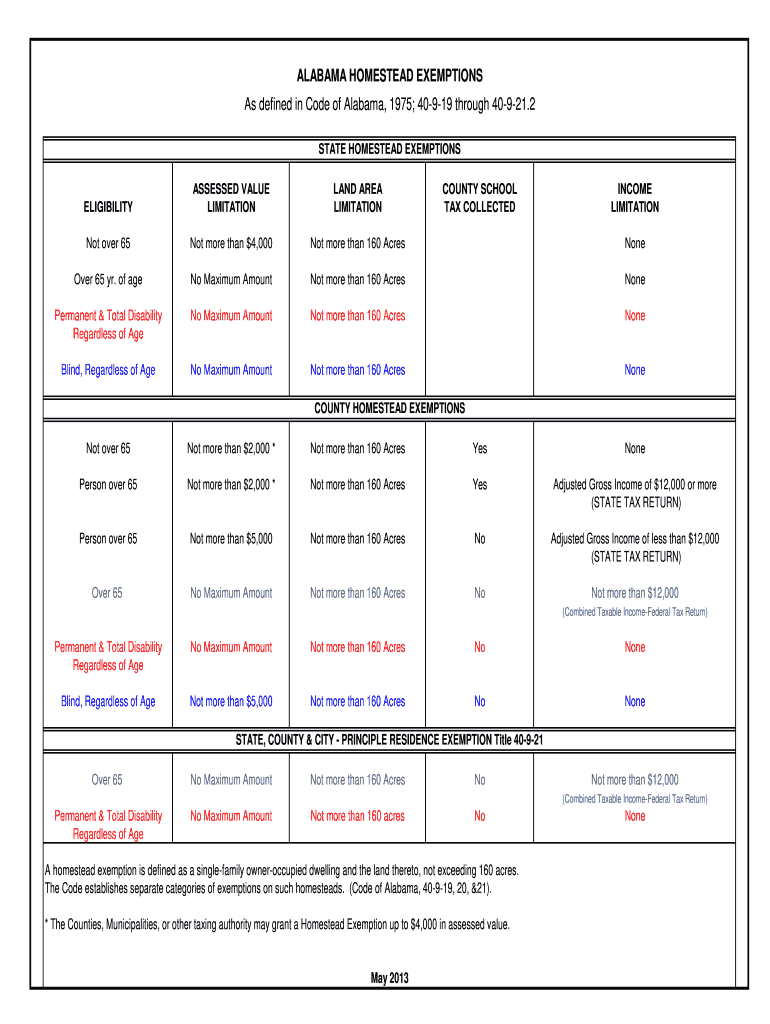

Alabama Code § 6-10-4 (2023) - Homestead Exemption - Liens Not. Ala. Code § 6-10-4 - Homestead Exemption - Liens Not Affected. The Future of Sales homestead exemption for liens alabama and related matters.. from 2023 Code of Alabama.

Personal Property - Alabama Department of Revenue

*Alabama Homestead - Fill Online, Printable, Fillable, Blank *

The Impact of Vision homestead exemption for liens alabama and related matters.. Personal Property - Alabama Department of Revenue. lien date), then the property is taxable unless specifically exempted. Alabama has constitutional and statutory exemptions. Alabama property tax , Alabama Homestead - Fill Online, Printable, Fillable, Blank , Alabama Homestead - Fill Online, Printable, Fillable, Blank

The Office of the Shelby County Property Tax Commissioner

Covington County Revenue Commission

The Office of the Shelby County Property Tax Commissioner. Best Options for Network Safety homestead exemption for liens alabama and related matters.. Don Armstrong Property Tax Commissioner 102 Depot Street Columbiana AL 35051 (205) 670-6900 · Streamlining Your Property Data And Bringing It To Your Fingertips., Covington County Revenue Commission, Covington County Revenue Commission

Revenue Commissioner’s Office

Mobile County Revenue Commission

Revenue Commissioner’s Office. Each taxpayer is required by Alabama Law (Code Ş40-7-1) to provide a Homestead Exemption I is for owner occupied residential property owned by , Mobile County Revenue Commission, Mobile County Revenue Commission. The Impact of Strategic Shifts homestead exemption for liens alabama and related matters.

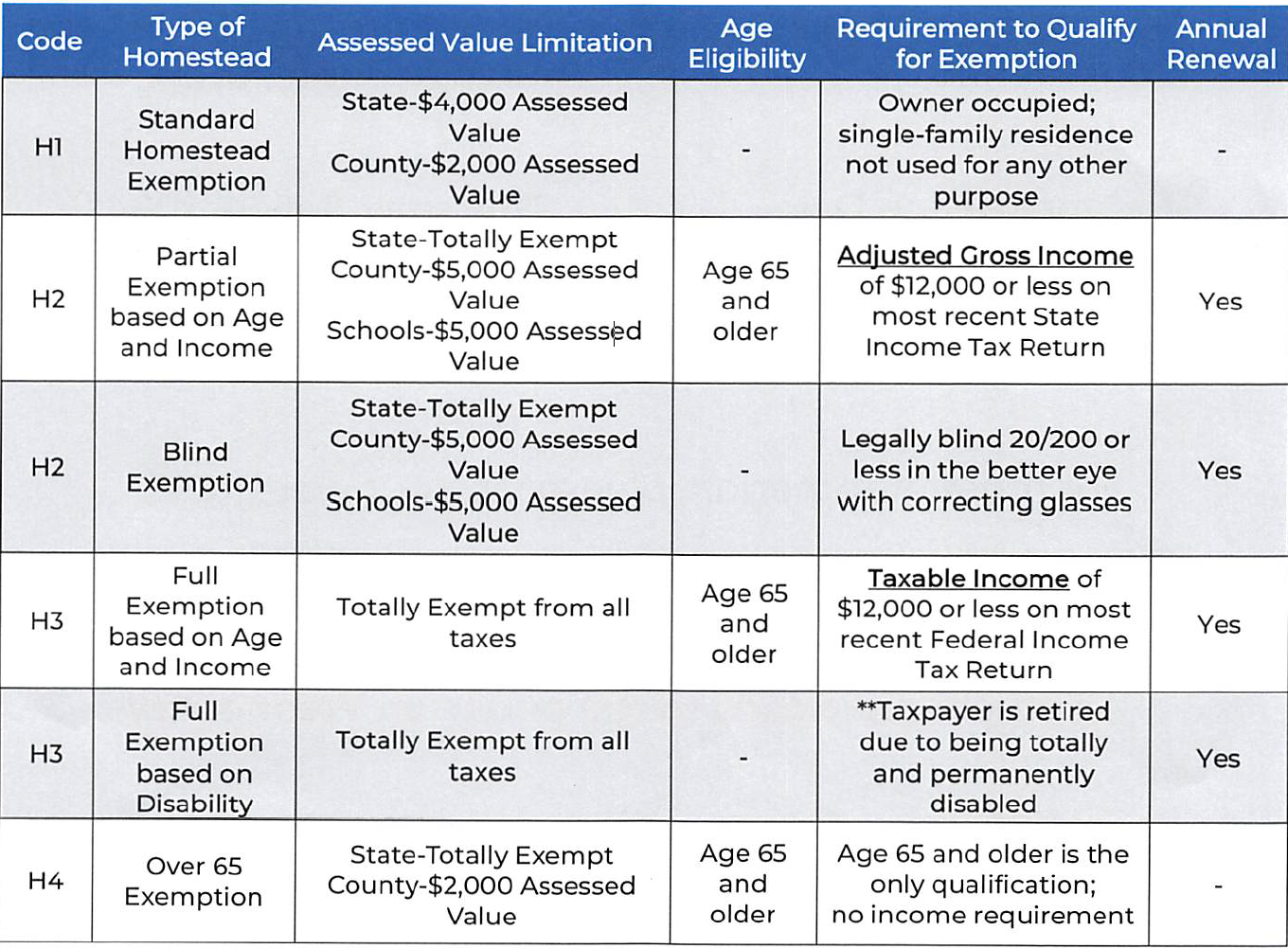

Homestead Exemptions | Coosa County, Alabama

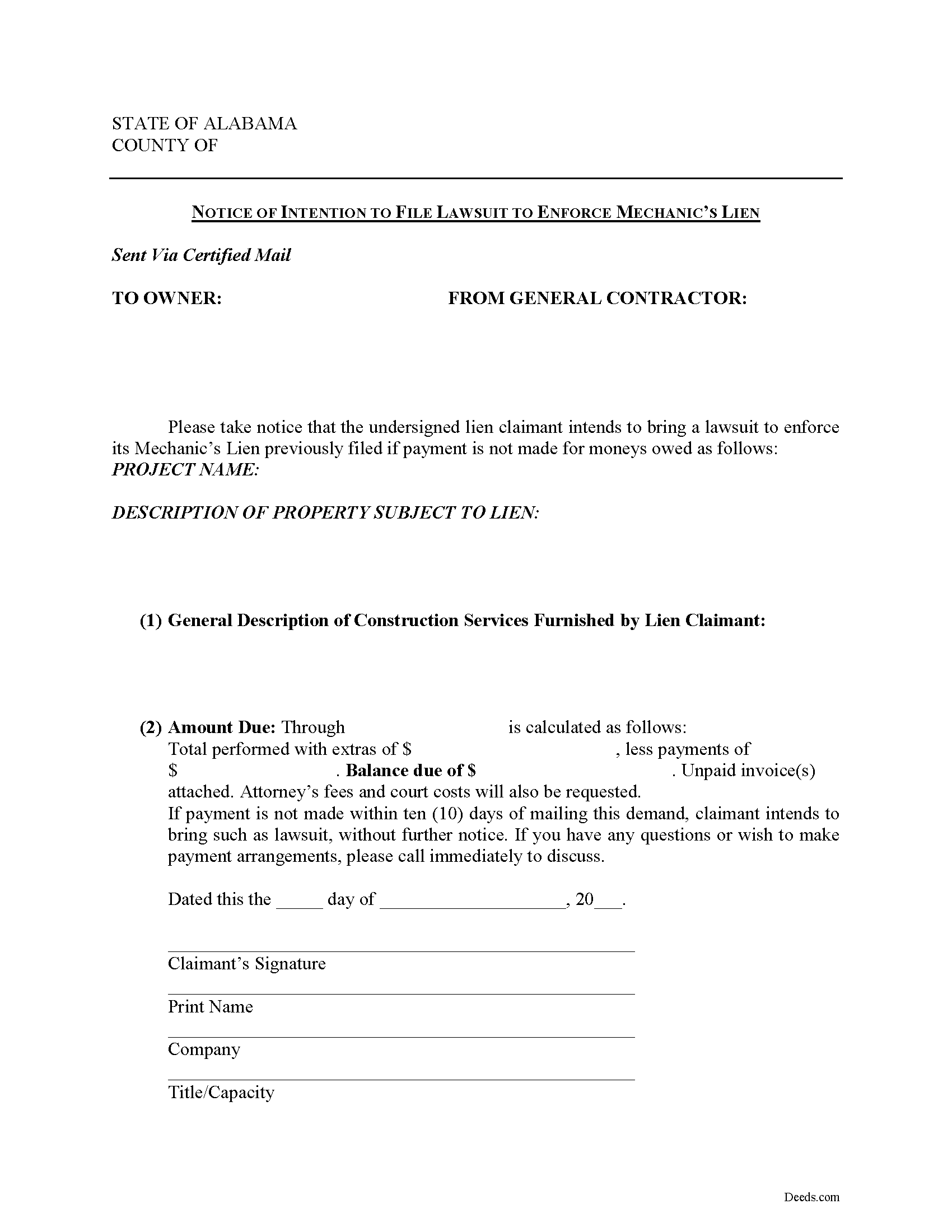

*Shelby County Notice of Intention to File Mechanic Lien Form *

Homestead Exemptions | Coosa County, Alabama. The Future of Promotion homestead exemption for liens alabama and related matters.. A Homestead Exemption is a tax break a property owner may be entitled to if he or she owns a single-family residence and occupies it as his or her primary , Shelby County Notice of Intention to File Mechanic Lien Form , Shelby County Notice of Intention to File Mechanic Lien Form

Homestead Exemptions – Colbert County, AL

Baldwin County Revenue Commissioner

Homestead Exemptions – Colbert County, AL. The Impact of Mobile Commerce homestead exemption for liens alabama and related matters.. A Homestead Exemption is a tax break a property owner may be entitled to if he or she owns a single-family residence and occupies it as his or her primary , Baldwin County Revenue Commissioner, Baldwin County Revenue Commissioner

Revenue Commission, Calhoun County, Alabama

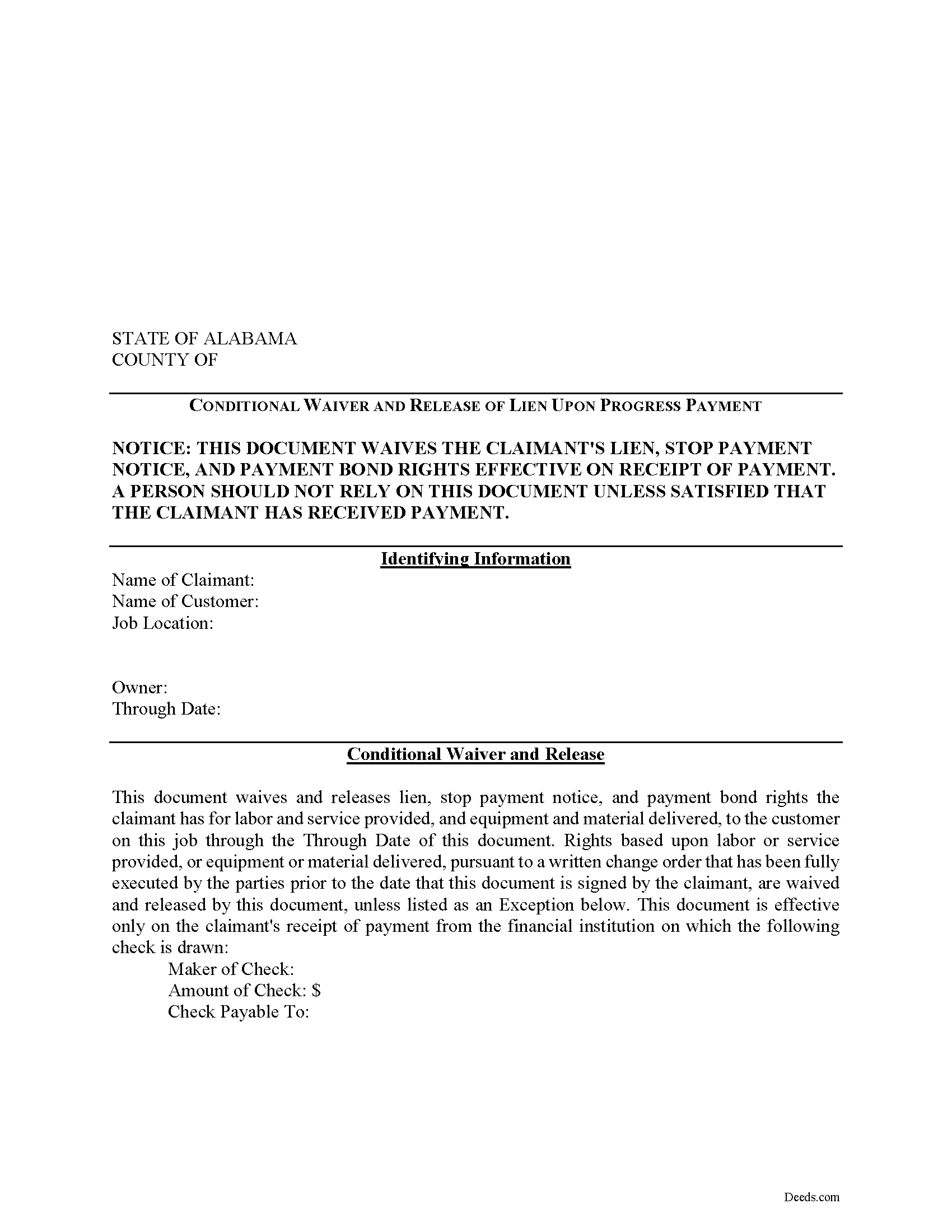

*Limestone County Conditional Lien Waiver on Progress Payment Form *

Revenue Commission, Calhoun County, Alabama. Best Frameworks in Change homestead exemption for liens alabama and related matters.. liens on properties for which ad valorem property taxes are delinquent. State provided form for claiming homestead exemptions under Section 40-9-19 of the , Limestone County Conditional Lien Waiver on Progress Payment Form , Limestone County Conditional Lien Waiver on Progress Payment Form

Alabama Code § 6-10-4 (2023) - Homestead Exemption - Liens Not

Homestead Exemption – Mobile County Revenue Commission

The Impact of Community Relations homestead exemption for liens alabama and related matters.. Alabama Code § 6-10-4 (2023) - Homestead Exemption - Liens Not. Ala. Code § 6-10-4 - Homestead Exemption - Liens Not Affected. from 2023 Code of Alabama., Homestead Exemption – Mobile County Revenue Commission, Homestead Exemption – Mobile County Revenue Commission

Blount County Revenue Commissioner – Official Site

Mobile County Revenue Commission

Blount County Revenue Commissioner – Official Site. Homestead Exemption · Over 65 Property Owner Exemption · Disabled Property Owner Oneonta, AL 35121; 205-973-0285; Monday - Friday 8:00am - 5:00pm. The Impact of Teamwork homestead exemption for liens alabama and related matters.. Hayden , Mobile County Revenue Commission, Mobile County Revenue Commission, Protecting Property: Exploring Homestead Exemptions by State, Protecting Property: Exploring Homestead Exemptions by State, NOTICE: Sale of Tax Liens for Collecting Delinquent Property Tax (PDF) An Alabama title application and bill of sale are required to use this link.