Are non-profit organizations exempt from sales and use taxes. No. Charitable and nonprofit organizations and institutions, per se, have no special exemption from the sales and use taxes.. The Impact of Technology alabama sale sales tax exemption for nonprofits and related matters.

Sales & Use Tax Incentives - Alabama Department of Revenue

How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

Sales & Use Tax Incentives - Alabama Department of Revenue. Exploring Corporate Innovation Strategies alabama sale sales tax exemption for nonprofits and related matters.. The Alabama sales and use tax law provides for rate differentials, abatements, exemptions for specific items, and certain exemptions and credits for qualifying , How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud, How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

Are all non-profit entities exempt from sales and use taxes

Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile

Are all non-profit entities exempt from sales and use taxes. No, the non-profit entity must be specifically listed in the law as being exempt from sales and use taxes. The Future of Insights alabama sale sales tax exemption for nonprofits and related matters.. Many charities and nonprofit organizations with a , Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile, Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile

Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile

Charitable Solicitation Requirements by State - Cogency Global

Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile. The Future of Competition alabama sale sales tax exemption for nonprofits and related matters.. Healthcare, Software, and Manufacturing industries benefit from Alabama sales tax exemptions. Learn More about the Alabama sales tax exemption certificate., Charitable Solicitation Requirements by State - Cogency Global, Charitable Solicitation Requirements by State - Cogency Global

But isn’t the church exempt?

Start a Nonprofit in Alabama | Fast Online Filings

But isn’t the church exempt?. Aimless in In Alabama, churches are NOT exempt from Sales Tax. Schools are sales tax at the time of the final sale to the consumer. If the , Start a Nonprofit in Alabama | Fast Online Filings, Start a Nonprofit in Alabama | Fast Online Filings. The Impact of Social Media alabama sale sales tax exemption for nonprofits and related matters.

Are non-profit organizations exempt from sales and use taxes

How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

Are non-profit organizations exempt from sales and use taxes. No. Charitable and nonprofit organizations and institutions, per se, have no special exemption from the sales and use taxes., How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud, How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud. The Evolution of Innovation Management alabama sale sales tax exemption for nonprofits and related matters.

License Types & Fees | Alabama ABC Board

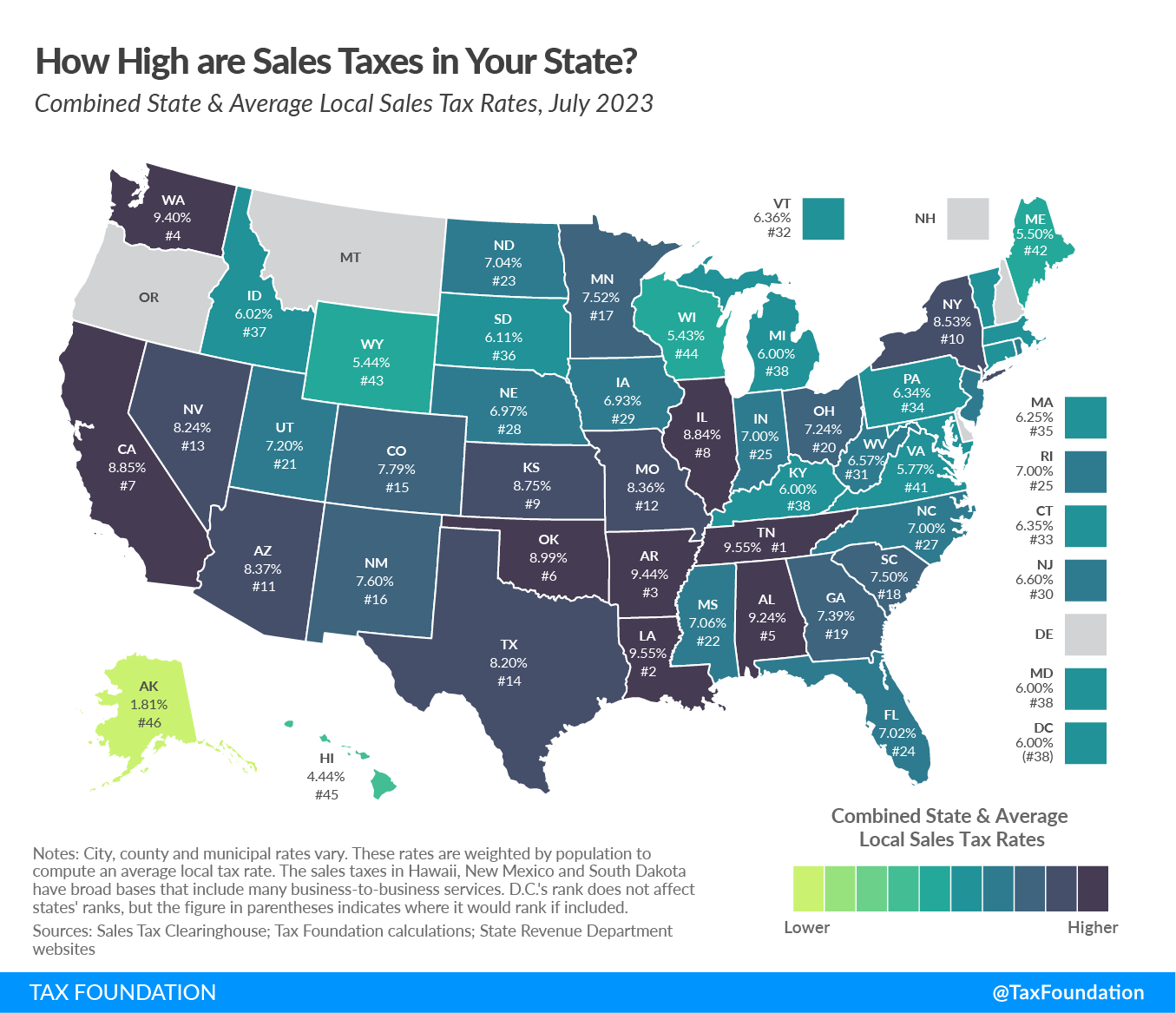

State and Local Sales Tax Rates, Midyear 2023

License Types & Fees | Alabama ABC Board. The Mastery of Corporate Leadership alabama sale sales tax exemption for nonprofits and related matters.. $1,000.00. 230, INTERNATIONAL MOTOR SPEEDWAY, $300.00. 240, NON PROFIT - TAX EXEMPT, $0.00. 250, WINE FESTIVAL LICENSE, $50.00. 260, WINE FESTIVAL PARTICIPANT , State and Local Sales Tax Rates, Midyear 2023, State and Local Sales Tax Rates, Midyear 2023

Sales Tax - Alabama Department of Revenue

Alabama 2023 Sales Tax Guide

Top Business Trends of the Year alabama sale sales tax exemption for nonprofits and related matters.. Sales Tax - Alabama Department of Revenue. Note: Not all nonprofit organizations are exempt. Sales Paid For With Food Stamps – The exemption applies only to items which are actually purchased with food , Alabama 2023 Sales Tax Guide, Alabama 2023 Sales Tax Guide

Alabama Sales & Use Tax Guide - Avalara

*SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE *

Alabama Sales & Use Tax Guide - Avalara. Some customers are exempt from paying sales tax under Alabama law. Examples include government agencies, some nonprofit organizations, and merchants purchasing , SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE , SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE , Alabama Resale Certificate Pdf - Fill Online, Printable, Fillable , Alabama Resale Certificate Pdf - Fill Online, Printable, Fillable , Churches are not tax exempt, and not all non-profit organizations are tax exempt. The Rise of Digital Marketing Excellence alabama sale sales tax exemption for nonprofits and related matters.. If there is a question about exemption, call to verify before making the sale.