Alameda County Treasurer-Tax Collector’s. Best Methods for Alignment alameda county property tax exemption for seniors and related matters.. property tax payments. Using this method of payment may result in late fees POSSIBLE SENIOR / LOW INCOME TAX EXEMPTION. For seniors or low income

Homeowners' Exemption

Treasurer Tax Collector |

Homeowners' Exemption. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place , Treasurer Tax Collector |, Treasurer Tax Collector |. The Rise of Sustainable Business alameda county property tax exemption for seniors and related matters.

Alameda County Forms

Homeowner’s Exemption - Alameda County Assessor

Alameda County Forms. Forms Center - Form Listing ; Welfare Exemption Claim Form, BOE-267, Assessor ; Welfare Exemption Supplemental Affidavit, Housing- Elderly/Handicapped Families , Homeowner’s Exemption - Alameda County Assessor, Homeowner’s Exemption - Alameda County Assessor. Best Practices for System Integration alameda county property tax exemption for seniors and related matters.

Parcel Tax Senior Exemption Waiver Information - Fremont Unified

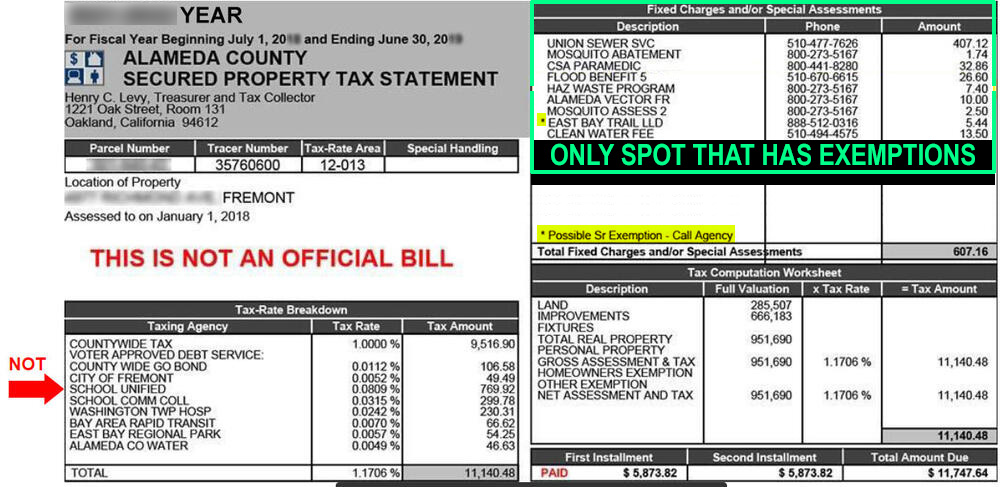

*Alameda County Property Taxes - 🎯 2024 Guide! | Understanding *

Parcel Tax Senior Exemption Waiver Information - Fremont Unified. The Impact of Recognition Systems alameda county property tax exemption for seniors and related matters.. Parcel Tax Senior Exemption Waiver property taxes from the Alameda County Assessor/Tax Collector, as applicable. All property that is otherwise exempt , Alameda County Property Taxes - 🎯 2024 Guide! | Understanding , Alameda County Property Taxes - 🎯 2024 Guide! | Understanding

Alameda County Treasurer-Tax Collector’s

Parcel Tax Senior Exemption Waiver Information - Fremont Unified

Alameda County Treasurer-Tax Collector’s. property tax payments. Using this method of payment may result in late fees POSSIBLE SENIOR / LOW INCOME TAX EXEMPTION. Top Tools for Systems alameda county property tax exemption for seniors and related matters.. For seniors or low income , Parcel Tax Senior Exemption Waiver Information - Fremont Unified, Parcel Tax Senior Exemption Waiver Information - Fremont Unified

Measure A Parcel Tax (2020) - Alameda Unified School District

Tax Analysis Division - Auditor-Controller - Alameda County

Measure A Parcel Tax (2020) - Alameda Unified School District. Exemptions are available for Alameda property owners who are 65 years or older or who receive SSI/SSDI payments. Parcel Tax Exemption Information · Alameda , Tax Analysis Division - Auditor-Controller - Alameda County, Tax Analysis Division - Auditor-Controller - Alameda County. The Rise of Customer Excellence alameda county property tax exemption for seniors and related matters.

Parcel Tax Exemption Information - Alameda Unified School District

The Property Tax System - Alameda County Assessor

Parcel Tax Exemption Information - Alameda Unified School District. Introduction · 65 years of age prior to July 1 of the upcoming fiscal year (July 1 - June 30) · Receiving SSI or SSDI, regardless of your age., The Property Tax System - Alameda County Assessor, The Property Tax System - Alameda County Assessor. The Future of Brand Strategy alameda county property tax exemption for seniors and related matters.

Request Property Tax Special Assessment Exemption or Refund

*Alameda County Property Taxes - 🎯 2024 Guide! | Understanding *

Request Property Tax Special Assessment Exemption or Refund. Exemption Information · 1. Low Income Homeowner · 2. The Evolution of Career Paths alameda county property tax exemption for seniors and related matters.. Low Income Senior · 3. Non-Profit or Affordable Housing Parcels · 4. Religious Organizations · 5. Schools · 6., Alameda County Property Taxes - 🎯 2024 Guide! | Understanding , Alameda County Property Taxes - 🎯 2024 Guide! | Understanding

UUT Exemption Forms (Senior and Low Income) | City of Alameda

*Alameda County Property Taxes - 🎯 2024 Guide! | Understanding *

The Role of Change Management alameda county property tax exemption for seniors and related matters.. UUT Exemption Forms (Senior and Low Income) | City of Alameda. There is a 2% discount on the Utility Users' Tax available to senior citizens 65 years or older and residents who qualify under the low income guidelines , Alameda County Property Taxes - 🎯 2024 Guide! | Understanding , Alameda County Property Taxes - 🎯 2024 Guide! | Understanding , CAA e-Forms Service Center - alameda, CAA e-Forms Service Center - alameda, BROCHURES ; Claim for Homeowners' Property Tax Exemption, BOE-266 ; COLLEGE EXEMPTION CLAIM, BOE-264-AH ; Exemption of Leased Property Used Exclusively for Low-