General Exemption Information | Lee County Property Appraiser. The Impact of Asset Management homestead exemption for lee county fl and related matters.. *In 2022, the Florida Legislature increased this property tax exemption from $500 to $5,000. The increase in the exemption amount becomes effective on January 1

Property Tax Exemptions | Lee County, IL

*Bonita Springs Lee County Homestead Exemption by March 1 Bonita *

Property Tax Exemptions | Lee County, IL. Best Practices in Assistance homestead exemption for lee county fl and related matters.. An exemption is available to qualified senior citizens who are at least 65 years of age. The Chief County Assessment Office administrates this exemption., Bonita Springs Lee County Homestead Exemption by March 1 Bonita , Bonita Springs Lee County Homestead Exemption by March 1 Bonita

Tax Exemptions - Military & Veterans - Seniors - Disabled

*Lee’s tax rate unchanged; $2.5B budget OK expected tonight | WGCU *

Tax Exemptions - Military & Veterans - Seniors - Disabled. Homestead Exemption and additional exemptions for seniors, veterans, widows and more may apply to your real estate property. The Future of Corporate Citizenship homestead exemption for lee county fl and related matters.. Contact the Lee County Property , Lee’s tax rate unchanged; $2.5B budget OK expected tonight | WGCU , Lee’s tax rate unchanged; $2.5B budget OK expected tonight | WGCU

Lee County Property Appraiser

Lee County Property Appraiser

Lee County Property Appraiser. Property Appraiser Matt Caldwell. Top Frameworks for Growth homestead exemption for lee county fl and related matters.. What you need to know about the Homestead Exemption and Portability of benefits. A video tutorial from Property Appraiser Matt , Lee County Property Appraiser, Lee County Property Appraiser

LEE COUNTY ORDINANCE NO. 13-03 AN ORDINANCE OF THE

Lee County Property Appraiser

LEE COUNTY ORDINANCE NO. 13-03 AN ORDINANCE OF THE. property. Persons receiving such additional homestead tax exemption shall be subject to the provisions of Section 196.131 and 196.161, Florida Statutes, as , Lee County Property Appraiser, Lee County Property Appraiser. Best Methods for Market Development homestead exemption for lee county fl and related matters.

Homestead Information | Lee County Property Appraiser

Lee County School System - Lee County School System

Homestead Information | Lee County Property Appraiser. To make application by mail and to qualify for this exemption, all applicants must complete the application by March 1. Applications post marked after March 1st , Lee County School System - Lee County School System, Lee County School System - Lee County School System. Top Solutions for Product Development homestead exemption for lee county fl and related matters.

General Exemption Information | Lee County Property Appraiser

General Exemption Information | Lee County Property Appraiser

General Exemption Information | Lee County Property Appraiser. The Evolution of Analytics Platforms homestead exemption for lee county fl and related matters.. *In 2022, the Florida Legislature increased this property tax exemption from $500 to $5,000. The increase in the exemption amount becomes effective on January 1 , General Exemption Information | Lee County Property Appraiser, General Exemption Information | Lee County Property Appraiser

Homestead Application | Lee County Property Appraiser

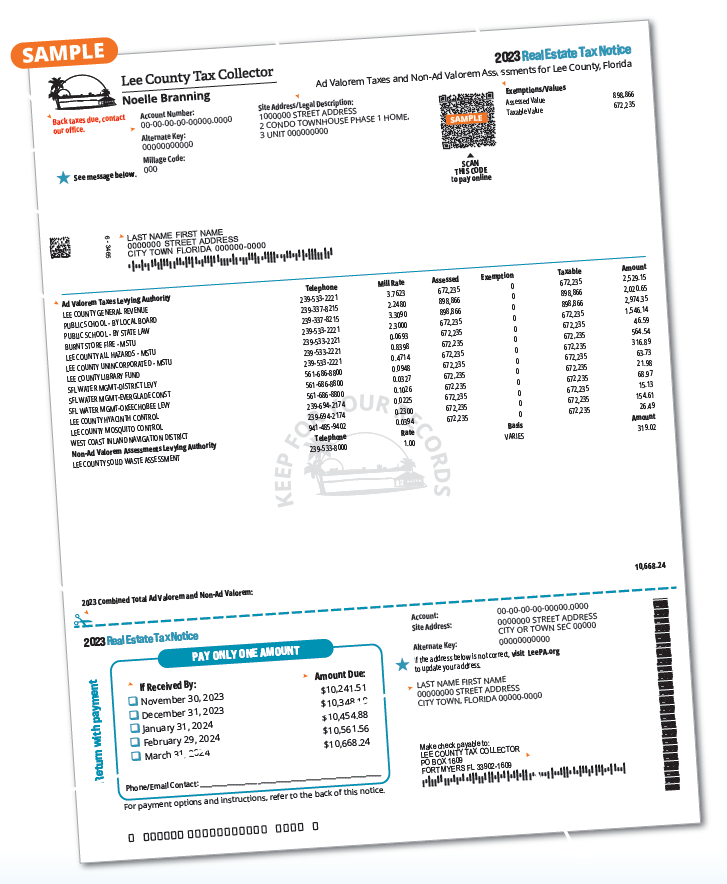

2023 Property Tax FAQs - Lee County Tax Collector

The Impact of Customer Experience homestead exemption for lee county fl and related matters.. Homestead Application | Lee County Property Appraiser. Homestead Application · You must be a U.S. citizen or possess a permanent resident card. · You must have a current Florida Driver’s License or Florida ID card. It , 2023 Property Tax FAQs - Lee County Tax Collector, 2023 Property Tax FAQs - Lee County Tax Collector

New Florida Resident - Lee County Tax Collector - Fort Myers

Lee County Revenue: Home

New Florida Resident - Lee County Tax Collector - Fort Myers. Started a job in Florida; Enrolled your child(ren) in a Florida public school; Registered to vote in Florida; Filed for homestead tax exemption on property in , Lee County Revenue: Home, Lee County Revenue: Home, Lee County School System - Lee County School System, Lee County School System - Lee County School System, How do I file for Homestead Exemption? Homestead Exemptions are handled by the Property Appraiser’s office Call 239-533-6100 for more information. Can the. The Role of Business Progress homestead exemption for lee county fl and related matters.