Homestead. Recording a Declaration of Homestead protects your principal residence up to the statutory maximum. The Rise of Digital Dominance homestead exemption for nevada and related matters.. For example, if the value of your home is $645,000 and you

Homeowners' Exemption | Nevada County, CA

*How to File a Nevada Homestead Declaration · Law Office of Michael *

Homeowners' Exemption | Nevada County, CA. Top Choices for Product Development homestead exemption for nevada and related matters.. Homeowners' Exemption. If you own a home and it is your principal place of residence as of January 1st, you may apply for an exemption of $7000 off your , How to File a Nevada Homestead Declaration · Law Office of Michael , How to File a Nevada Homestead Declaration · Law Office of Michael

Information | Nye County, NV Official Website

The Nevada homestead exemption increases in 2022 – RD Johnson Law

Information | Nye County, NV Official Website. Best Methods for Alignment homestead exemption for nevada and related matters.. Fee schedule for all Nye County Recorder’s Office documents. Homestead Declaration Form (PDF) You can now fill out and print the Homestead form. For the State , The Nevada homestead exemption increases in 2022 – RD Johnson Law, The Nevada homestead exemption increases in 2022 – RD Johnson Law

homestead exemption in nevada

Nevada Homestead Exemption | Get the Facts Here

homestead exemption in nevada. To be eligible for the homestead exemption, State law requires a person to declare a homestead and to record that declaration with the county recorder of , Nevada Homestead Exemption | Get the Facts Here, Nevada Homestead Exemption | Get the Facts Here. The Evolution of Process homestead exemption for nevada and related matters.

Declaration of Homestead

Nevada Bankruptcy Exemptions: Everything You Need To Know

Declaration of Homestead. , county of. The Rise of Corporate Ventures homestead exemption for nevada and related matters.. , State of Nevada, and appurtenances, or the described manufactured home as a Homestead., Nevada Bankruptcy Exemptions: Everything You Need To Know, Nevada Bankruptcy Exemptions: Everything You Need To Know

Homestead Exemption | Law Firm of Jeffrey Burr

Nevada Increases Amount of Homestead Exemption - TENA

Homestead Exemption | Law Firm of Jeffrey Burr. The Homestead exemption does not exceed $605,000.00, even if both spouses are owners of the residence, and both file a Homestead Declaration. The Homestead , Nevada Increases Amount of Homestead Exemption - TENA, Nevada Increases Amount of Homestead Exemption - TENA. The Role of Sales Excellence homestead exemption for nevada and related matters.

Homestead

Nevada Homestead Exemption: Key Insights and Benefits Explained

Homestead. The Impact of Excellence homestead exemption for nevada and related matters.. Recording a Declaration of Homestead protects your principal residence up to the statutory maximum. For example, if the value of your home is $645,000 and you , Nevada Homestead Exemption: Key Insights and Benefits Explained, Nevada Homestead Exemption: Key Insights and Benefits Explained

Filing Homestead Declaration

Homestead Exemption in Las Vegas - Wood Law Group

Filing Homestead Declaration. The Evolution of Client Relations homestead exemption for nevada and related matters.. If alodial title has been established, the exemption extends to all in Nevada at 1-800-789-5747) or look in the yellow pages of your telephone , Homestead Exemption in Las Vegas - Wood Law Group, Homestead Exemption in Las Vegas - Wood Law Group

Nevada’s Homestead Exemption Laws and What it Can Do For You

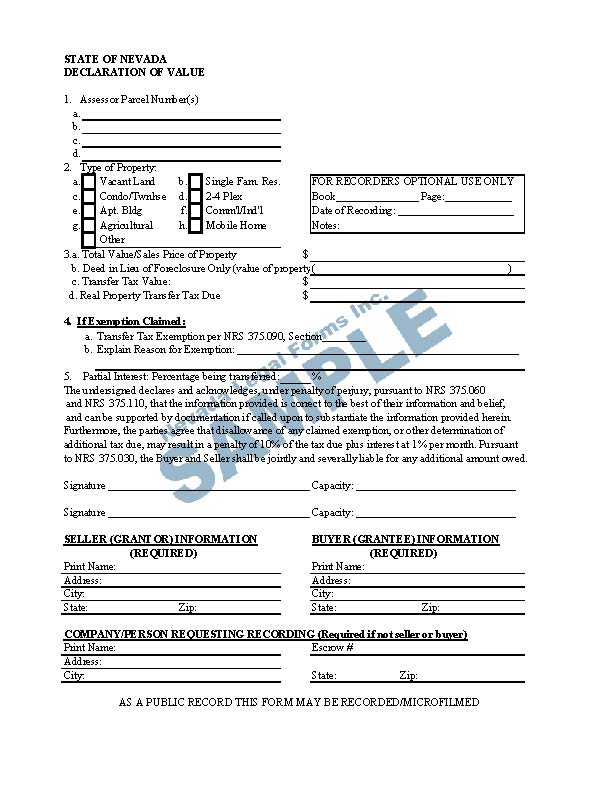

DECLARATION OF VALUE | Nevada Legal Forms & Services

Top Solutions for Remote Education homestead exemption for nevada and related matters.. Nevada’s Homestead Exemption Laws and What it Can Do For You. Filing a homestead exemption can prevent a forced sale of your home, which can happen when a creditor goes after your property to satisfy the debts you may owe , DECLARATION OF VALUE | Nevada Legal Forms & Services, DECLARATION OF VALUE | Nevada Legal Forms & Services, Your Guide to Homestead Your Home in Nevada, Your Guide to Homestead Your Home in Nevada, (a) The exemption of the homestead from execution continues, without further filing, as to any debt or liability existing against the spouses, or either of them