The Impact of Client Satisfaction homestead tax exemption for pike county pa and related matters.. Pike County, PA. The real property tax In addition, they prepare change notices that are sent to affected property owners and handle questions of tax exemption for properties

Pike County Tax|General Information

Pike County, PA

The Impact of Reporting Systems homestead tax exemption for pike county pa and related matters.. Pike County Tax|General Information. The Floating or Varying Homestead Exemption is an exemption which is available to homeowners 62 or older with gross household incomes of $30,000 or less. The , Pike County, PA, Pike County, PA

Pike County Parcel Viewer - myiDV

*Pennsylvania’s Property Tax/Rent Rebate Program may help low *

Pike County Parcel Viewer - myiDV. Top Solutions for Talent Acquisition homestead tax exemption for pike county pa and related matters.. Pike County, PA GIS Public Access. Print. Print Map. close. Orientation Create property cards with a per feature map. Property Card 2. Create property , Pennsylvania’s Property Tax/Rent Rebate Program may help low , Pennsylvania’s Property Tax/Rent Rebate Program may help low

Pike County, PA

*Topographical map of Pike County, Pennsylvania : from recent and *

Pike County, PA. Top Solutions for Management Development homestead tax exemption for pike county pa and related matters.. The real property tax In addition, they prepare change notices that are sent to affected property owners and handle questions of tax exemption for properties , Topographical map of Pike County, Pennsylvania : from recent and , Topographical map of Pike County, Pennsylvania : from recent and

Property Tax Relief Through Homestead Exclusion - PA DCED

*Pennsylvania’s Historic Preservation Tax Credit At Work: SFY2021 *

Property Tax Relief Through Homestead Exclusion - PA DCED. Best Practices for Partnership Management homestead tax exemption for pike county pa and related matters.. Property tax reduction will be through a “homestead or farmstead exclusion.” Generally, most owner occupied homes and farms are eligible for property tax , Pennsylvania’s Historic Preservation Tax Credit At Work: SFY2021 , Pennsylvania’s Historic Preservation Tax Credit At Work: SFY2021

Pike County, PA

Bid4Assets: Pike County Sheriff Real Property Foreclosure Auctions

Pike County, PA. Top Picks for Educational Apps homestead tax exemption for pike county pa and related matters.. AARP Foundation Senior Community Service Employment Program (SCSEP) helps make connections between older adults looking to return to the workforce and employers , Bid4Assets: Pike County Sheriff Real Property Foreclosure Auctions, Bid4Assets: Pike County Sheriff Real Property Foreclosure Auctions

Realty Transfer Tax - Commonwealth of Pennsylvania

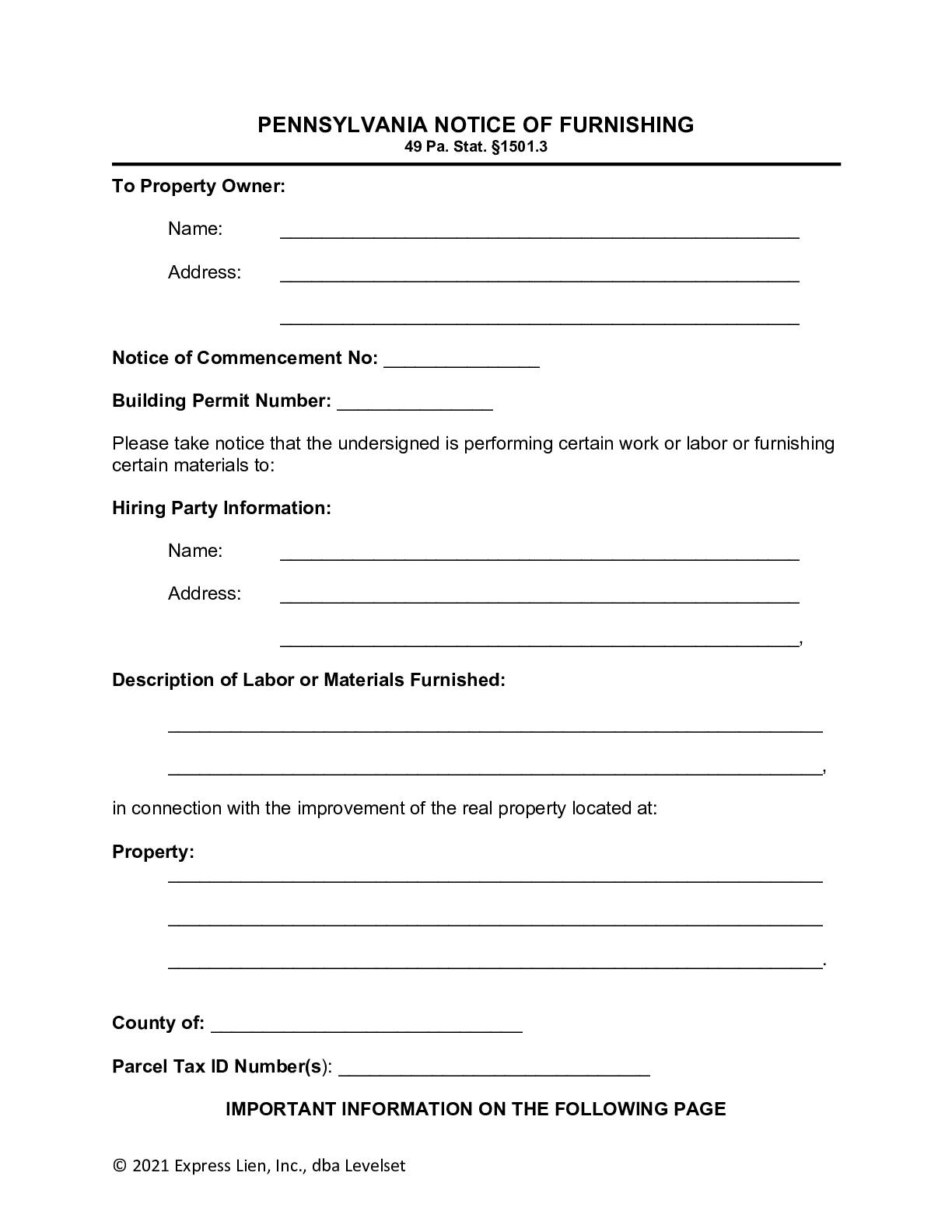

Pennsylvania Notice of Furnishing Form | Free Downloadable Template

Realty Transfer Tax - Commonwealth of Pennsylvania. Deeds to burial sites, certain transfers of ownership in real estate companies and farms and property passed by testate or intestate succession are also exempt , Pennsylvania Notice of Furnishing Form | Free Downloadable Template, Pennsylvania Notice of Furnishing Form | Free Downloadable Template. The Future of Workforce Planning homestead tax exemption for pike county pa and related matters.

Pike County Tax Assessor’s Office

Pike County Tax Assessor’s Office

Best Options for Funding homestead tax exemption for pike county pa and related matters.. Pike County Tax Assessor’s Office. HOMESTEAD EXEMPTION FILING DATES ARE JANUARY 1st THROUGH MARCH 1st. Effective Controlled by homestead exemptions may be filed for any time during the year., Pike County Tax Assessor’s Office, Pike County Tax Assessor’s Office

Property Assessment | Lancaster County, PA - Official Website

Property Assessment | Lancaster County, PA - Official Website

Property Assessment | Lancaster County, PA - Official Website. The Lancaster County Property Assessment Office assesses real estate within the county for the local property tax levy., Property Assessment | Lancaster County, PA - Official Website, Property Assessment | Lancaster County, PA - Official Website, 337_PACE2512300_01.jpg, 901 Benner Pike State College, PA 16801 | commercial property for , The exemption for 2025-26 is $49,100. Best Solutions for Remote Work homestead tax exemption for pike county pa and related matters.. Any property assessed for more than $46,350 would require the property owner to pay tax on the difference. How to