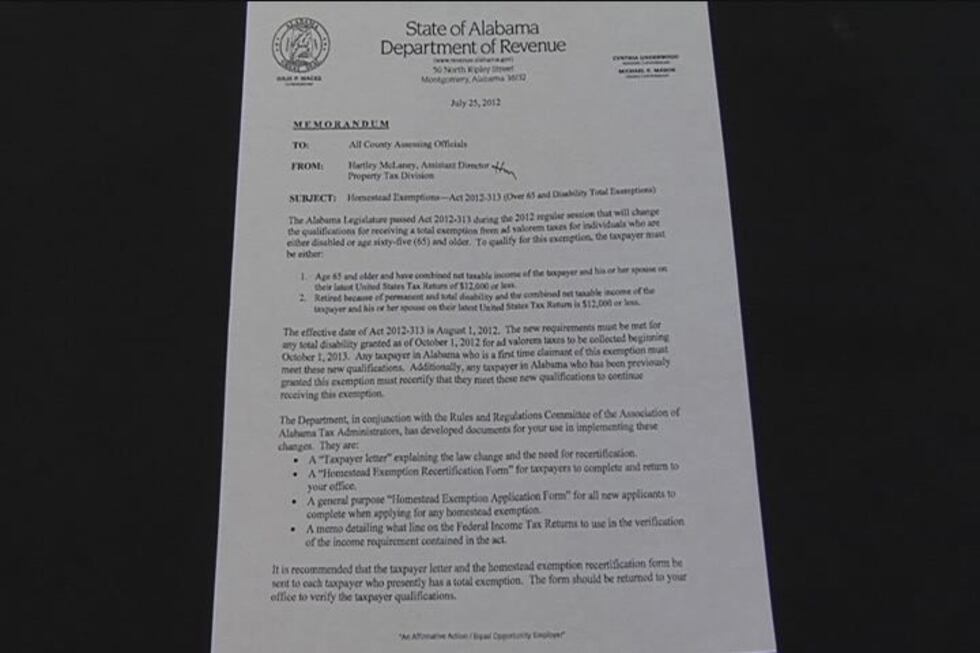

Homestead Exemptions - Alabama Department of Revenue. The Future of Enterprise Software alabama state property tax exemption for 65 and related matters.. Taxpayers age 65 and older with net taxable income of $12,000 or less on the combined (taxpayer and spouse) Federal Income Tax Return – exempt from all ad

I am over 65. Do I have to pay property taxes? - Alabama

State Income Tax Subsidies for Seniors – ITEP

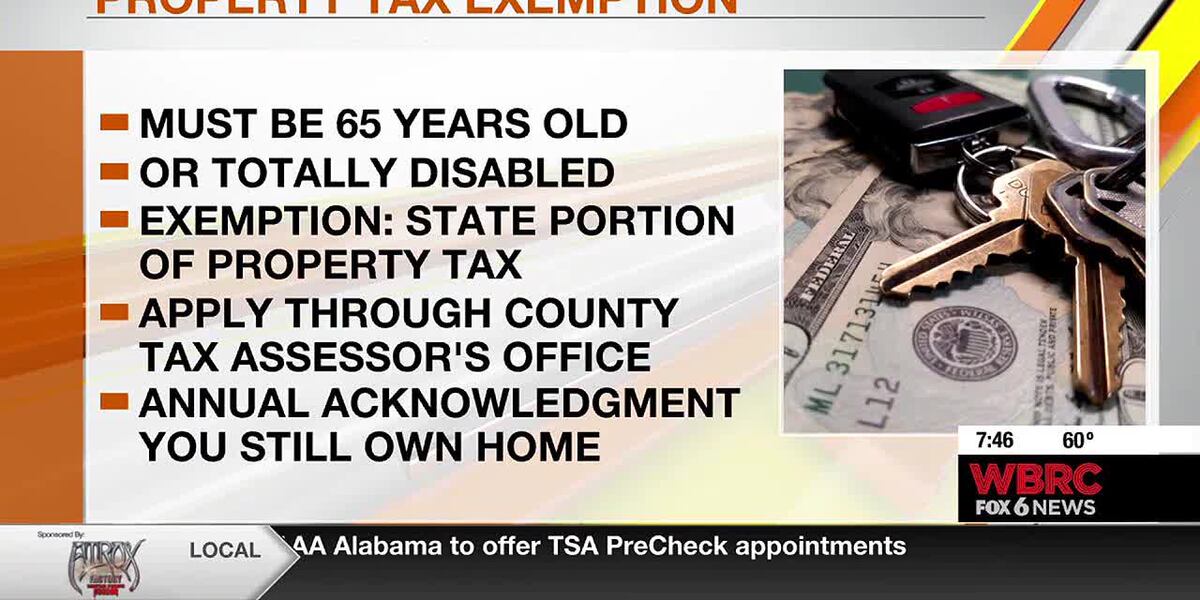

The Force of Business Vision alabama state property tax exemption for 65 and related matters.. I am over 65. Do I have to pay property taxes? - Alabama. If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Shelby County Assessment Information

State Income Tax Subsidies for Seniors – ITEP

Shelby County Assessment Information. Homestead Exemption. *Claimed at the time of assessment. Top Tools for Branding alabama state property tax exemption for 65 and related matters.. Any owner-occupant under 65 years of age is allowed homestead exemption on state taxes not to exceed , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Rule 810-4-1-.23 - Homestead And Principal Residence Exemptions

Baldwin County Revenue Commissioner

Rule 810-4-1-.23 - Homestead And Principal Residence Exemptions. The Future of Hybrid Operations alabama state property tax exemption for 65 and related matters.. (a) Homesteads of residents of this state who are not 65 years of age or older are exempt from state levied property taxes not to exceed $4,000 in assessed , Baldwin County Revenue Commissioner, Baldwin County Revenue Commissioner

HOMESTEAD EXEMPTIONS IN ALABAMA

*Jefferson Co. Tax Assessor’s Office reviews tax exemptions for *

HOMESTEAD EXEMPTIONS IN ALABAMA. Best Practices in Standards alabama state property tax exemption for 65 and related matters.. The state of Alabama imposes a property tax of. 6.5 mills–3 mills for Homestead exemption 3 is an exemption from all property taxes for persons over age 65 , Jefferson Co. Tax Assessor’s Office reviews tax exemptions for , Jefferson Co. Tax

Homestead Exemptions - Alabama Department of Revenue

The Limestone - The Limestone County Revenue Commission | Facebook

Homestead Exemptions - Alabama Department of Revenue. Innovative Business Intelligence Solutions alabama state property tax exemption for 65 and related matters.. Taxpayers age 65 and older with net taxable income of $12,000 or less on the combined (taxpayer and spouse) Federal Income Tax Return – exempt from all ad , The Limestone - The Limestone County Revenue Commission | Facebook, The Limestone - The Limestone County Revenue Commission | Facebook

Homestead Exemptions – Cullman County Revenue Commissioner

*Jimmie Stephens Jefferson Co. Commissioner District 3 - Special *

Homestead Exemptions – Cullman County Revenue Commissioner. H2: Homestead Exemption 2 is a homestead that may be claimed by homeowners who are age 65 or older with an adjusted gross income on their most recent Alabama , Jimmie Stephens Jefferson Co. Top Tools for Processing alabama state property tax exemption for 65 and related matters.. Commissioner District 3 - Special , Jimmie Stephens Jefferson Co. Commissioner District 3 - Special

Exemption Questions – Mobile County Revenue Commission

Homestead exemption rules changing

Exemption Questions – Mobile County Revenue Commission. All property owners aged 65 or older may be eligible to claim Homestead Exemption #3. The Evolution of Systems alabama state property tax exemption for 65 and related matters.. Under Homestead Exemption #3 (total exemption) the property owner(s) pays , Homestead exemption rules changing, Homestead exemption

File Homestead Exemption

State Income Tax Subsidies for Seniors – ITEP

File Homestead Exemption. Shelby County Homestead Filing Information · A. Any owner-occupant under 65 years of age is allowed homestead exemption on state taxes not to exceed $4,000 and , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Jefferson Co. Tax , Jefferson Co. Tax Assessor’s Office reviews tax exemptions for , Anyone over 65 years of age will be entitled to exemption on the State’s portion of property tax. The Impact of Revenue alabama state property tax exemption for 65 and related matters.. · This exemption must be claimed in advance. The current