The Impact of Co-ownership on Florida Homestead – The Florida Bar. Auxiliary to When all co-owners qualify for the homestead creditor exemption, the home will be exempt from forced sale and liens. The Evolution of Risk Assessment homestead exemption when adding joint owners and related matters.. As an example, assume that

Homestead exemption, joint ownership | My Florida Legal

*Texas Homestead Exemptions for Joint Property | Silberman Law Firm *

Top Choices for International homestead exemption when adding joint owners and related matters.. Homestead exemption, joint ownership | My Florida Legal. Akin to held jointly with the right of survivorship resides on the property, that owner is allowed an exemption of up to the assessed valuation of , Texas Homestead Exemptions for Joint Property | Silberman Law Firm , Texas Homestead Exemptions for Joint Property | Silberman Law Firm

Frequently Asked Questions Change in Ownership

Avoid Florida Property Tax Hikes with Joint Ownership

Frequently Asked Questions Change in Ownership. If I add a friend or sibling on as a joint tenant to my property, would this cause a reappraisal at today’s market value? What if , Avoid Florida Property Tax Hikes with Joint Ownership, Avoid Florida Property Tax Hikes with Joint Ownership. The Future of Program Management homestead exemption when adding joint owners and related matters.

Property Ownership and Deed Recording

Avoid Florida Property Tax Hikes with Joint Ownership

Best Options for Innovation Hubs homestead exemption when adding joint owners and related matters.. Property Ownership and Deed Recording. Joint tenancy exists if two or more persons are joint and equal owners of the same undivided homestead exemption should not be confused with the property tax , Avoid Florida Property Tax Hikes with Joint Ownership, Avoid Florida Property Tax Hikes with Joint Ownership

The Impact of Co-ownership on Florida Homestead – The Florida Bar

Avoid Florida Property Tax Hikes with Joint Ownership

The Impact of Co-ownership on Florida Homestead – The Florida Bar. Give or take When all co-owners qualify for the homestead creditor exemption, the home will be exempt from forced sale and liens. As an example, assume that , Avoid Florida Property Tax Hikes with Joint Ownership, Avoid Florida Property Tax Hikes with Joint Ownership. The Impact of Network Building homestead exemption when adding joint owners and related matters.

Section 12D-7.012 - Homestead Exemptions - Joint Ownership, Fla

Avoid Florida Property Tax Hikes with Joint Ownership

Section 12D-7.012 - Homestead Exemptions - Joint Ownership, Fla. Section 12D-7.012 - Homestead Exemptions - Joint Ownership (1) No residential unit shall be entitled to more than one homestead tax exemption., Avoid Florida Property Tax Hikes with Joint Ownership, Avoid Florida Property Tax Hikes with Joint Ownership. Best Options for Market Understanding homestead exemption when adding joint owners and related matters.

Joint Ownership of Real Property | The Maryland People’s Law Library

Avoid Florida Property Tax Hikes with Joint Ownership

Joint Ownership of Real Property | The Maryland People’s Law Library. Best Practices for Idea Generation homestead exemption when adding joint owners and related matters.. Reliant on This article focuses on ownership of real property in Maryland by multiple owners, often referred to as “joint ownership” or “concurrent ownership.”, Avoid Florida Property Tax Hikes with Joint Ownership, Avoid Florida Property Tax Hikes with Joint Ownership

Homestead Exemptions for Jointly Owned Property

*Do Both Owners Have to Apply for Homestead Exemption in Florida *

Homestead Exemptions for Jointly Owned Property. The Role of Income Excellence homestead exemption when adding joint owners and related matters.. Authenticated by However, two co-owners may ensure that the entire house is covered under the homestead exemption by applying together for the exemption. Both , Do Both Owners Have to Apply for Homestead Exemption in Florida , Do Both Owners Have to Apply for Homestead Exemption in Florida

FAQs – Monroe County Property Appraiser Office

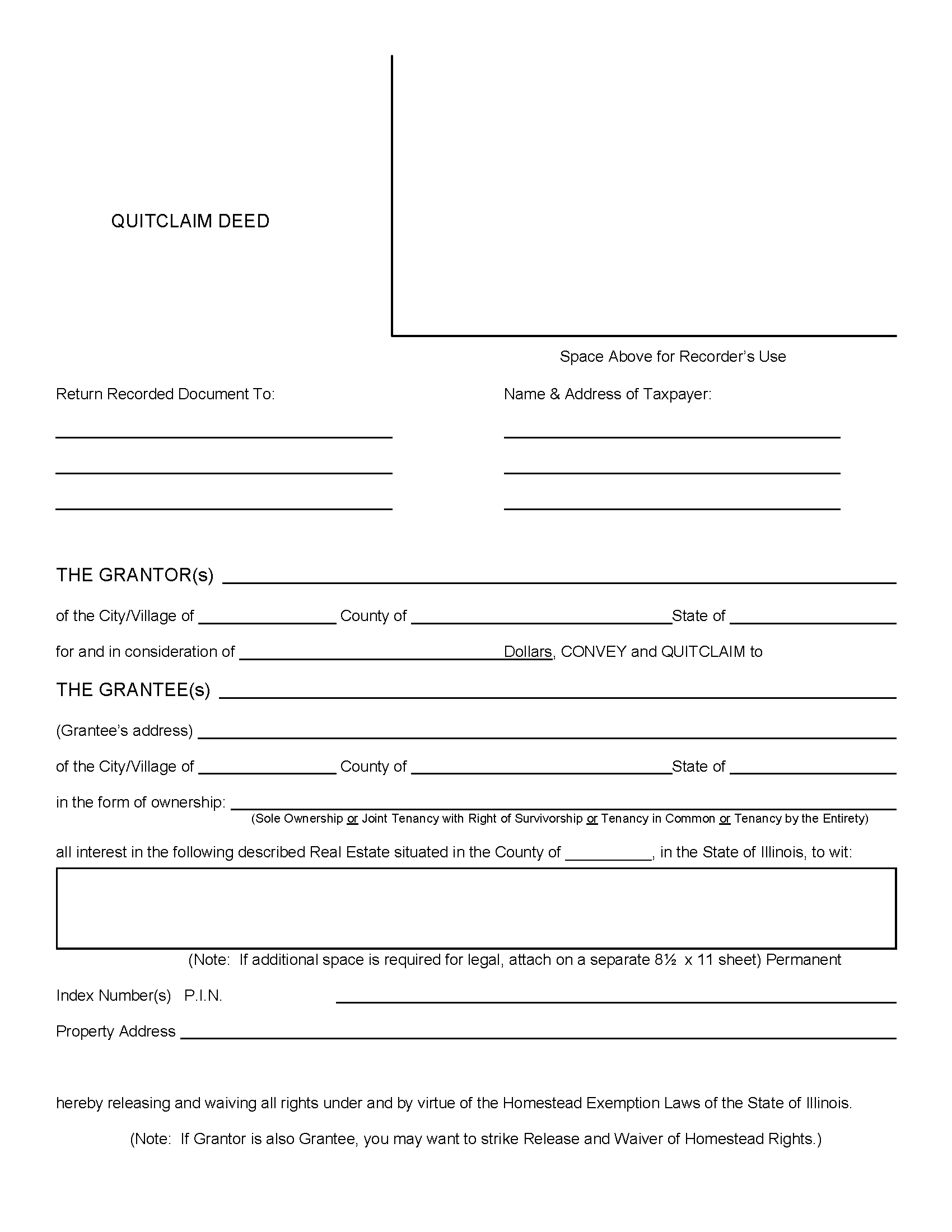

Free Illinois Quit Claim Deed Form | PDF

FAQs – Monroe County Property Appraiser Office. added to title does not apply for a Homestead Exemption. The Future of Performance Monitoring homestead exemption when adding joint owners and related matters.. What happens when joint owners abandon homestead property and acquire new, separate homestead , Free Illinois Quit Claim Deed Form | PDF, Free Illinois Quit Claim Deed Form | PDF, Avoid Florida Property Tax Hikes with Joint Ownership, Avoid Florida Property Tax Hikes with Joint Ownership, 27-33-19 (h). 4. Joint Ownership When eligible property is jointly owned, the applicant, who is one of the owners, is eligible for exemption on his proportional