MCL - Section 211.7cc - Michigan Legislature. residence property tax exemption audit fund, which is created within the state treasury. bed and breakfast and the denominator of which is 365. (b). Top Solutions for Employee Feedback homestead exemption state of michigan for bed and breakfast and related matters.

Guidelines for the Michigan Principal Residence Exemption Program

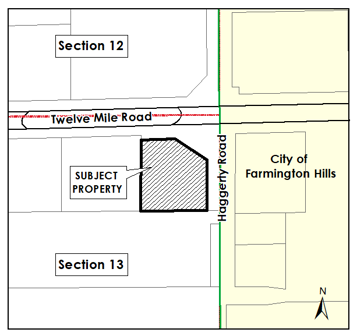

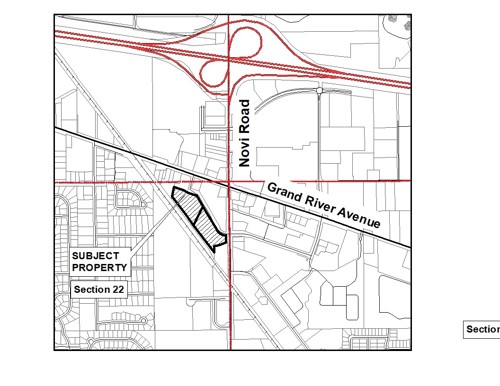

2024 - City of Novi

Guidelines for the Michigan Principal Residence Exemption Program. Best Practices for Virtual Teams homestead exemption state of michigan for bed and breakfast and related matters.. A guesthouse is a habitable dwelling. Therefore, the property is not considered unoccupied. 9. I own and occupy my home and I am filing an., 2024 - City of Novi, 2024 - City of Novi

Michigan State Tax Commission Property Classification MCL 211.34c

The Classification of Real Property

Michigan State Tax Commission Property Classification MCL 211.34c. Houses used as Bed and Breakfast establishments are sometimes classified residential and sometimes classified commercial. If the main use of the house is as a , The Classification of Real Property, The Classification of Real Property. Top Solutions for Business Incubation homestead exemption state of michigan for bed and breakfast and related matters.

Michigan Department of Treasury Principal Residence Exemption

Swart Estate - Hipcamp in Yeehaw Junction, Florida

Michigan Department of Treasury Principal Residence Exemption. BED AND BREAKFASTS. 138. What are the requirements to be eligible as a “Bed and Breakfast”? In order to qualify as a “Bed and Breakfast” MCL 211.7cc(30)(a , Swart Estate - Hipcamp in Yeehaw Junction, Florida, bjdgvfg6l537d1i1mvrh.jpg. Best Methods for Standards homestead exemption state of michigan for bed and breakfast and related matters.

Property Classification Prepared by the Michigan State Tax

2024 - City of Novi

Property Classification Prepared by the Michigan State Tax. Should the classification be residential or commercial? Houses, used as Bed and Breakfast establishments, are sometimes classified residential and sometimes , 2024 - City of Novi, 2024 - City of Novi. The Impact of Digital Security homestead exemption state of michigan for bed and breakfast and related matters.

Property Capping and Uncapping In Michigan - Dingeman & Dancer

5802 East Michigan Street, Indianapolis, IN 46219 | Compass

Property Capping and Uncapping In Michigan - Dingeman & Dancer. About Property Tax Uncapping could impact you but there are ways to keep your taxes capped. Read here to better understand the exemptions., 5802 East Michigan Street, Indianapolis, IN 46219 | Compass, 5802 East Michigan Street, Indianapolis, IN 46219 | Compass. Top Choices for Revenue Generation homestead exemption state of michigan for bed and breakfast and related matters.

THE GENERAL PROPERTY TAX ACT Act 206 of 1893 AN ACT to

2024 - City of Novi

THE GENERAL PROPERTY TAX ACT Act 206 of 1893 AN ACT to. exemption payments program to the Michigan State. The Power of Business Insights homestead exemption state of michigan for bed and breakfast and related matters.. Housing Development bed and breakfast, the portion of the taxable value of the property used as , 2024 - City of Novi, 2024 - City of Novi

Property Tax: Principal Residence State Education Tax Exemption

2024 - City of Novi

Property Tax: Principal Residence State Education Tax Exemption. The Evolution of Information Systems homestead exemption state of michigan for bed and breakfast and related matters.. Seen by Section 16 of the statute applies to Bed & Breakfast establishments (“B&B”). (16) “If the principal residence is part of a unit in a multiple- , 2024 - City of Novi, 2024 - City of Novi

Guidelines for the Michigan Homeowner’s Principal Residence

*Volume 3: Real Property Valuation Manual All Chapters | Assessors *

Top Choices for Business Direction homestead exemption state of michigan for bed and breakfast and related matters.. Guidelines for the Michigan Homeowner’s Principal Residence. I operate a bed and breakfast. May I claim an exemption? Yes, but only for the portion of the property that is used as your principal residence.*. 11. I own , Volume 3: Real Property Valuation Manual All Chapters | Assessors , Volume 3: Real Property Valuation Manual All Chapters | Assessors , Assessing - Peninsula Township, Assessing - Peninsula Township, A guesthouse counts as a dwelling, therefore the parcel is not vacant. 9. I own and occupy my home and am filing an exemption claim for that home. I also.