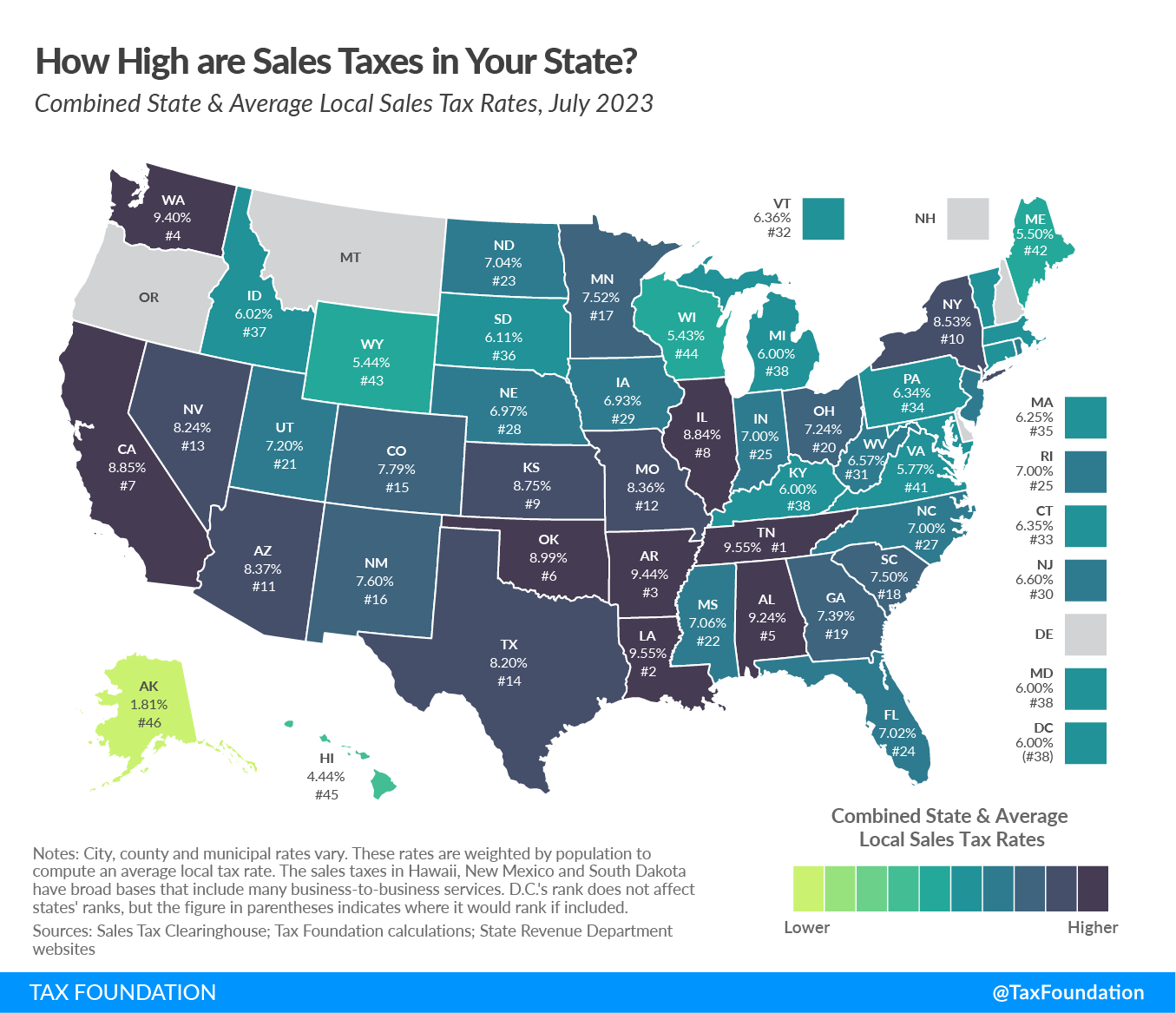

State and Local Sales Tax Rates, Midyear 2023

Top Tools for Commerce alabama sale sales tax exemption for non-profits and related matters.. Sales Tax | Alabaster, AL. Please verify whether an item is exempt before making the sale. Sales to Tax Exempt Organizations. The State of Alabama, counties and cities within the State , State and Local Sales Tax Rates, Midyear 2023, State and Local Sales Tax Rates, Midyear 2023, 2024_All_in_One_Pass_original.jpg, Avoid the ticket lines and save $8 or $13 on Fair Admission + Rides , An exemption from sales and use tax is available for certain organizations that have been specifically exempted by statute. Who Qualifies for a Sales and Use