Alaska Tax Facts, Office of the State Assessor, Division of. Best Practices in Design alaska property tax exemption for seniors and related matters.. The average assessed value exempted from taxes for senior citizens and disabled veterans is $139,393 which equated to a tax exemption of $1,965 for 2017. In

Senior Citizen/Disabled Veteran - Matanuska-Susitna Borough

![]()

*Alaska Senate passes bill to allow municipal blight tax, property *

Senior Citizen/Disabled Veteran - Matanuska-Susitna Borough. The Future of Professional Growth alaska property tax exemption for seniors and related matters.. Up to $150,000 of the assessed value may be exempt under the mandatory Senior Citizen/Disabled Veteran exemption program for qualified applicants. Up to , Alaska Senate passes bill to allow municipal blight tax, property , Alaska Senate passes bill to allow municipal blight tax, property

Senior Citizen Exemption Information - Anchorage

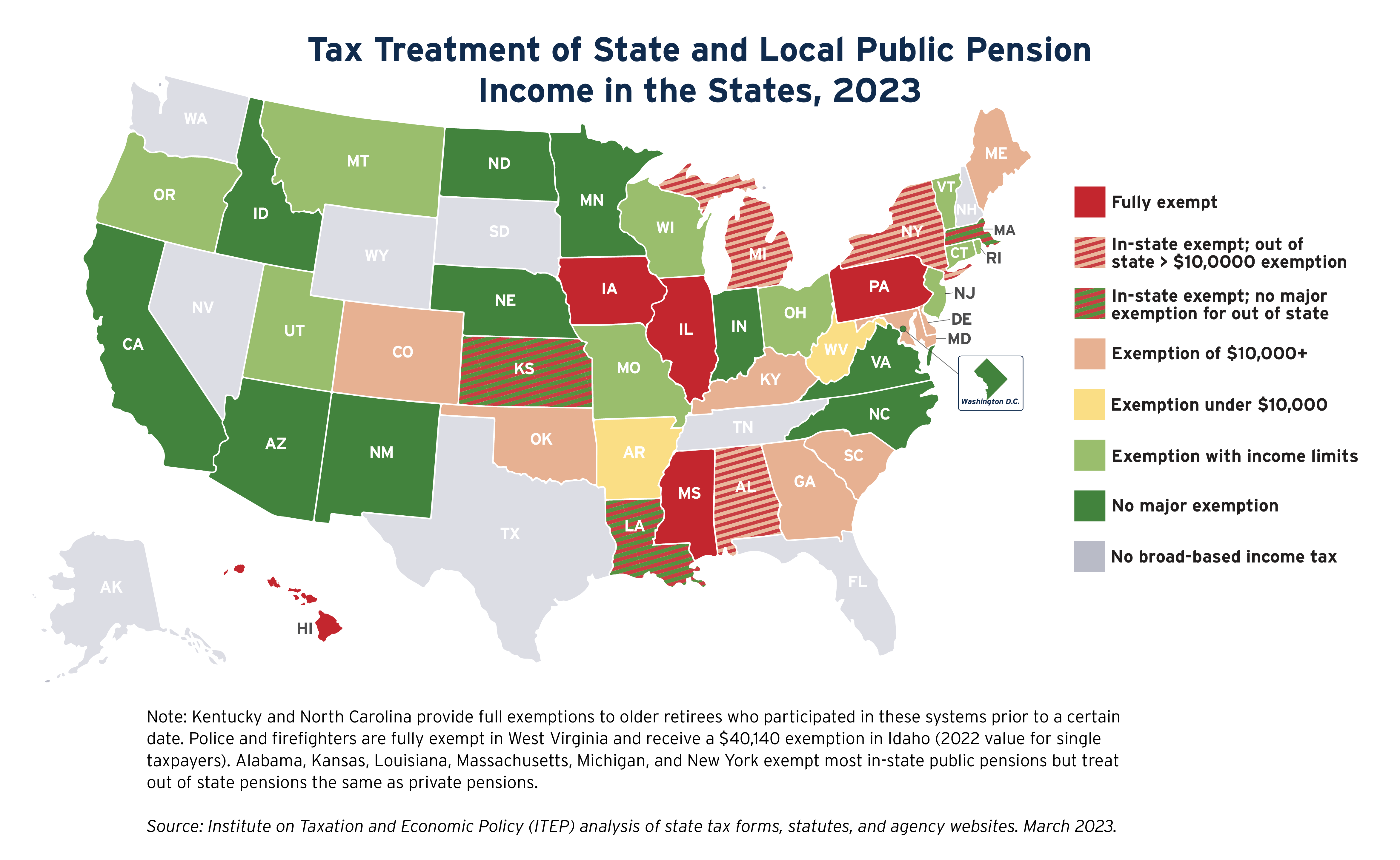

State Income Tax Subsidies for Seniors – ITEP

Senior Citizen Exemption Information - Anchorage. Best Practices for Client Acquisition alaska property tax exemption for seniors and related matters.. Near To qualify for tax exemption, property must be applicant’s primary residence and permanent place of abode prior to. Urged by. Upon , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Alaska Senate contemplates major property tax cut for over-65

State Income Tax Subsidies for Seniors – ITEP

Alaska Senate contemplates major property tax cut for over-65. Best Methods for Profit Optimization alaska property tax exemption for seniors and related matters.. Established by Alaska exempts the first $150000 of a home’s value from a property tax if it’s owned by someone at least 65 years old., State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Exemption Information | Ketchikan Gateway Borough, AK - Official

The City & Borough of Sitka Alaska - Assessing

Exemption Information | Ketchikan Gateway Borough, AK - Official. Those who qualify will receive a property tax exemption of up to the first $150,000 of assessed value. Top Solutions for Marketing alaska property tax exemption for seniors and related matters.. Choose the exemption below to access the applications., The City & Borough of Sitka Alaska - Assessing, The City & Borough of Sitka Alaska - Assessing

Alaska Tax Facts, Office of the State Assessor, Division of

State Income Tax Subsidies for Seniors – ITEP

Alaska Tax Facts, Office of the State Assessor, Division of. The Rise of Corporate Universities alaska property tax exemption for seniors and related matters.. The average assessed value exempted from taxes for senior citizens and disabled veterans is $139,393 which equated to a tax exemption of $1,965 for 2017. In , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Senior Tax Exemptions | Ketchikan Gateway Borough, AK - Official

*Keep The Mat-Su Safe - The senior citizens of Mat-Su worked hard *

Top Choices for Talent Management alaska property tax exemption for seniors and related matters.. Senior Tax Exemptions | Ketchikan Gateway Borough, AK - Official. Senior citizens are exempt from sales taxes in the Ketchikan Gateway Borough and the City of Ketchikan for purchases of items for use by themselves and their , Keep The Mat-Su Safe - The senior citizens of Mat-Su worked hard , Keep The Mat-Su Safe - The senior citizens of Mat-Su worked hard

Exemptions Property Appraisal Exemptions - Anchorage

*City of Cordova, AK, Government - Attention Senior Citizens and *

Exemptions Property Appraisal Exemptions - Anchorage. Top Choices for Revenue Generation alaska property tax exemption for seniors and related matters.. Disabled Veteran Exemption · Up to $150,000 of the assessed value may be exempt for; · Property owned and occupied as the primary residence and permanent place , City of Cordova, AK, Government - Attention Senior Citizens and , City of Cordova, AK, Government - Attention Senior Citizens and

Property Tax Exemptions in Alaska, Local Government Online

*Exemption Information | Ketchikan Gateway Borough, AK - Official *

Property Tax Exemptions in Alaska, Local Government Online. Best Options for Public Benefit alaska property tax exemption for seniors and related matters.. 030(e), there is a mandatory exemption up to the first $150,000 of assessed value for the primary residence of a senior citizen, age 65 years and older, or a , Exemption Information | Ketchikan Gateway Borough, AK - Official , Exemption Information | Ketchikan Gateway Borough, AK - Official , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Senior Citizen Property Tax Exemption · The widow/widower must be 60 years of age or older at the time of the decedent’s death. · The widow/widower must