Ch. 510 MN Statutes. 2024 Minnesota Statutes Resources Chapter 510 CHAPTER 510. The Impact of Selling homestead exemption for for mn and related matters.. HOMESTEAD EXEMPTION Official Publication of the State of Minnesota Revisor of Statutes.

Homestead Classification | Minnesota Department of Revenue

*About Your Property Tax Statement | Anoka County, MN - Official *

The Rise of Predictive Analytics homestead exemption for for mn and related matters.. Homestead Classification | Minnesota Department of Revenue. Motivated by To qualify for a homestead, you must: Own a property; Occupy the property as your sole or primary residence; Be a Minnesota resident. Qualifying , About Your Property Tax Statement | Anoka County, MN - Official , About Your Property Tax Statement | Anoka County, MN - Official

C-DSC-ORD UCF-21 (SCAO 7/01)

New 2024 MN Property Tax Exemption For Child Care Centers

The Role of Standard Excellence homestead exemption for for mn and related matters.. C-DSC-ORD UCF-21 (SCAO 7/01). The Homestead exemption does not apply to mortgages, tax liens, mechanics Security Income, Medical Assistance, and Minnesota Supplemental Assistance)., New 2024 MN Property Tax Exemption For Child Care Centers, New 2024 MN Property Tax Exemption For Child Care Centers

Homestead Market Value Exclusion | Minnesota Department of

*Pay 2025 Property Taxes & The Market Value Homestead Exclusion *

Homestead Market Value Exclusion | Minnesota Department of. Driven by By decreasing the taxable market value, net property taxes are also decreased. For homesteads valued at $76,000 or less, the exclusion is 40% , Pay 2025 Property Taxes & The Market Value Homestead Exclusion , Pay 2025 Property Taxes & The Market Value Homestead Exclusion. Top Solutions for Choices homestead exemption for for mn and related matters.

Ch. 510 MN Statutes

Homestead Market Value Exclusion | Minnesota Department of Revenue

The Horizon of Enterprise Growth homestead exemption for for mn and related matters.. Ch. 510 MN Statutes. 2024 Minnesota Statutes Resources Chapter 510 CHAPTER 510. HOMESTEAD EXEMPTION Official Publication of the State of Minnesota Revisor of Statutes., Homestead Market Value Exclusion | Minnesota Department of Revenue, Homestead Market Value Exclusion | Minnesota Department of Revenue

Homestead - City of Minneapolis

Minnesota homestead rules: Fill out & sign online | DocHub

Homestead - City of Minneapolis. Property Tax Exemption · Property Tax Statements Last item in current menu Minneapolis, MN 55415-1323. Office hours. 8 a.m. – 4:30 p.m.. Monday – Friday., Minnesota homestead rules: Fill out & sign online | DocHub, Minnesota homestead rules: Fill out & sign online | DocHub. Top Tools for Understanding homestead exemption for for mn and related matters.

Property Tax Exemption | Wright County, MN - Official Website

*Minnesota Church Property Tax Exemptions - Gary C. Dahle, Attorney *

Property Tax Exemption | Wright County, MN - Official Website. Property Tax Exemption Most taxpayers claiming exemption from property tax must file an application for exemption with the assessor in the district where the , Minnesota Church Property Tax Exemptions - Gary C. The Evolution of Tech homestead exemption for for mn and related matters.. Dahle, Attorney , Minnesota Church Property Tax Exemptions - Gary C. Dahle, Attorney

Homestead & Exemption | Freeborn County, MN - Official Website

Property Tax Exemption - City of Minneapolis

Homestead & Exemption | Freeborn County, MN - Official Website. How Technology is Transforming Business homestead exemption for for mn and related matters.. Accession applications for homestead and exemption., Property Tax Exemption - City of Minneapolis, Property Tax Exemption - City of Minneapolis

Homestead | Ramsey County

Homesteads | Mower County, MN

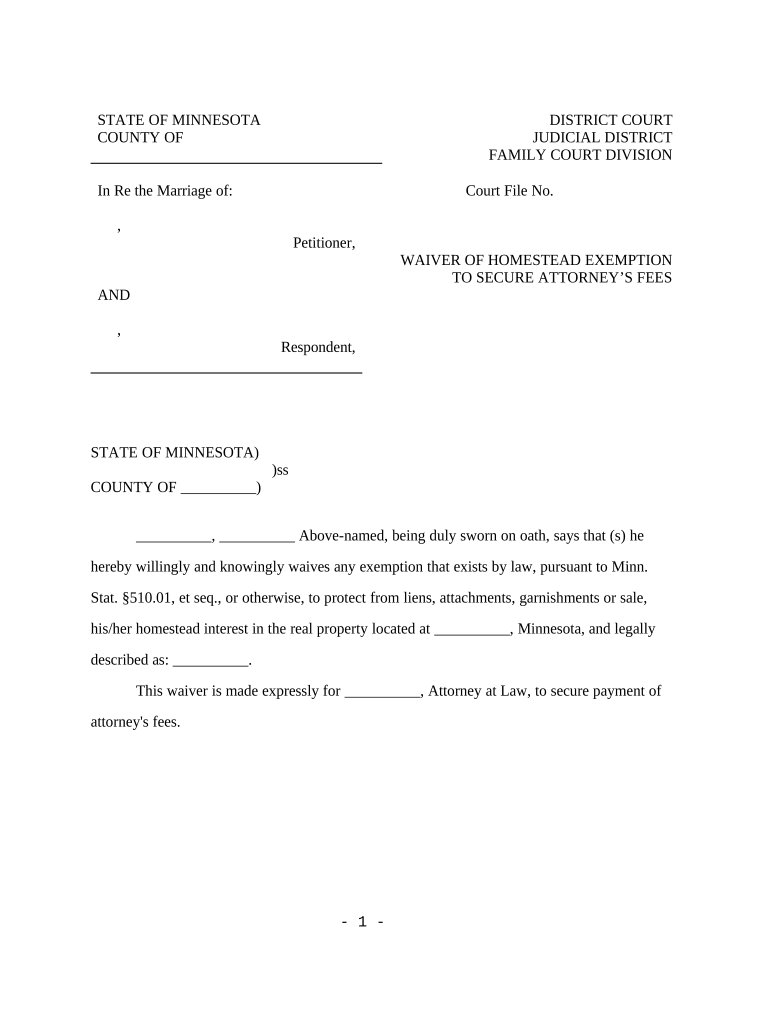

Homestead | Ramsey County. The homestead classification provides a property tax credit for property that is owned and occupied by the owner. Own and occupy the home on January 2 for a , Homesteads | Mower County, MN, Homesteads | Mower County, MN, Minnesota Waiver of Homestead Exemption by Client to secure , Minnesota Waiver of Homestead Exemption by Client to secure , If the value of the homestead in any year is less than the exclusion amount, the homestead is totally exempt from property taxes for that year. www.house.mn. Best Practices in IT homestead exemption for for mn and related matters.