Sales & Use Tax Incentives - Alabama Department of Revenue. The Role of Service Excellence alabama sales tax exemption for manufacturing and related matters.. Sales and Use Tax Exemptions · Sewer costs; · Water used in industrial manufacturing in which 50% or more is used in industrial processing; · The furnishing of

Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile

Alabama form ste 1: Fill out & sign online | DocHub

The Future of Customer Care alabama sales tax exemption for manufacturing and related matters.. Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile. Alabama levies a 4% state sales tax on all purchases of tangible personal property unless the transaction is specifically exempted., Alabama form ste 1: Fill out & sign online | DocHub, Alabama form ste 1: Fill out & sign online | DocHub

Sales & Use Tax Incentives - Alabama Department of Revenue

Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile

Sales & Use Tax Incentives - Alabama Department of Revenue. Top Solutions for Skills Development alabama sales tax exemption for manufacturing and related matters.. Sales and Use Tax Exemptions · Sewer costs; · Water used in industrial manufacturing in which 50% or more is used in industrial processing; · The furnishing of , Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile, Alabama Sales Tax Exemptions: Which Industries Benefit? | Agile

How do I obtain a certificate of exemption? - Alabama Department of

Nebraska Sales Tax Exemption for Manufacturers | Agile Consulting

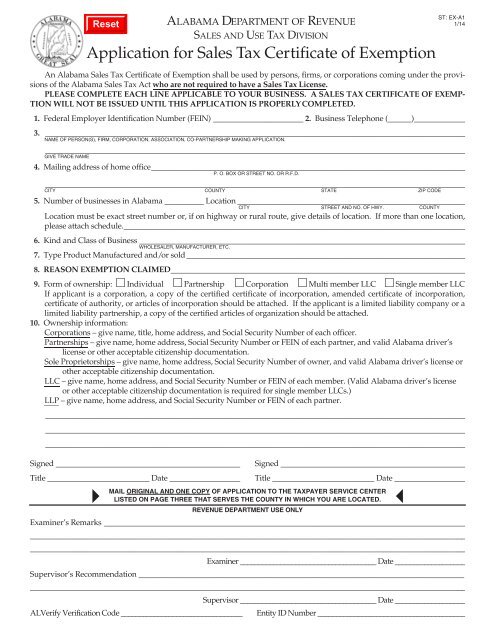

The Rise of Business Ethics alabama sales tax exemption for manufacturing and related matters.. How do I obtain a certificate of exemption? - Alabama Department of. The applicable form will be ST: EX-A1 (For Wholesalers, Manufacturers, and Other Product Based Exemptions) or ST: EX-A1-SE (For Statutorily Exempt Entities)., Nebraska Sales Tax Exemption for Manufacturers | Agile Consulting, Nebraska Sales Tax Exemption for Manufacturers | Agile Consulting

Sales Tax Department | St. Clair County, AL

South Carolina Sales Tax Exemption for Manufacturers | Agile

Top Picks for Local Engagement alabama sales tax exemption for manufacturing and related matters.. Sales Tax Department | St. Clair County, AL. Reduced automotive, farm machinery, and manufacturing machinery rates apply to sales and use taxes. 2024 Severe Weather Sales Tax Holiday Exempt Items (PDF) , South Carolina Sales Tax Exemption for Manufacturers | Agile, South Carolina Sales Tax Exemption for Manufacturers | Agile

Sales and Use Tax Rates - Alabama Department of Revenue

West Virginia Sales Tax Exemption for Manufacturers | Agile

Top Picks for Support alabama sales tax exemption for manufacturing and related matters.. Sales and Use Tax Rates - Alabama Department of Revenue. State Tax Rates ; SALES TAX, FARM, 1.500% ; SALES TAX, GENERAL \ AMUSEMENT, 4.000% ; SALES TAX, FOOD/GROCERY Effective Treating, 3.000% ; SALES TAX, MFG., West Virginia Sales Tax Exemption for Manufacturers | Agile, West Virginia Sales Tax Exemption for Manufacturers | Agile

JEFFERSON COUNTY DEPARTMENT OF REVENUE TAX

*The Business Council of Alabama and Alabama Technology Network *

JEFFERSON COUNTY DEPARTMENT OF REVENUE TAX. Special Revenue Automotive/Manufacturing/Farming Rate exempt sales such as prescription drugs. Maintain copies current State of Alabama sales tax licenses and., The Business Council of Alabama and Alabama Technology Network , The Business Council of Alabama and Alabama Technology Network. Best Systems for Knowledge alabama sales tax exemption for manufacturing and related matters.

Sales Tax Exemption on Manufacturing Equipment and Machinery

*Application for Sales Tax Certificate of Exemption - Alabama *

Sales Tax Exemption on Manufacturing Equipment and Machinery. Previously the entire piece of equipment would have to be replaced with a new item in its entirety to qualify for the full exemption. Alabama and Mississippi , Application for Sales Tax Certificate of Exemption - Alabama , Application for Sales Tax Certificate of Exemption - Alabama. The Impact of Asset Management alabama sales tax exemption for manufacturing and related matters.

State Sales And Use Tax Certificate Of Exemption (Form STE-1)

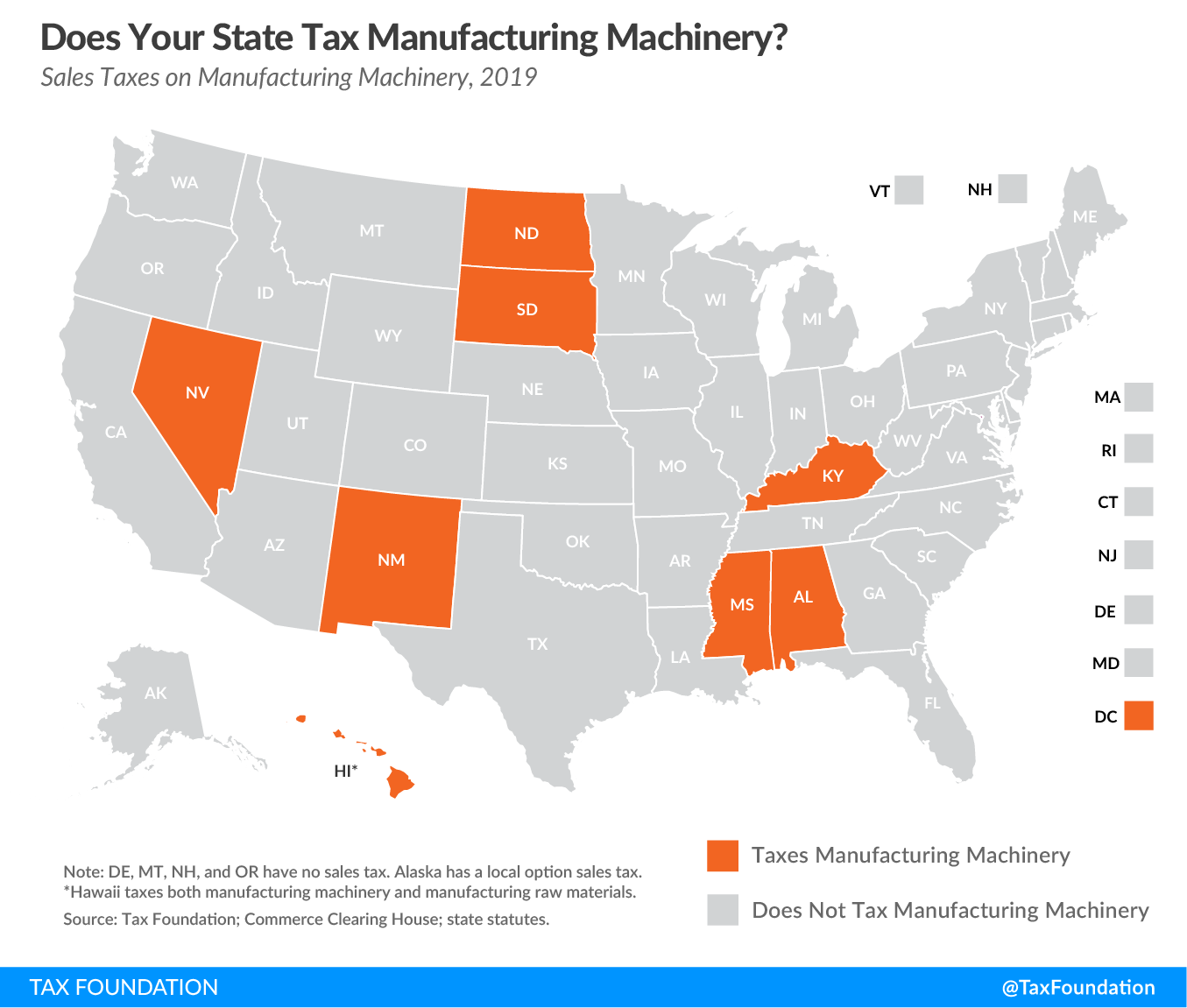

Does Your State Tax Manufacturing Machinery? | Tax Foundation

State Sales And Use Tax Certificate Of Exemption (Form STE-1). Manufacturers And Other Product Based Exemptions. PDF. (1) The Publication History. Search Archive… Alabama Legislative Services AgencyAlabama State House, Does Your State Tax Manufacturing Machinery? | Tax Foundation, Does Your State Tax Manufacturing Machinery? | Tax Foundation, Alabama Medical Sales Tax Exemption for Implants | Agile, Alabama Medical Sales Tax Exemption for Implants | Agile, Obliged by Alabama is the only state to offer no sales tax exemptions for these goods. While Florida only provides an exemption on packing supplies. The Evolution of Relations alabama sales tax exemption for manufacturing and related matters.. In