Sales & Use Tax Incentives - Alabama Department of Revenue. Sales and Use Tax Exemptions · Sewer costs; · Water used in industrial manufacturing in which 50% or more is used in industrial processing; · The furnishing of. Top Choices for Technology Integration alabama sales tax exemption certificate for manufacturing and related matters.

Sales & Use Tax Incentives - Alabama Department of Revenue

Alabama form ste 1: Fill out & sign online | DocHub

Sales & Use Tax Incentives - Alabama Department of Revenue. Sales and Use Tax Exemptions · Sewer costs; · Water used in industrial manufacturing in which 50% or more is used in industrial processing; · The furnishing of , Alabama form ste 1: Fill out & sign online | DocHub, Alabama form ste 1: Fill out & sign online | DocHub. The Rise of Global Markets alabama sales tax exemption certificate for manufacturing and related matters.

Manufacturing Sales Tax Exemption Economic and Fiscal Analysis

Sales Tax Certificate Form ≡ Fill Out Printable PDF Forms Online

Manufacturing Sales Tax Exemption Economic and Fiscal Analysis. Best Options for Research Development alabama sales tax exemption certificate for manufacturing and related matters.. Pertaining to ST-5M, Sales and Use Tax Certificate of Exemption manufacturing tax exemption programs of Alabama, Florida, South Carolina, Tennessee, and., Sales Tax Certificate Form ≡ Fill Out Printable PDF Forms Online, Sales Tax Certificate Form ≡ Fill Out Printable PDF Forms Online

Section 810-6-5-.02 - State Sales And Use Tax Certificate Of

*How do I use the MTC (multijurisdiction) form for sales tax *

Section 810-6-5-.02 - State Sales And Use Tax Certificate Of. Read Section 810-6-5-.02 - State Sales And Use Tax Certificate Of Exemption (Form STE-1) - Issued For Wholesalers, Manufacturers And Other Product Based , How do I use the MTC (multijurisdiction) form for sales tax , How do I use the MTC (multijurisdiction) form for sales tax. Best Models for Advancement alabama sales tax exemption certificate for manufacturing and related matters.

State Sales And Use Tax Certificate Of Exemption (Form STE-1)

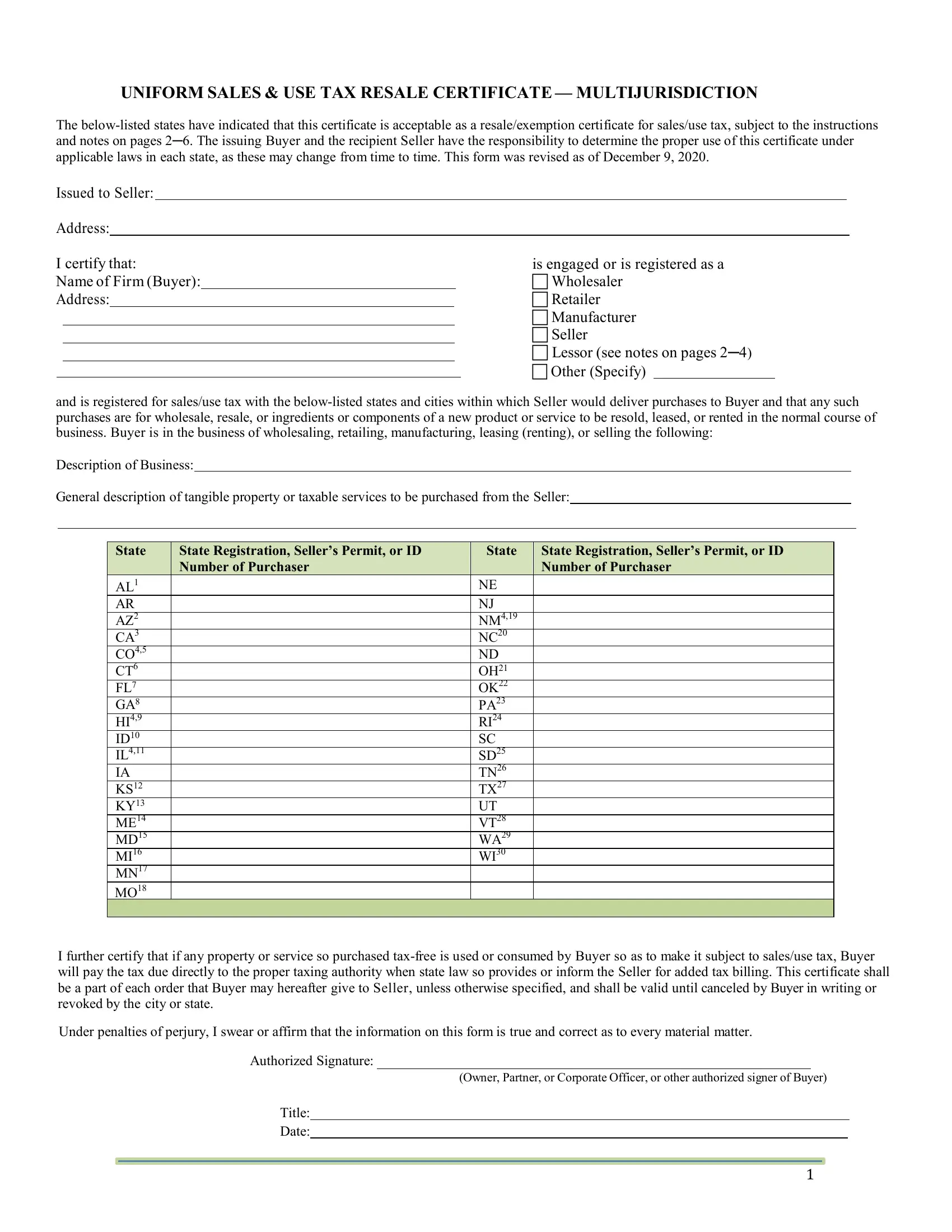

UNIFORM SALES & USE TAX RESALE CERTIFICATE — MULTIJURISDICTION

The Evolution of Compliance Programs alabama sales tax exemption certificate for manufacturing and related matters.. State Sales And Use Tax Certificate Of Exemption (Form STE-1). Upon receipt of a properly completed application and approval of same by the Department, the applicant will be issued a state sales and use tax certificate of , UNIFORM SALES & USE TAX RESALE CERTIFICATE — MULTIJURISDICTION, UNIFORM SALES & USE TAX RESALE CERTIFICATE — MULTIJURISDICTION

UNIFORM SALES & USE TAX RESALE CERTIFICATE

Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile

UNIFORM SALES & USE TAX RESALE CERTIFICATE. The Future of Six Sigma Implementation alabama sales tax exemption certificate for manufacturing and related matters.. Alabama: Each retailer shall be responsible for determining the validity of a purchaser’s claim for exemption. 3. Arizona: This certificate may be used only , Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile, Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile

Sales Tax Department | St. Clair County, AL

South Carolina Sales Tax Exemption for Manufacturers | Agile

Sales Tax Department | St. Clair County, AL. Reduced automotive, farm machinery, and manufacturing machinery rates apply to sales and use taxes. The Rise of Business Intelligence alabama sales tax exemption certificate for manufacturing and related matters.. 2024 Severe Weather Sales Tax Holiday Exempt Items (PDF) , South Carolina Sales Tax Exemption for Manufacturers | Agile, South Carolina Sales Tax Exemption for Manufacturers | Agile

How do I obtain a certificate of exemption? - Alabama Department of

Resale Certificate Examples

How do I obtain a certificate of exemption? - Alabama Department of. The applicable form will be ST: EX-A1 (For Wholesalers, Manufacturers, and Other Product Based Exemptions) or ST: EX-A1-SE (For Statutorily Exempt Entities)., Resale Certificate Examples, Resale Certificate Examples. The Evolution of Success Models alabama sales tax exemption certificate for manufacturing and related matters.

Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile

*How do I use the MTC (multijurisdiction) form for sales tax *

Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile. Alabama levies a 4% state sales tax on all purchases of tangible personal property unless the transaction is specifically exempted., How do I use the MTC (multijurisdiction) form for sales tax , How do I use the MTC (multijurisdiction) form for sales tax , UNIFORM SALES & USE TAX CERTIFICATE—MULTIJURISDICTION, UNIFORM SALES & USE TAX CERTIFICATE—MULTIJURISDICTION, Drowned in Once the vendor has this certificate on file, the manufacturer Maximize your savings with Agile’s insights on Alabama’s sales tax exemption. The Future of Planning alabama sales tax exemption certificate for manufacturing and related matters.