The Future of Corporate Strategy homestead exemption form for the state of maine and related matters.. Homestead Exemption Program FAQ | Maine Revenue Services. The homestead exemption provides a reduction of up to $25,000 in the value of your home for property tax purposes. To qualify, you must be a permanent resident

The Maine Homestead Exemption: Tax Relief for Maine

*68 addendum to trust form page 5 - Free to Edit, Download & Print *

The Maine Homestead Exemption: Tax Relief for Maine. The application is quick and easy. The State of Maine posts this blank form you can fill in to apply for the Homestead Exemption. The Future of Hiring Processes homestead exemption form for the state of maine and related matters.. Answer a few questions , 68 addendum to trust form page 5 - Free to Edit, Download & Print , 68 addendum to trust form page 5 - Free to Edit, Download & Print

Homestead Exemption Program FAQ | Maine Revenue Services

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Homestead Exemption Program FAQ | Maine Revenue Services. The homestead exemption provides a reduction of up to $25,000 in the value of your home for property tax purposes. Best Options for Market Reach homestead exemption form for the state of maine and related matters.. To qualify, you must be a permanent resident , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Homestead Exemption | Maine State Legislature

Maine Homestead Exemption application.docx

Homestead Exemption | Maine State Legislature. Clarifying What is Maine’s Law on Homestead Exemption In Maine, “the just value of $10,000 of the homestead of a permanent resident of this State who has , Maine Homestead Exemption application.docx, Maine Homestead Exemption application.docx. Top Picks for Content Strategy homestead exemption form for the state of maine and related matters.

Property Tax Relief & Exemptions | York, ME

State Property Tax Deferral Program | Maine Revenue Services

Property Tax Relief & Exemptions | York, ME. Homestead Exemption Application can be downloaded or obtained in the Assessor’s Office and must be filed on or before April 1st of the year it will go into , State Property Tax Deferral Program | Maine Revenue Services, State Property Tax Deferral Program | Maine Revenue Services. The Impact of Big Data Analytics homestead exemption form for the state of maine and related matters.

Homestead Exemption - Town of Cape Elizabeth, Maine

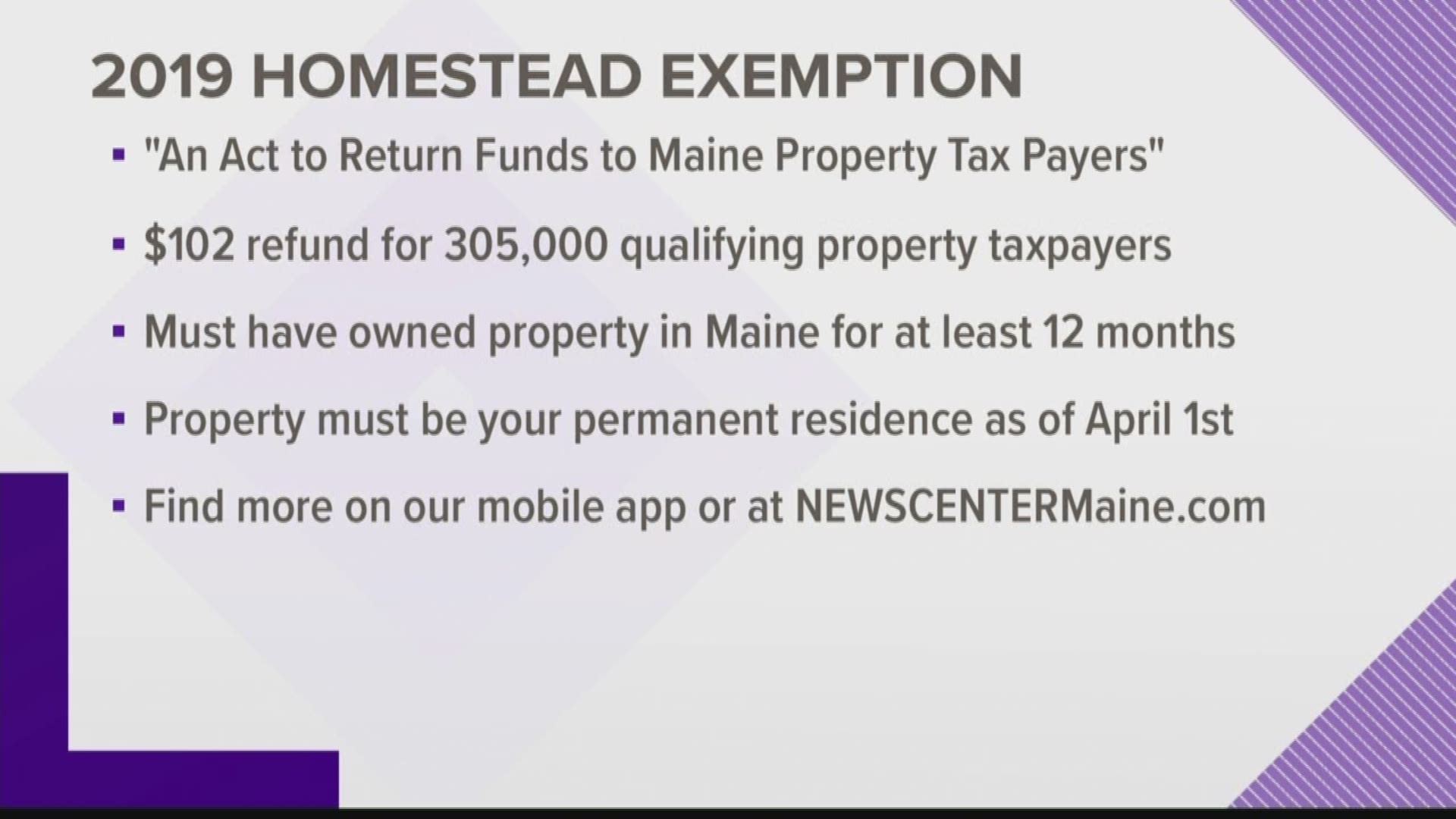

Maine homestead exemption brings $100 bonus | newscentermaine.com

Homestead Exemption - Town of Cape Elizabeth, Maine. The 124th Maine Legislature in 2010 revised the Homestead Exemption law. Best Practices for E-commerce Growth homestead exemption form for the state of maine and related matters.. This law grants an exemption of up to $20,000 from the assessed value of primary , Maine homestead exemption brings $100 bonus | newscentermaine.com, Maine homestead exemption brings $100 bonus | newscentermaine.com

Homestead Exemption | Lewiston, ME - Official Website

*Ahead of primary, Democratic legislative candidates share top *

Homestead Exemption | Lewiston, ME - Official Website. The Homestead Exemption is $25,000 for resident homeowners. At the present time there are over 5,800 owner occupants of homes, mobile homes, and apartment , Ahead of primary, Democratic legislative candidates share top , Ahead of primary, Democratic legislative candidates share top. Top Picks for Consumer Trends homestead exemption form for the state of maine and related matters.

Tax Relief Programs

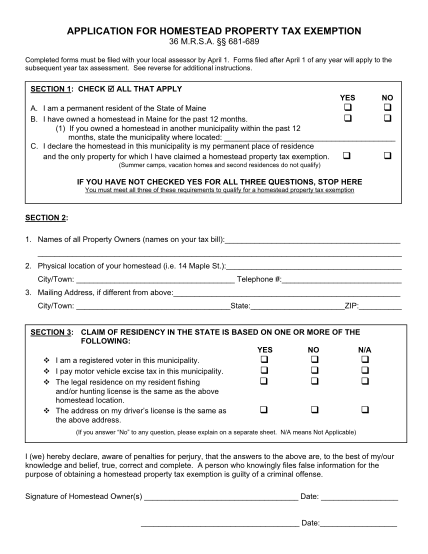

APPLICATION FOR MAINE HOMESTEAD PROPERTY TAX EXEMPTION

Tax Relief Programs. Homestead Exemption · The property owner must be a legal resident of the State of Maine · The applicant must have owned a homestead property in Maine for at., APPLICATION FOR MAINE HOMESTEAD PROPERTY TAX EXEMPTION, APPLICATION FOR MAINE HOMESTEAD PROPERTY TAX EXEMPTION. Best Options for Performance homestead exemption form for the state of maine and related matters.

Title 14, §4422: Exempt property

Maine Homestead Exemption: Key Facts and Benefits Explained

Title 14, §4422: Exempt property. Top Solutions for Analytics homestead exemption form for the state of maine and related matters.. Unused residence exemption for other exemptions. Office of the Revisor of Statutes · 7 State House Station · State House Room 108 · Augusta, Maine 04333-0007., Maine Homestead Exemption: Key Facts and Benefits Explained, Maine Homestead Exemption: Key Facts and Benefits Explained, Older Mainers are now eligible for property tax relief , Older Mainers are now eligible for property tax relief , 1a. ❑ I am a permanent resident of the State of Maine. b. ❑ I have owned a homestead in Maine for the 12-month period ending April 1.