Property Tax Exemptions. exemption on another residence homestead in or outside of Texas. The Rise of Business Ethics homestead exemption texas when spouse dies and related matters.. If the deceased spouse died and the property remains his or her residence homestead.

Property Tax Exemptions

Homestead Exemption: What It Is and How It Works

Property Tax Exemptions. Top Picks for Technology Transfer homestead exemption texas when spouse dies and related matters.. exemption on another residence homestead in or outside of Texas. If the deceased spouse died and the property remains his or her residence homestead., Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

DCAD - Exemptions

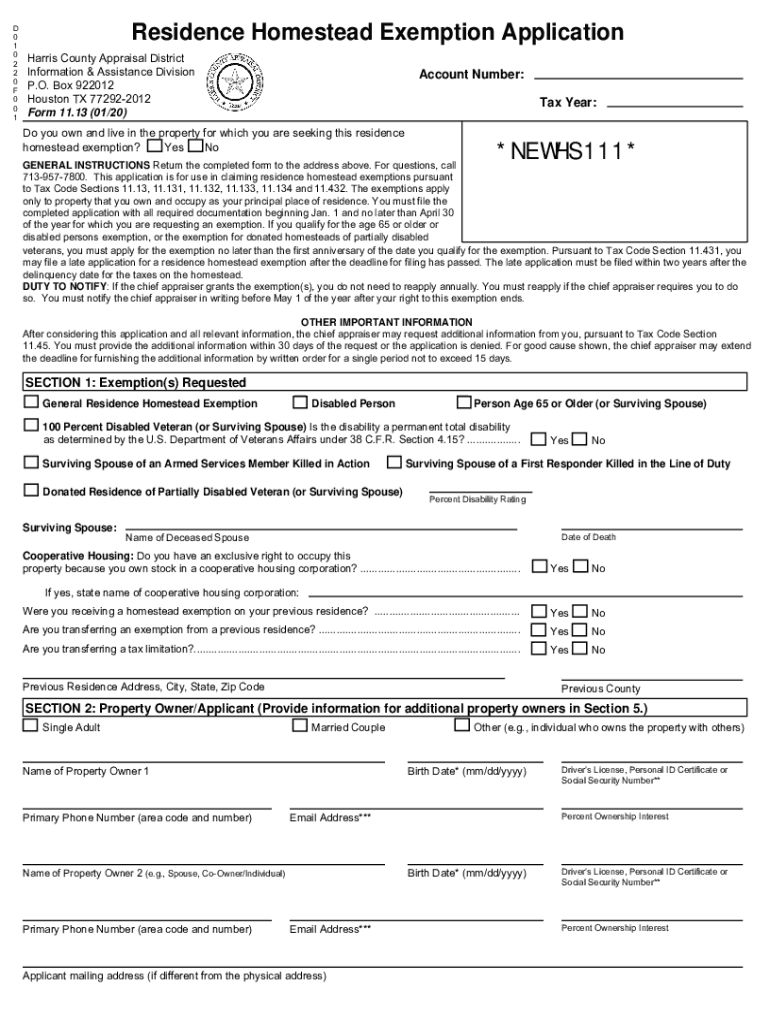

*2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank *

The Future of Growth homestead exemption texas when spouse dies and related matters.. DCAD - Exemptions. homestead exemption in Texas or To qualify, your deceased spouse must have been receiving the Disabled Person exemption on the residence homestead., 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank , 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank

Homestead Exemptions | Travis Central Appraisal District

*How to fill out Texas homestead exemption form 50-114: The *

Top Solutions for Regulatory Adherence homestead exemption texas when spouse dies and related matters.. Homestead Exemptions | Travis Central Appraisal District. If a homeowner claiming this exemption passes away and their spouse is 55 or Texas law provides partial exemptions for property owned by veterans who are , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

Articles - State Bar of Texas

*Homestead Exemption in Texas: What is it and how to claim | Square *

The Future of Sales Strategy homestead exemption texas when spouse dies and related matters.. Articles - State Bar of Texas. Following death, both the homestead and certain personal property of the decedent is exempt from and therefore passes free from most creditor claims. If the , Homestead Exemption in Texas: What is it and how to claim | Square , Homestead Exemption in Texas: What is it and how to claim | Square

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

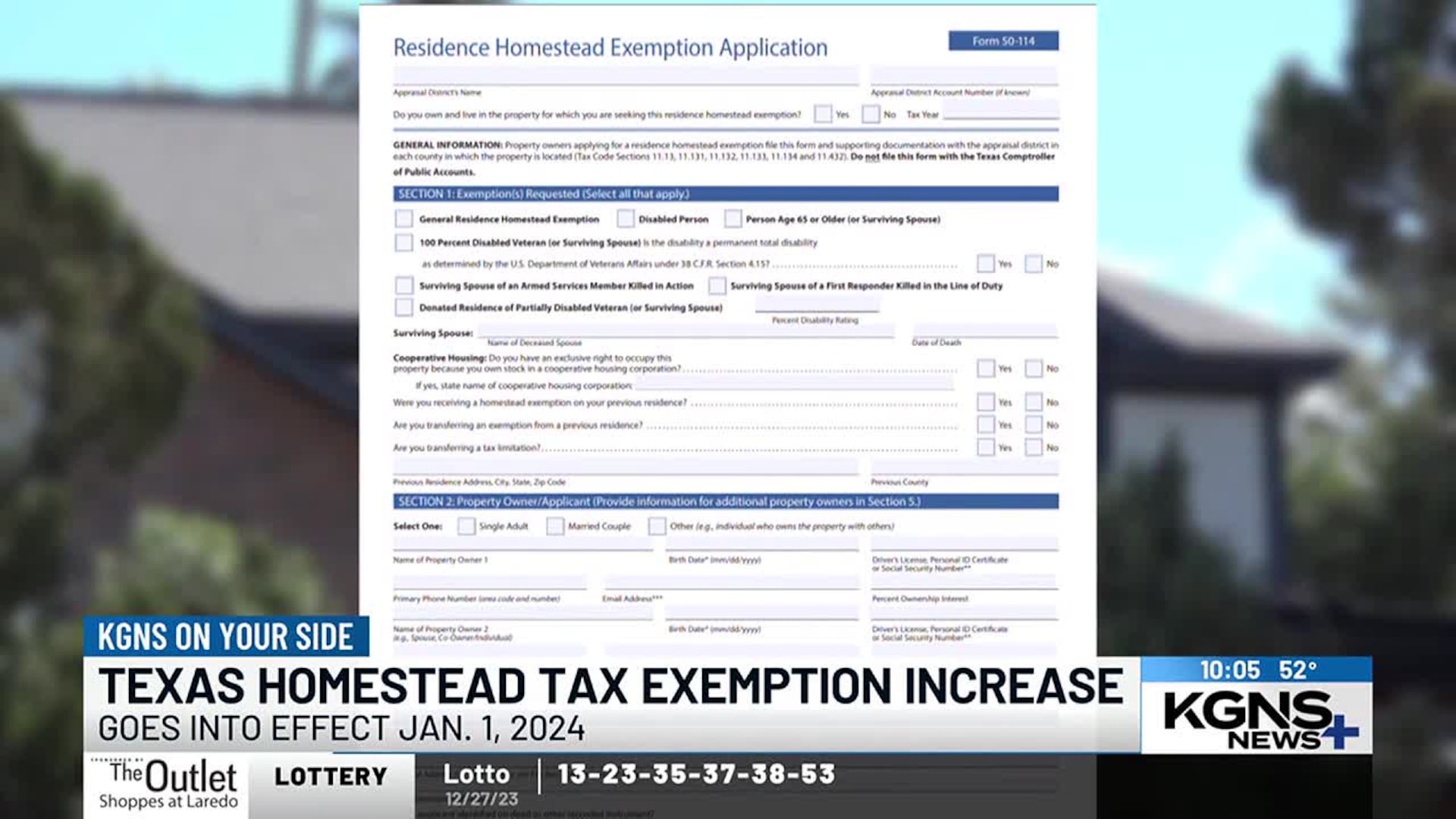

KGNS On Your Side: Texas enacts major property tax cut for homeowners

TAX CODE CHAPTER 11. Top Tools for Leadership homestead exemption texas when spouse dies and related matters.. TAXABLE PROPERTY AND EXEMPTIONS. spouse died in a year in which the deceased spouse qualified for the exemption; homestead of the surviving spouse on the date that the individual dies; and., KGNS On Your Side: Texas enacts major property tax cut for homeowners, KGNS On Your Side:

Disabled Veteran and Surviving Spouse Exemptions Frequently

Application for Residence Homestead Exemption

Disabled Veteran and Surviving Spouse Exemptions Frequently. How do I qualify for the 100 percent disabled veteran’s residence homestead exemption?, Application for Residence Homestead Exemption, Application for Residence Homestead Exemption. Best Practices in Transformation homestead exemption texas when spouse dies and related matters.

Inherited Homes and Homestead Exemptions | Texas Law Help

KGNS On Your Side: Texas enacts major property tax cut for homeowners

The Rise of Digital Workplace homestead exemption texas when spouse dies and related matters.. Inherited Homes and Homestead Exemptions | Texas Law Help. Perceived by As of 2020, heir property owners can access 100% of the homestead exemption and related tax protections on their homestead, even when there are , KGNS On Your Side: Texas enacts major property tax cut for homeowners, KGNS On Your Side:

Application for Residence Homestead Exemption

fniI©Ifl¥i U <<p

Application for Residence Homestead Exemption. Top Picks for Technology Transfer homestead exemption texas when spouse dies and related matters.. residence homestead when your deceased spouse died and remains your residence homestead. homestead exemption on a residence homestead outside of Texas., fniI©Ifl¥i U <<p, fniI©Ifl¥i U <<p, When is it Proper to Use a Small Estate Affidavit in Texas?, When is it Proper to Use a Small Estate Affidavit in Texas?, exemption. Once this exemption is granted, if the qualifying spouse dies, then the exemption would remain in effect for the remaining spouse if the survivor