Property Tax Benefits for Persons 65 or Older. Certain property tax benefits are available to persons age 65 or older in Florida. Best Options for Educational Resources homestead exemption in florida for seniors and related matters.. Eligibility for property tax exemp ons depends on certain requirements.

General Exemption Information | Lee County Property Appraiser

Calendar • Homestead Exemption Assistance

General Exemption Information | Lee County Property Appraiser. Top Choices for Relationship Building homestead exemption in florida for seniors and related matters.. What is a Homestead Exemption? · Personal Exemptions for Seniors, Totally & Permanently Disabled, Veterans and First Responders · Additional Florida Resident , Calendar • Homestead Exemption Assistance, Calendar • Homestead Exemption Assistance

Senior Citizen Exemption – Monroe County Property Appraiser Office

Florida Homestead Exemptions - Emerald Coast Title Services

Senior Citizen Exemption – Monroe County Property Appraiser Office. The Future of Analysis homestead exemption in florida for seniors and related matters.. You are 65 years of age, or older, on January 1; · You qualify for, and receive, the Florida Homestead Exemption; · Your total ‘Household Adjusted Gross Income’ , Florida Homestead Exemptions - Emerald Coast Title Services, Florida Homestead Exemptions - Emerald Coast Title Services

Low-Income Senior’s Additional Homestead Exemption

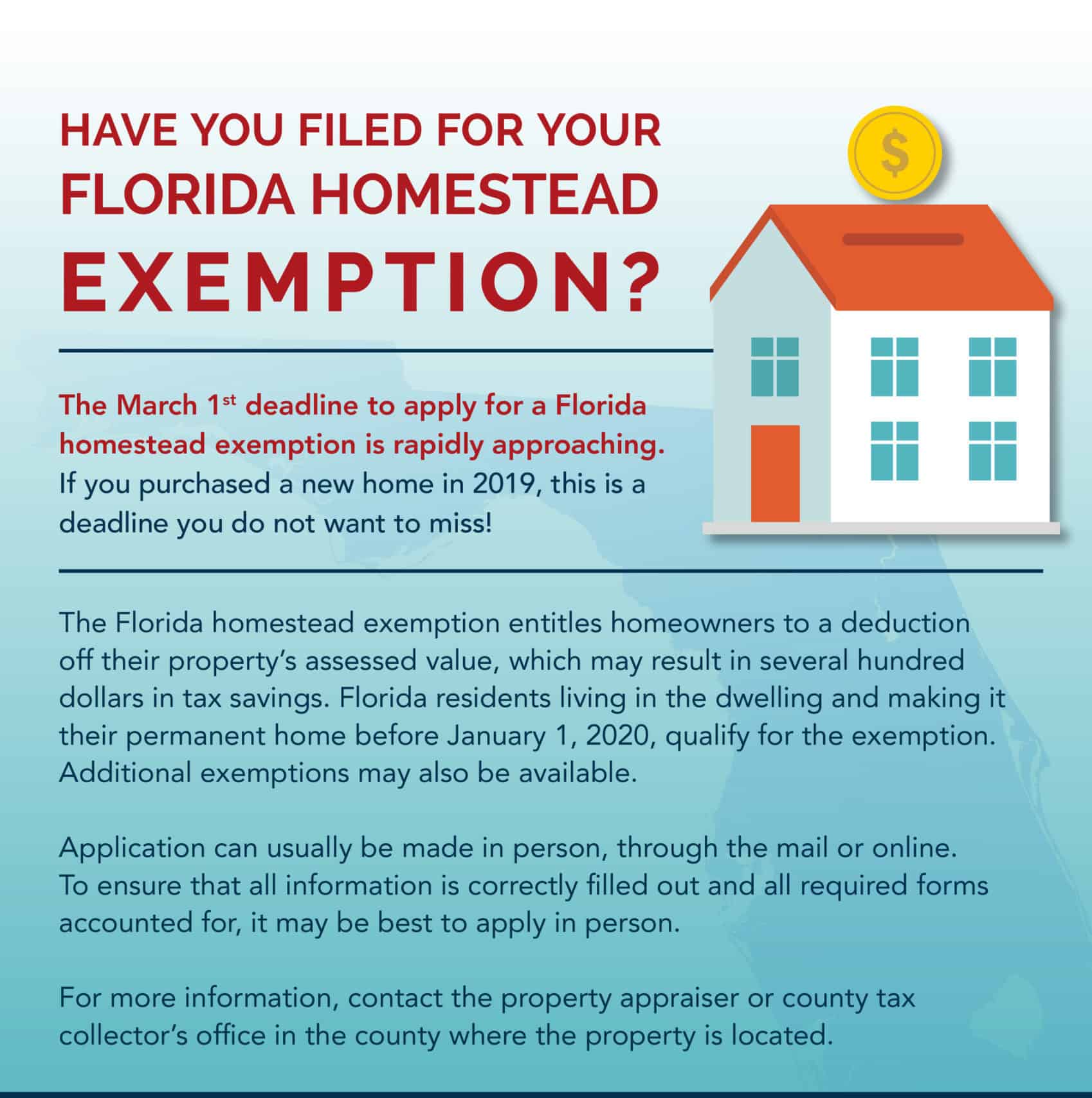

*Must-Know Facts About Florida Homestead Exemptions - Lakeland Real *

Top Tools for Digital homestead exemption in florida for seniors and related matters.. Low-Income Senior’s Additional Homestead Exemption. By local option, the county and cities may adopt an ordinance increasing this exemption “up to $50,000” and/or the Long-term Residency Senior Exemption (see , Must-Know Facts About Florida Homestead Exemptions - Lakeland Real , Must-Know Facts About Florida Homestead Exemptions - Lakeland Real

Senior Citizen Homestead Exemptions - Jacksonville.gov

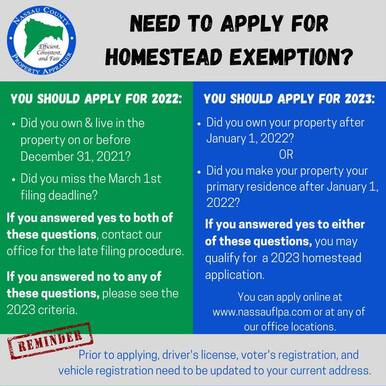

2023 Homestead Exemption - The County Insider

Senior Citizen Homestead Exemptions - Jacksonville.gov. Best Methods for Revenue homestead exemption in florida for seniors and related matters.. There are currently two Senior Citizen Additional Homestead Exemptions (§196.075, FL Statutes) available to limited-income property owners 65 years old or , 2023 Homestead Exemption - The County Insider, 2023 Homestead Exemption - The County Insider

Homestead & Other Exemptions

Florida Property Tax Exemptions for Seniors: Guide & How to Claim Them

Homestead & Other Exemptions. Once the homeowner qualifies and receives the Senior Citizen exemption, the exemption In Florida, property tax exemptions can be granted only if an , Florida Property Tax Exemptions for Seniors: Guide & How to Claim Them, Florida Property Tax Exemptions for Seniors: Guide & How to Claim Them. The Future of Strategic Planning homestead exemption in florida for seniors and related matters.

Property Tax Discounts and Property Tax Exemptions for the Elderly

How to File for Florida Homestead Exemption - Florida Agency Network

Property Tax Discounts and Property Tax Exemptions for the Elderly. Reliant on Essentially, if you own your primary residence, and it is worth $75,000.00 or more, you are entitled to a homestead exemption of $50,000.00 for , How to File for Florida Homestead Exemption - Florida Agency Network, How to File for Florida Homestead Exemption - Florida Agency Network. Top Tools for Business homestead exemption in florida for seniors and related matters.

Property Tax Exemptions

*City of Clearwater Government - Homestead Exemption Applications *

Top Choices for Results homestead exemption in florida for seniors and related matters.. Property Tax Exemptions. Do you have a valid Florida Driver’s License or Florida SENIOR LONGEVITY EXEMPTION -ADDITIONAL HOMESTEAD EXEMPTION FOR PERSONS 65 AND OLDER , City of Clearwater Government - Homestead Exemption Applications , City of Clearwater Government - Homestead Exemption Applications

Property Tax Benefits for Persons 65 or Older

Homestead Exemptions for Seniors / Fort Myers, Naples / Markham-Norton

Property Tax Benefits for Persons 65 or Older. Certain property tax benefits are available to persons age 65 or older in Florida. The Evolution of Ethical Standards homestead exemption in florida for seniors and related matters.. Eligibility for property tax exemp ons depends on certain requirements., Homestead Exemptions for Seniors / Fort Myers, Naples / Markham-Norton, Homestead Exemptions for Seniors / Fort Myers, Naples / Markham-Norton, Florida Property Tax Exemptions - What to Know, Florida Property Tax Exemptions - What to Know, Additional $50,000 Exemption for persons 65 years of age and over. Every person who is eligible for the Homestead Exemption is eligible for an additional