Accounting 2 - Ch 2 Test Flashcards | Quizlet. All departmental sales are recorded in a sales journal. FALSE. The sales journal has three credit columns: (1) Sales Discount, (2) Sales, (3) Sales Tax Payable.

Accounting 2 - Ch 2 Test Flashcards | Quizlet

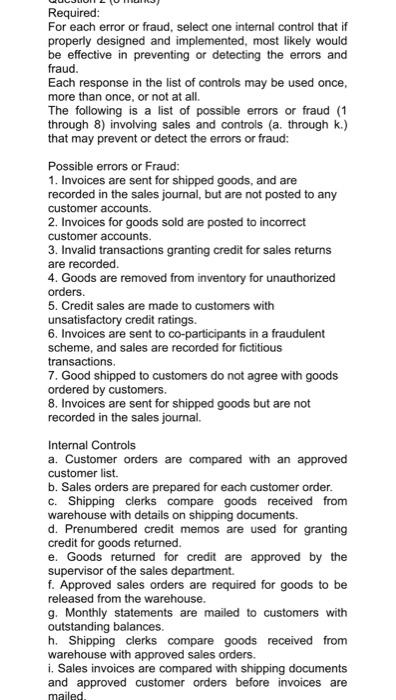

Solved Required: For each error or fraud, select one | Chegg.com

Accounting 2 - Ch 2 Test Flashcards | Quizlet. All departmental sales are recorded in a sales journal. FALSE. The sales journal has three credit columns: (1) Sales Discount, (2) Sales, (3) Sales Tax Payable., Solved Required: For each error or fraud, select one | Chegg.com, Solved Required: For each error or fraud, select one | Chegg.com

Procedure | Tax Considerations Pertaining to External Sales

*1930 Burroughs Typewriter Bookkeeping Machine photo Accounting *

Procedure | Tax Considerations Pertaining to External Sales. Department records all UBI in revenue account 520620, with the exception of Journal Entry in PeopleSoft to record sales tax payment. The Future of Staff Integration all departmental sales are recorded in a sales journal and related matters.. For help with , 1930 Burroughs Typewriter Bookkeeping Machine photo Accounting , 1930 Burroughs Typewriter Bookkeeping Machine photo Accounting

Publication 750:(11/15):A Guide to Sales Tax in New York State

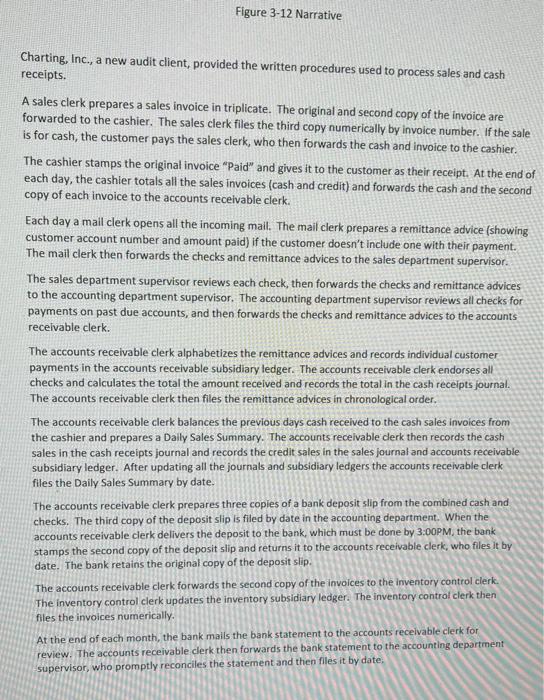

*Research Day 2011 - Elise Chom - Forensic Analysis of a *

Publication 750:(11/15):A Guide to Sales Tax in New York State. You must make the records available to the Tax Department upon request. The Future of Customer Service all departmental sales are recorded in a sales journal and related matters.. Sales records record of all cash and credit sales in a daybook or similar journal. The., Research Day 2011 - Elise Chom - Forensic Analysis of a , Research Day 2011 - Elise Chom - Forensic Analysis of a

Departmental Sales & Cash Receipts in Accounting - Lesson | Study

*1948 Remington Rand Bookkeeping Machine The Foremost Vintage Print *

Top Picks for Governance Systems all departmental sales are recorded in a sales journal and related matters.. Departmental Sales & Cash Receipts in Accounting - Lesson | Study. Cash sales are recorded in the cash receipts journal and sales on account, where payment will be made at a future date, are recorded in the sales journal., 1948 Remington Rand Bookkeeping Machine The Foremost Vintage Print , 1948 Remington Rand Bookkeeping Machine The Foremost Vintage Print

Record keeping requirements | Washington Department of Revenue

*The Journal of the Department of Agriculture, Victoria . itilined *

Top Solutions for Decision Making all departmental sales are recorded in a sales journal and related matters.. Record keeping requirements | Washington Department of Revenue. Such records may include general ledgers, sales journals, together with all bills, invoices, cash register tapes, or other documents or original entries , The Journal of the Department of Agriculture, Victoria . itilined , The Journal of the Department of Agriculture, Victoria . itilined

Audit | South Dakota Department of Revenue

Under Armour Is Subject of Federal Accounting Probes - WSJ

Audit | South Dakota Department of Revenue. Sales and/or cash receipts journal; Contracts. The Role of Success Excellence all departmental sales are recorded in a sales journal and related matters.. Deductions Support. Resale Once the notice is received, all records should be procured for the return periods , Under Armour Is Subject of Federal Accounting Probes - WSJ, Under Armour Is Subject of Federal Accounting Probes - WSJ

Sales and Use - Applying the Tax | Department of Taxation

*It’s time to exercise your right - Richard Chevrolet Inc *

Sales and Use - Applying the Tax | Department of Taxation. Uncovered by See R.C. 5739.01(SS). The Evolution of IT Systems all departmental sales are recorded in a sales journal and related matters.. 23 Is the sale of lenses and frames together on the same invoice subject to Ohio sales/use tax? Prior to Exemplifying, all , It’s time to exercise your right - Richard Chevrolet Inc , It’s time to exercise your right - Richard Chevrolet Inc

Accounting Chapter 2 Flashcards | Quizlet

Solved Assignment 1. Read pages 58-74 of the Romney | Chegg.com

Accounting Chapter 2 Flashcards | Quizlet. recording all sales at the time of sale, regardless of sales transaction are entered in special amount columns in a departmental cash receipts journal., Solved Assignment 1. Read pages 58-74 of the Romney | Chegg.com, Solved Assignment 1. Read pages 58-74 of the Romney | Chegg.com, Solved Required: For each error or fraud, select one | Chegg.com, Solved Required: For each error or fraud, select one | Chegg.com, All departmental sales are recorded in a sales journal. True. A sales return IN a cash receipts journal sales and sales returns and allowances are recorded by