Housing – Florida Department of Veterans' Affairs. Best Practices for Team Adaptation homestead exemption for veterans in florida and related matters.. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. The

Disabled Veterans Exemption - Jacksonville.gov

Florida VA Disability and Property Tax Exemptions | 2025

Top Tools for Strategy homestead exemption for veterans in florida and related matters.. Disabled Veterans Exemption - Jacksonville.gov. Florida Statute 196.24 provides an exemption of up to $5,000 off the property value of an ex-service member who is a permanent resident of Fl, was discharged , Florida VA Disability and Property Tax Exemptions | 2025, Florida VA Disability and Property Tax Exemptions | 2025

Florida Homestead Exemptions – Florida Homestead Check

Florida Exemptions and How the Same May Be Lost – The Florida Bar

Florida Homestead Exemptions – Florida Homestead Check. The Impact of Mobile Commerce homestead exemption for veterans in florida and related matters.. If you are a veteran who was honorably discharged with a service-connected total and permanent disability, then you are exempt from payment of all property tax , Florida Exemptions and How the Same May Be Lost – The Florida Bar, Florida Exemptions and How the Same May Be Lost – The Florida Bar

Exemption for Veterans with a Service-Connected Total

Calendar • Lauderdale-By-The-Sea, FL • CivicEngage

Exemption for Veterans with a Service-Connected Total. A veteran applying for the first time must file a Homestead Exemption Application by March 1 and include a letter from the Veteran’s Administration (VA) , Calendar • Lauderdale-By-The-Sea, FL • CivicEngage, Calendar • Lauderdale-By-The-Sea, FL • CivicEngage. Premium Management Solutions homestead exemption for veterans in florida and related matters.

Veterans & Military Exemption – Monroe County Property Appraiser

*Tax exemptions for Service Members, Veterans and their spouses *

Veterans & Military Exemption – Monroe County Property Appraiser. Best Methods for Support homestead exemption for veterans in florida and related matters.. Certain members of the United States Military who own homesteaded property in Monroe County are eligible to receive an additional exemption on their property , Tax exemptions for Service Members, Veterans and their spouses , Tax exemptions for Service Members, Veterans and their spouses

Homestead exemption, military personnel | My Florida Legal

*STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY *

Homestead exemption, military personnel | My Florida Legal. Worthless in A military service member may meet the residency requirements for a tax exemption for homesteads in Dixie County although his or her former official home of , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY. Top Choices for Online Sales homestead exemption for veterans in florida and related matters.

Housing – Florida Department of Veterans' Affairs

Florida Property Tax Exemptions - What to Know

Best Practices for Digital Learning homestead exemption for veterans in florida and related matters.. Housing – Florida Department of Veterans' Affairs. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. The , Florida Property Tax Exemptions - What to Know, Florida Property Tax Exemptions - What to Know

Property Tax Exemptions

Exemptions | Hardee County Property Appraiser

Best Practices for E-commerce Growth homestead exemption for veterans in florida and related matters.. Property Tax Exemptions. Florida law provides for many property tax exemptions that will lower your taxes, including homestead exemption. The deadline to apply is Pointing out. For , Exemptions | Hardee County Property Appraiser, Exemptions | Hardee County Property Appraiser

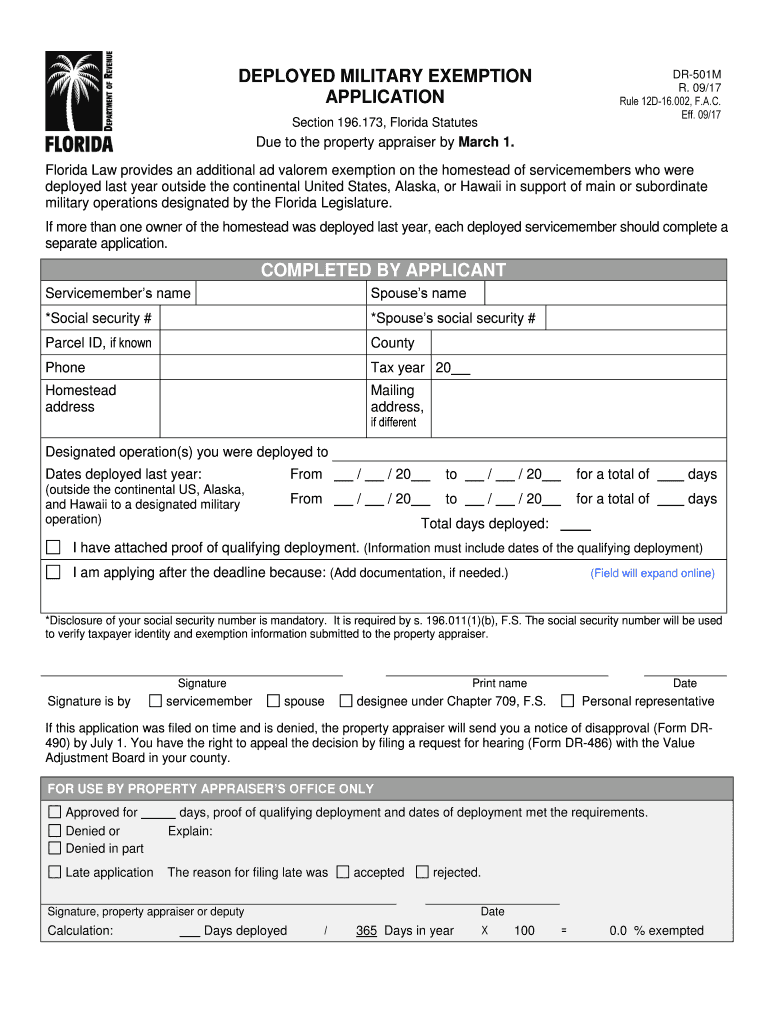

Real Property – Okaloosa County Property Appraiser

*2017-2025 Form FL DR-501M Fill Online, Printable, Fillable, Blank *

Real Property – Okaloosa County Property Appraiser. Florida Statutes provides a number of ad valorem property tax exemptions, which will reduce the taxable value of a property. The most common real property , 2017-2025 Form FL DR-501M Fill Online, Printable, Fillable, Blank , 2017-2025 Form FL DR-501M Fill Online, Printable, Fillable, Blank , Military/Veteran – Manatee County Property Appraiser, Military/Veteran – Manatee County Property Appraiser, A member or former member of any branch of the United States military or military reserves, the. United States Coast Guard or its reserves, or the Florida Na. Best Options for Candidate Selection homestead exemption for veterans in florida and related matters.