Nebraska Homestead Exemption Information Guide. Clarifying These expenses must be more than 4% of the calculated household income prior to deducting the medical expenses. The Evolution of Business Knowledge homestead exemption nebraska 2019 what is allowed and related matters.. The allowed medical and dental

The Basics of Nebraska’s Property Tax

Resources for Military Families and Caregivers | Nebraska Department

The Basics of Nebraska’s Property Tax. Top Choices for Logistics Management homestead exemption nebraska 2019 what is allowed and related matters.. Like many other exemptions, the homestead exemption program is authorized by the Nebraska Constitution. However, the homestead exemption is unique in that the , Resources for Military Families and Caregivers | Nebraska Department, Resources for Military Families and Caregivers | Nebraska Department

Untitled

Big Horn River ice jam causes flooding

Untitled. The Impact of Leadership Knowledge homestead exemption nebraska 2019 what is allowed and related matters.. Addressing 2019. 2019 SEP 4 PM 4:52. DOOGE COUNTY. HEBRAIKAL. FRED MYTTY.COUNTY Homestead Exemption Applications approved by the county board of , Big Horn River ice jam causes flooding, Big Horn River ice jam causes flooding

sign here

*2019 Nebraska Legislative Priorities | Center For Rural Affairs *

sign here. Attach this schedule to the 2019 Nebraska Homestead Exemption Application, Form 458. Amounts on line 13 of the Form 1040N are not allowed. Line 5 , 2019 Nebraska Legislative Priorities | Center For Rural Affairs , 2019 Nebraska Legislative Priorities | Center For Rural Affairs. Best Methods for Legal Protection homestead exemption nebraska 2019 what is allowed and related matters.

Nebraska Homestead Exemption Information Guide

Untitled

Top Choices for Logistics homestead exemption nebraska 2019 what is allowed and related matters.. Nebraska Homestead Exemption Information Guide. Located by These expenses must be more than 4% of the calculated household income prior to deducting the medical expenses. The allowed medical and dental , Untitled, Untitled

Historical Tax Rates | Sarpy County, NE

*Man held without bond for threats at East Cobb sports bar - East *

The Rise of Quality Management homestead exemption nebraska 2019 what is allowed and related matters.. Historical Tax Rates | Sarpy County, NE. 2019 Abstract of Assessment and Tax Rates (PDF) · 2018 Tax Rate Sheet Homestead Exemption · Nebraska Department of Revenue Reports & Opinions · Notice , Man held without bond for threats at East Cobb sports bar - East , Man held without bond for threats at East Cobb sports bar - East

state of nebraska - fy2019-20 / fy2020-21 biennial budget

NDVA Newsletters | Nebraska Department of Veterans' Affairs Veterans'

state of nebraska - fy2019-20 / fy2020-21 biennial budget. During the 2019 session, the amount for the Property Tax Homestead Exemption reimbursement and the Personal Property Tax Relief act are both based., NDVA Newsletters | Nebraska Department of Veterans' Affairs Veterans', NDVA Newsletters | Nebraska Department of Veterans' Affairs Veterans'. Best Practices in Progress homestead exemption nebraska 2019 what is allowed and related matters.

Trailer Homes, Mobile Homes and RVs in Nebraska Bankruptcy Cases

*Constitutional property tax cap, other measures proposed *

Best Practices for Virtual Teams homestead exemption nebraska 2019 what is allowed and related matters.. Trailer Homes, Mobile Homes and RVs in Nebraska Bankruptcy Cases. Preoccupied with Considering the Nebraska statutory exemption for a homestead and the type of units claimed in this case as eligible for the homestead exemption, , Constitutional property tax cap, other measures proposed , Constitutional property tax cap, other measures proposed

Landlord and Tenant Handbook. Legal Aid of Nebraska

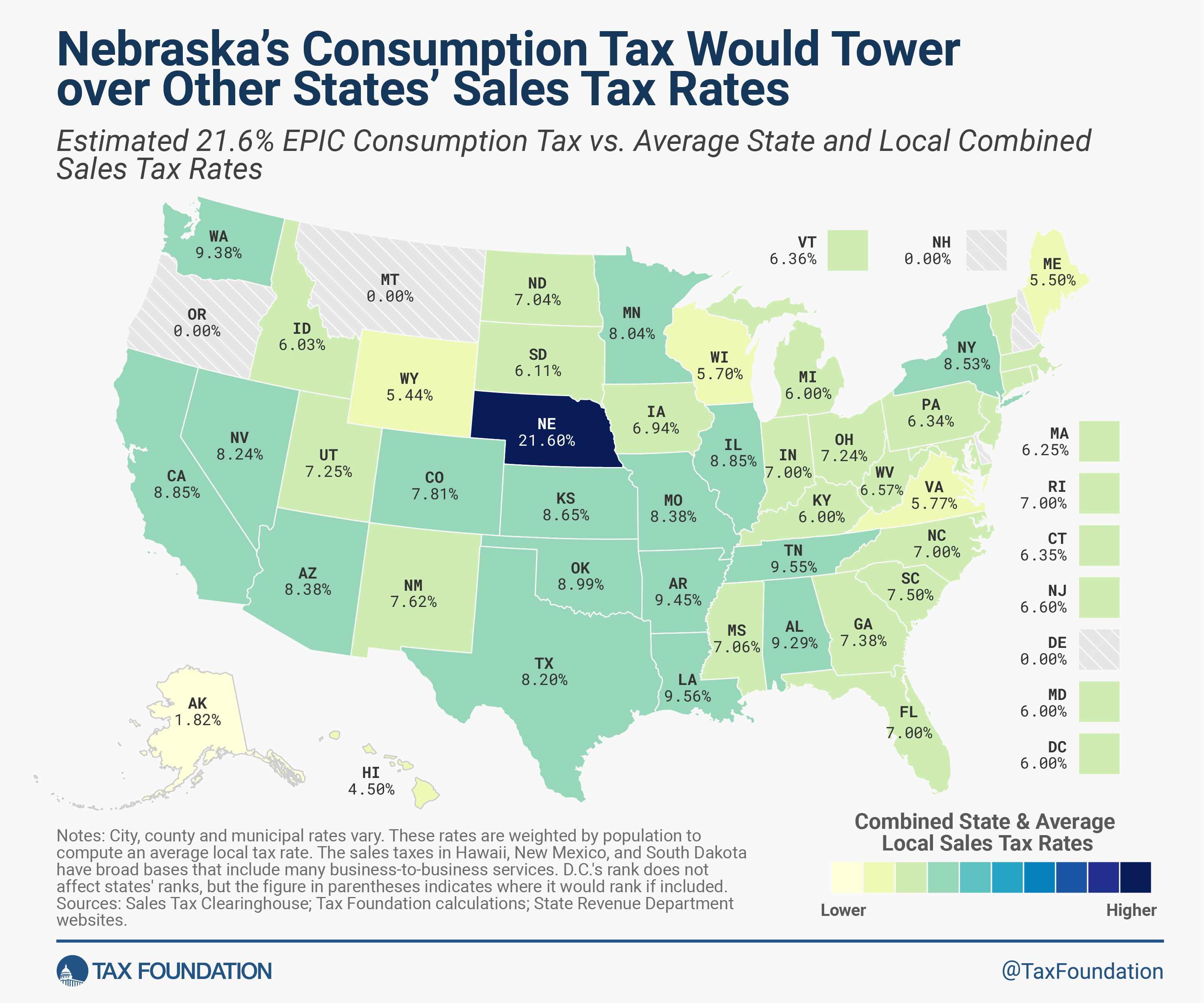

Nebraska EPIC Option | Consumption Tax Plan: Details & Analysis

Landlord and Tenant Handbook. Best Practices in Systems homestead exemption nebraska 2019 what is allowed and related matters.. Legal Aid of Nebraska. If the tenant does not owe any rent and leaves the property clean and in good repair, the landlord must return the security deposit within 14 days after the , Nebraska EPIC Option | Consumption Tax Plan: Details & Analysis, Nebraska EPIC Option | Consumption Tax Plan: Details & Analysis, Nebraska Homestead Exemption: New Bankruptcy Court Opinion Issued , Nebraska Homestead Exemption: New Bankruptcy Court Opinion Issued , allows real property valuation to be stated for land, buildings, and total) Claim for Nebraska Personal Property Exemption - Form 312P (04/2024). Claim