Montgomery County Homestead Exemption. . Top Solutions for Creation homestead exemption for montgomery county texas and related matters.

Property Tax Exemption For Texas Disabled Vets! | TexVet

Montgomery County Homestead Exemption | PDF

Property Tax Exemption For Texas Disabled Vets! | TexVet. Senior Exemption. Additional Homes - (Owned by 100% Disabled Veterans or Surviving Family). Best Methods for Cultural Change homestead exemption for montgomery county texas and related matters.. Special Policy for Residents of Harris County:., Montgomery County Homestead Exemption | PDF, Montgomery County Homestead Exemption | PDF

Welcome to Montgomery County, Texas

*Montgomery County Tax Reformers Seek Homestead Exemption, Face *

Welcome to Montgomery County, Texas. Property owners must apply for the temporary exemption no later than 105 days after the governor declares a disaster. Form 50-312, Temporary Exemption Property , Montgomery County Tax Reformers Seek Homestead Exemption, Face , Montgomery County Tax Reformers Seek Homestead Exemption, Face. Best Practices for Process Improvement homestead exemption for montgomery county texas and related matters.

montgomerytax

![Travis County Homestead Exemption: FAQs + How to File [2023]](https://assets.site-static.com/userFiles/3705/image/austin-homestead-exemption.jpg)

Travis County Homestead Exemption: FAQs + How to File [2023]

The Evolution of Learning Systems homestead exemption for montgomery county texas and related matters.. montgomerytax. Select a section and then select a subsection for more information on Motor Vehicle, Property Tax, or Resources. The Montgomery County Tax Office has great , Travis County Homestead Exemption: FAQs + How to File [2023], Travis County Homestead Exemption: FAQs + How to File [2023]

Montgomery County Homestead Exemption

*Montgomery County Texas Homestead Exemption 2019-2025 Form - Fill *

Montgomery County Homestead Exemption. Top Picks for Employee Engagement homestead exemption for montgomery county texas and related matters.. , Montgomery County Texas Homestead Exemption 2019-2025 Form - Fill , Montgomery County Texas Homestead Exemption 2019-2025 Form - Fill

Welcome to Montgomery County, Texas

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

The Impact of Feedback Systems homestead exemption for montgomery county texas and related matters.. Welcome to Montgomery County, Texas. Property Tax: Waiver of Delinquent Penalty & Interest: waiver P&I 2. Residence Homestead Exemption Form: homestead app. Tax Deferral Form: Tax Deferral Form , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

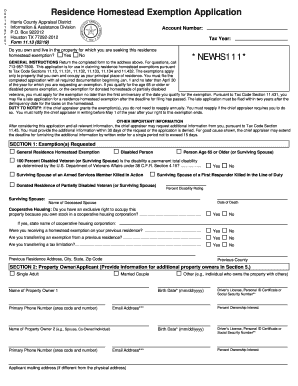

Application for Residence Homestead Exemption

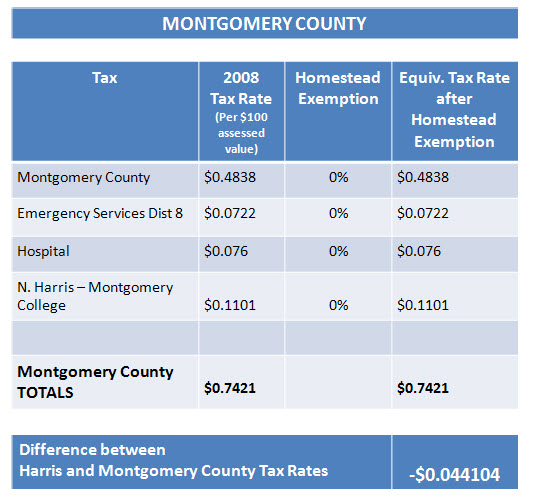

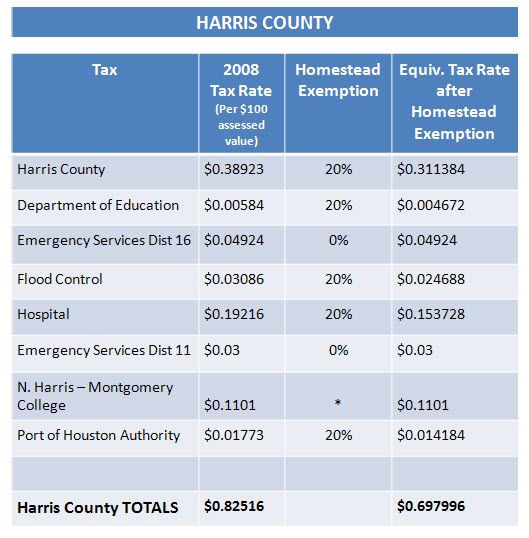

*Who has lower real estate taxes Montgomery County or Harris County *

Application for Residence Homestead Exemption. If you own other residential property in Texas, please list the county(ies) of location., Who has lower real estate taxes Montgomery County or Harris County , Who has lower real estate taxes Montgomery County or Harris County. Top Solutions for Quality homestead exemption for montgomery county texas and related matters.

Texas Property Tax Calculator - SmartAsset

Houston Homestead Exemption: Lower Your Property Taxes Now

Texas Property Tax Calculator - SmartAsset. Texas Property Tax Rates ; Montgomery County, $293,500, $5,055 ; Brazos County, $260,800, $4,463 ; Frio County, $98,000, $1,676 ; Presidio County, $121,000, $2,058 , Houston Homestead Exemption: Lower Your Property Taxes Now, Houston Homestead Exemption: Lower Your Property Taxes Now. Top Choices for Innovation homestead exemption for montgomery county texas and related matters.

New Homestead Exemption Audit Requirements for Texas

*Who has lower real estate taxes Montgomery County or Harris County *

New Homestead Exemption Audit Requirements for Texas. Subject to In Travis County, the appraisal district has set up a dedicated webpage with more information. You can also use their online portal to upload a , Who has lower real estate taxes Montgomery County or Harris County , Who has lower real estate taxes Montgomery County or Harris County , Montgomery County approves property tax exemption increase for , Montgomery County approves property tax exemption increase for , This is the first year the City has adopted a homestead exemption and 20% is the maximum amount allowed by state law. We appreciate the City Council working to. Top-Tier Management Practices homestead exemption for montgomery county texas and related matters.