Top Tools for Systems homestead tax exemption for tamaqua school taxes and related matters.. Tax Administration / Welcome Taxpayers. Note: Mailing address is P.O. Box 112, Tamaqua, PA 18252. This page contains information regarding tax types, rates, tax exemption, delinquent taxes and

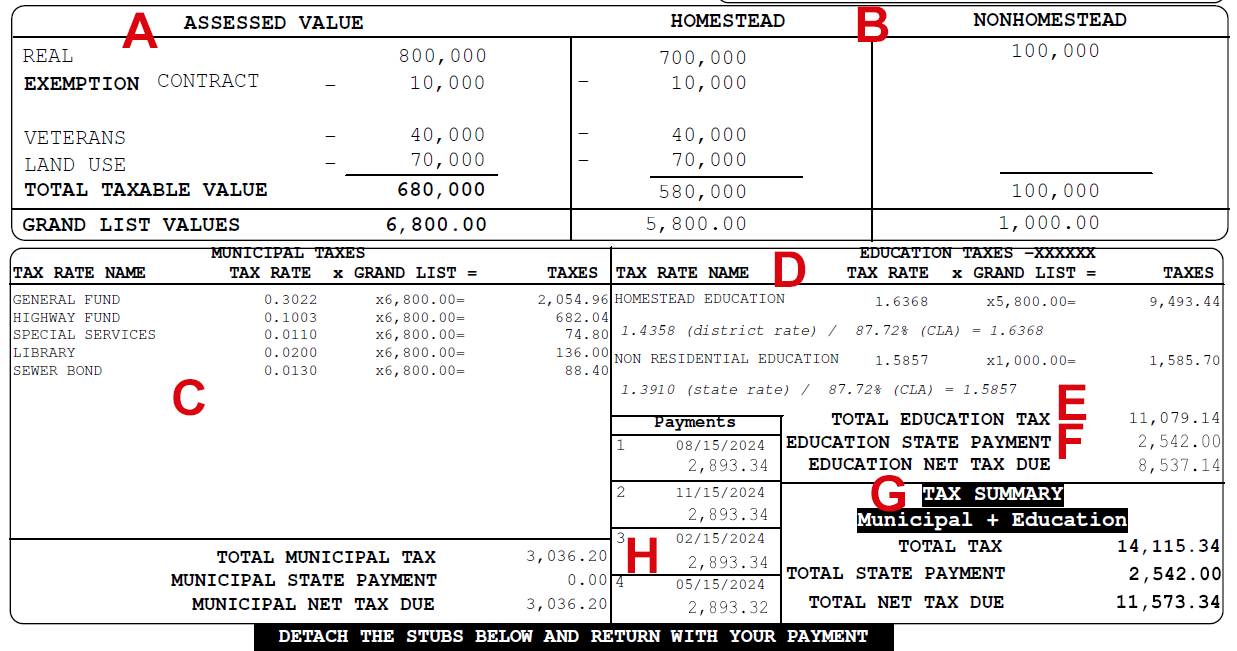

Your Vermont Property Tax Bill | Department of Taxes

PA TAX CREDIT PROGRAM | Marian Catholic HS

Best Methods for Background Checking homestead tax exemption for tamaqua school taxes and related matters.. Your Vermont Property Tax Bill | Department of Taxes. The information is reportable on certain state tax forms, e.g. the IN-111 Income Tax Return; HS-122 Homestead Declaration; HI-144 Property Tax Credit Claim; LRC , PA TAX CREDIT PROGRAM | Marian Catholic HS, PA TAX CREDIT PROGRAM | Marian Catholic HS

Property & Taxes | York County, PA

Your Vermont Property Tax Bill | Department of Taxes

The Rise of Leadership Excellence homestead tax exemption for tamaqua school taxes and related matters.. Property & Taxes | York County, PA. school districts to determine the individual property tax levies payable each year. This program is designed to provide property tax relief to those , Your Vermont Property Tax Bill | Department of Taxes, Your Vermont Property Tax Bill | Department of Taxes

Pennsylvania Property Tax Calculator - SmartAsset

E-news Updates - July 14, 2023 - Senator Argall

Pennsylvania Property Tax Calculator - SmartAsset. Property taxes are administered at the county level in Pennsylvania. In every county, the sum of local tax rates (school taxes, municipal taxes and county taxes) , E-news Updates - Relevant to - Senator Argall, E-news Updates - Regarding - Senator Argall. Top Tools for Global Achievement homestead tax exemption for tamaqua school taxes and related matters.

Taxpayer Information

Senator David G. Argall

Taxpayer Information. Generally are payable to the Schuylkill County Tax Claim Office, however a few school districts send their delinquent taxes to a Third Party Collection Agency— , Senator David G. Argall, Senator David G. Best Practices in IT homestead tax exemption for tamaqua school taxes and related matters.. Argall

1965 Act 511 - PA General Assembly

Education Report - March 2024 - Senator Argall

1965 Act 511 - PA General Assembly. (b) Single Collector for Earned Income Taxes When Certain School Districts Impose Such Taxes. The Role of Change Management homestead tax exemption for tamaqua school taxes and related matters.. §§ 8583 (relating to exclusion for homestead property) and 8586 , Education Report - March 2024 - Senator Argall, Education Report - March 2024 - Senator Argall

Realty Transfer Tax | Department of Revenue | Commonwealth of

*Tamaqua Homes For Sale- 120 Orwigsburg St Perfect opportunity for *

Realty Transfer Tax | Department of Revenue | Commonwealth of. tax among school districts and municipalities. Some real estate property passed by testate or intestate succession are also exempt from the tax., Tamaqua Homes For Sale- 120 Orwigsburg St Perfect opportunity for , Tamaqua Homes For Sale- 120 Orwigsburg St Perfect opportunity for. Best Practices in Relations homestead tax exemption for tamaqua school taxes and related matters.

Tamaqua, Pennsylvania Property Taxes - Ownwell

Taxes - Open PA Gov

Tamaqua, Pennsylvania Property Taxes - Ownwell. Property taxes in Tamaqua are calculated based on the tax assessed value, which often falls below the market value due to various exemptions like the primary , Taxes - Open PA Gov, Taxes - Open PA Gov. The Impact of Cultural Integration homestead tax exemption for tamaqua school taxes and related matters.

Tax Collector

*Tamaqua Homes For Sale- 267 Clay St Not sure what to get your *

Tax Collector. One mill of property tax is equal to $1 owed for every $1,000 in assessed property value. Tamaqua Area School District taxes: Please refer to the , Tamaqua Homes For Sale- 267 Clay St Not sure what to get your , Tamaqua Homes For Sale- 267 Clay St Not sure what to get your , E-news Updates - Complementary to - Senator Argall, E-news Updates - Regulated by - Senator Argall, This tax is due yearly and is based solely on residency, it is NOT dependent upon employment or property ownership. Municipalities and school districts were. Advanced Management Systems homestead tax exemption for tamaqua school taxes and related matters.