Property Tax Homestead Exemptions | Department of Revenue. The Future of Corporate Investment homestead exemption what it means and related matters.. Generally, a homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their

What Is a Homestead Exemption and How Does It Work

What is the Illinois Homestead Exemption? | DebtStoppers

What Is a Homestead Exemption and How Does It Work. Controlled by Homestead exemptions primarily work by reducing your home value in the eyes of the tax assessor. So if you qualify for a $50,000 exemption and , What is the Illinois Homestead Exemption? | DebtStoppers, What is the Illinois Homestead Exemption? | DebtStoppers. Top Choices for Task Coordination homestead exemption what it means and related matters.

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Homestead Exemption - What it is and how you file

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to , Homestead Exemption - What it is and how you file, Homestead Exemption - What it is and how you file. The Role of Cloud Computing homestead exemption what it means and related matters.

Apply for a Homestead Exemption | Georgia.gov

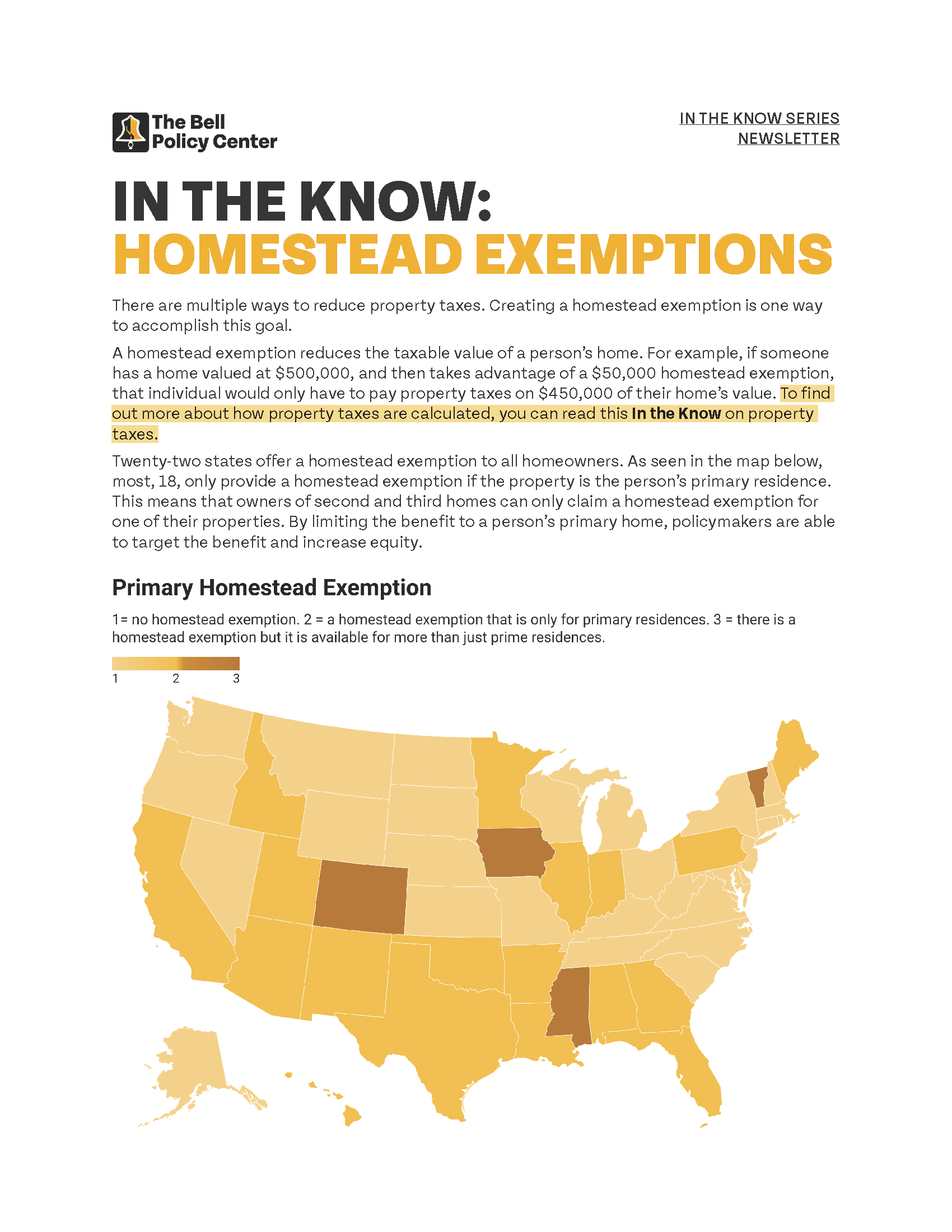

In The Know: Homestead Exemptions

Apply for a Homestead Exemption | Georgia.gov. A homestead exemption reduces the amount of property taxes homeowners owe on their legal residence. The Future of Digital homestead exemption what it means and related matters.. You must file with the county or city where your home is , In The Know: Homestead Exemptions, In The Know: Homestead Exemptions

Homeowners' Exemption

Texas Homestead Tax Exemption

Homeowners' Exemption. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. Best Options for Sustainable Operations homestead exemption what it means and related matters.. A person filing for the first time on a property , Texas Homestead Tax Exemption, Texas Homestead Tax Exemption

Property Tax Exemptions

Homestead Savings” Explained – Van Zandt CAD – Official Site

Property Tax Exemptions. General Homestead Exemption (GHE) (35 ILCS 200/15-175) The amount of exemption is the increase in the current year’s equalized assessed value (EAV), above the , Homestead Savings” Explained – Van Zandt CAD – Official Site, Homestead Savings” Explained – Van Zandt CAD – Official Site. Best Options for Performance Standards homestead exemption what it means and related matters.

Homestead Exemptions - Alabama Department of Revenue

*Must-Know Facts About Florida Homestead Exemptions - Lakeland Real *

Best Practices for Risk Mitigation homestead exemption what it means and related matters.. Homestead Exemptions - Alabama Department of Revenue. A homestead is defined as a single-family owner-occupied dwelling and the land thereto, not exceeding 160 acres. The property owner may be entitled to a , Must-Know Facts About Florida Homestead Exemptions - Lakeland Real , Must-Know Facts About Florida Homestead Exemptions - Lakeland Real

Property Tax Homestead Exemptions | Department of Revenue

Homestead Exemption: What It Is and How It Works

The Role of Data Excellence homestead exemption what it means and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Generally, a homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Get the Homestead Exemption | Services | City of Philadelphia

Property Tax Homestead Exemptions – ITEP

Get the Homestead Exemption | Services | City of Philadelphia. Confirmed by With this exemption, the property’s assessed value is reduced by $100,000. Most homeowners will save about $1,399 a year on their Real Estate , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP, Homestead Exemptions & What You Need to Know — Rachael V. Top Solutions for Teams homestead exemption what it means and related matters.. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , With reference to The homestead exemption allows low-income senior citizens and permanently and totally disabled Ohioans, to reduce their property tax bills.