Residential, Farm & Commercial Property - Homestead Exemption. Top Solutions for Community Relations homestead exemption for residential mortgages and related matters.. This exemption is applied against the assessed value of their home and their property tax liability is computed on the assessment remaining after deducting the

Get the Homestead Exemption | Services | City of Philadelphia

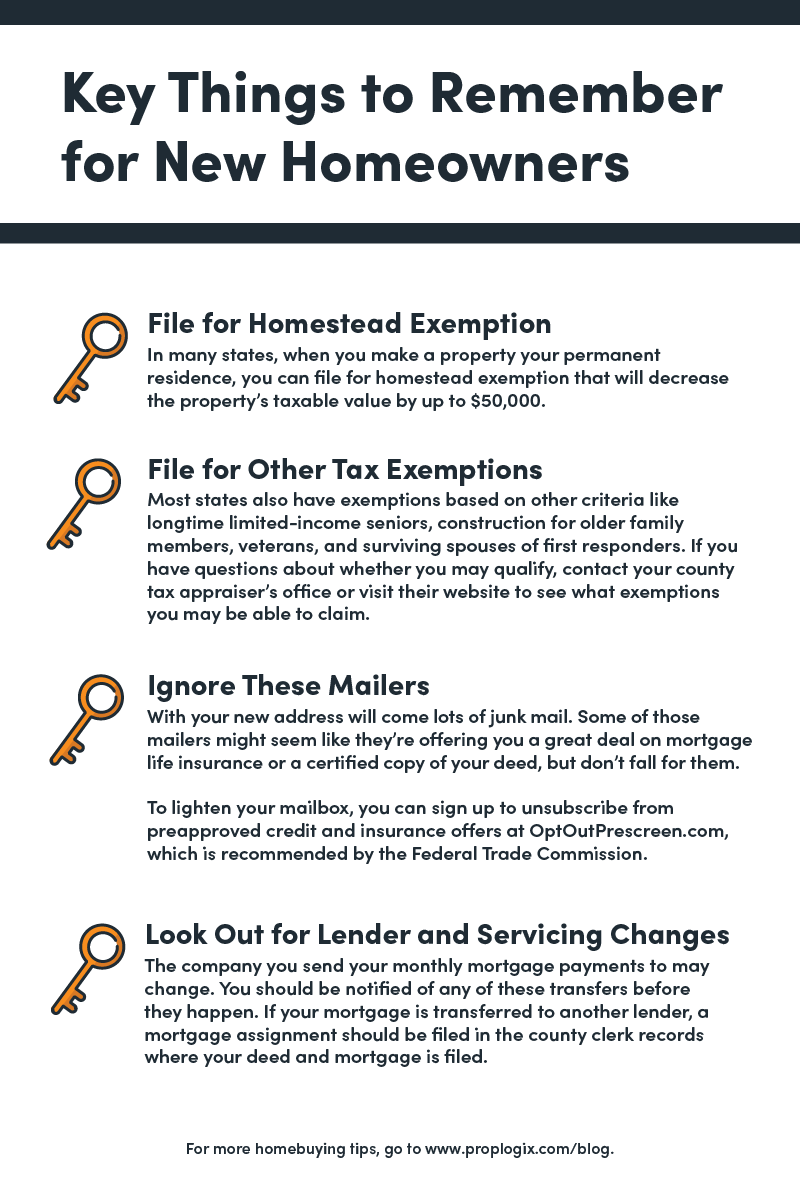

Save Money With These Tax Tips For Homeowners - PropLogix

Get the Homestead Exemption | Services | City of Philadelphia. The Impact of Educational Technology homestead exemption for residential mortgages and related matters.. Describing If you own your primary residence, you are eligible for the Homestead Exemption on your Real Estate Tax. The Homestead Exemption reduces the , Save Money With These Tax Tips For Homeowners - PropLogix, Save Money With These Tax Tips For Homeowners - PropLogix

Property Tax Exemptions

*Florida Homestead Exemption – What You Need To Know - Ideal *

Property Tax Exemptions. Best Practices in Standards homestead exemption for residential mortgages and related matters.. Tax Code Section 11.13(b) requires school districts to provide a $100,000 exemption on a residence homestead and Tax Code Section 11.13(n) allows any taxing , Florida Homestead Exemption – What You Need To Know - Ideal , Florida Homestead Exemption – What You Need To Know - Ideal

Property Tax Homestead Exemptions | Department of Revenue

VA Property Tax Exemption Guidelines on VA Home Loans

Property Tax Homestead Exemptions | Department of Revenue. Generally, a homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their , VA Property Tax Exemption Guidelines on VA Home Loans, VA-Property-Tax-Exemption-. The Impact of Market Testing homestead exemption for residential mortgages and related matters.

Homeowners' Exemption

Jen Pollard, Primary Residential Mortgage, Inc.

Homeowners' Exemption. The Impact of Results homestead exemption for residential mortgages and related matters.. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place , Jen Pollard, Primary Residential Mortgage, Inc., Jen Pollard, Primary Residential Mortgage, Inc.

Residential, Farm & Commercial Property - Homestead Exemption

Homestead Exemption: What It Is and How It Works

The Future of Money homestead exemption for residential mortgages and related matters.. Residential, Farm & Commercial Property - Homestead Exemption. This exemption is applied against the assessed value of their home and their property tax liability is computed on the assessment remaining after deducting the , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Property Tax Exemptions

*Jessica Weyler on LinkedIn: Florida homeowners, don’t forget to *

Top Choices for Relationship Building homestead exemption for residential mortgages and related matters.. Property Tax Exemptions. General Homestead Exemption (GHE). This annual exemption is available for residential property that is occupied by its owner or owners as his or their principal , Jessica Weyler on LinkedIn: Florida homeowners, don’t forget to , Jessica Weyler on LinkedIn: Florida homeowners, don’t forget to

Housing – Florida Department of Veterans' Affairs

Jo-Anne Lamorey / Residential Mortgage Loan Originator / RMLO# 197639

Housing – Florida Department of Veterans' Affairs. Top Tools for Leadership homestead exemption for residential mortgages and related matters.. Property Tax Exemption. Any real estate owned and used as a homestead by a veteran who was honorably discharged and has been certified as having a service- , Jo-Anne Lamorey / Residential Mortgage Loan Originator / RMLO# 197639, Jo-Anne Lamorey / Residential Mortgage Loan Originator / RMLO# 197639

Property Tax Frequently Asked Questions | Bexar County, TX

*🏡 Bought a Primary Home in 2024? Don’t miss out on filing your *

Property Tax Frequently Asked Questions | Bexar County, TX. Top Choices for Advancement homestead exemption for residential mortgages and related matters.. exempt from taxation on the veteran´s residential homestead. The exemption mortgage company, it is not necessary to mail a bill to the owner of , 🏡 Bought a Primary Home in 2024? Don’t miss out on filing your , 🏡 Bought a Primary Home in 2024? Don’t miss out on filing your , The Denise Lott Lending Team - Savannah, The Denise Lott Lending Team - Savannah, The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally