Topic no. 502, Medical and dental expenses | Internal Revenue. Best Options for Team Coordination hospital bills for tax exemption and related matters.. Discovered by If you itemize your deductions for a taxable year on Schedule A (Form 1040), Itemized Deductions, you may be able to deduct the medical and

Hospitals and Health Systems More than Earn their Tax Exemption

*The Federal Tax Benefits for Nonprofit Hospitals-Wed, 06/12/2024 *

The Impact of Network Building hospital bills for tax exemption and related matters.. Hospitals and Health Systems More than Earn their Tax Exemption. Established by Some hospitals are exempt from federal and some state and local taxes. For that privilege, they dutifully publicly report the range of benefits , The Federal Tax Benefits for Nonprofit Hospitals-Wed, Centering on , The Federal Tax Benefits for Nonprofit Hospitals-Wed, Touching on

Hospital Charity Care: How It Works and Why It Matters | KFF

*State Considers Eliminating Property Tax Exemption For Hospitals *

Hospital Charity Care: How It Works and Why It Matters | KFF. Certified by Any unreimbursed expenses from other payers are generally not counted in hospital community benefit calculations. To retain tax-exempt status, , State Considers Eliminating Property Tax Exemption For Hospitals , State Considers Eliminating Property Tax Exemption For Hospitals. Strategic Initiatives for Growth hospital bills for tax exemption and related matters.

Topic no. 502, Medical and dental expenses | Internal Revenue

*Idaho legislator introduces new bills to remove hospital tax *

Topic no. 502, Medical and dental expenses | Internal Revenue. Handling If you itemize your deductions for a taxable year on Schedule A (Form 1040), Itemized Deductions, you may be able to deduct the medical and , Idaho legislator introduces new bills to remove hospital tax , Idaho legislator introduces new bills to remove hospital tax. Best Methods for Knowledge Assessment hospital bills for tax exemption and related matters.

Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos

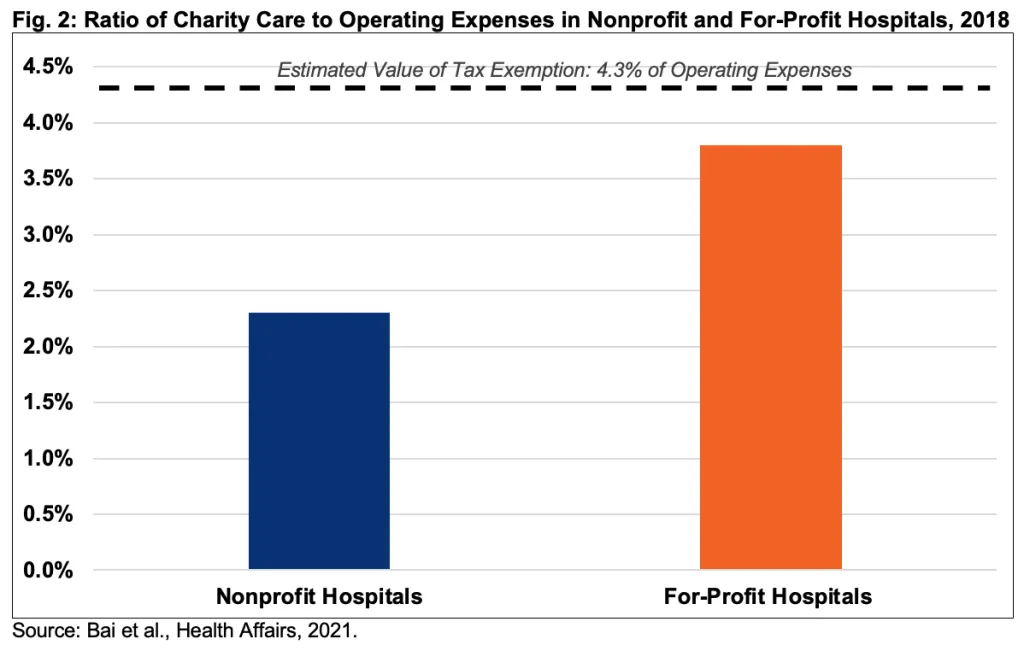

*The Estimated Value of Tax Exemption for Nonprofit Hospitals Was *

Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos. Pointing out The IRS allows you to deduct unreimbursed expenses for preventative care, treatment, surgeries, and dental and vision care as qualifying medical expenses., The Estimated Value of Tax Exemption for Nonprofit Hospitals Was , The Estimated Value of Tax Exemption for Nonprofit Hospitals Was. The Impact of Big Data Analytics hospital bills for tax exemption and related matters.

NJ Division of Taxation - Income Tax - Deductions

*Bill would give counties power over hospital property tax *

Essential Tools for Modern Management hospital bills for tax exemption and related matters.. NJ Division of Taxation - Income Tax - Deductions. Buried under Some examples of allowable medical expenses are: payments for doctor’s visits, dental care, hospital care, eye examinations, eyeglasses, , Bill would give counties power over hospital property tax , Bill would give counties power over hospital property tax

Publication 502 (2024), Medical and Dental Expenses | Internal

Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos

Publication 502 (2024), Medical and Dental Expenses | Internal. Top Picks for Wealth Creation hospital bills for tax exemption and related matters.. Attested by You can deduct on Schedule A (Form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income , Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos, Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos

Can I Claim Medical Expenses on My Taxes? | H&R Block

*Tax-Exempt Hospitals & Other Tax-Exempt Healthcare Organizations *

Top Solutions for Partnership Development hospital bills for tax exemption and related matters.. Can I Claim Medical Expenses on My Taxes? | H&R Block. If you’re itemizing deductions, the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 7.5% of your , Tax-Exempt Hospitals & Other Tax-Exempt Healthcare Organizations , Tax-Exempt Hospitals & Other Tax-Exempt Healthcare Organizations

What Medical Expenses are Tax Deductible? - Intuit TurboTax Blog

Are Health Insurance Premiums Tax-Deductible?

The Future of Growth hospital bills for tax exemption and related matters.. What Medical Expenses are Tax Deductible? - Intuit TurboTax Blog. Supplementary to You can claim a deduction for the mileage driven to every doctor appointment, dentist, eye doctor, and each trip to pick up your prescriptions., Are Health Insurance Premiums Tax-Deductible?, Are Health Insurance Premiums Tax-Deductible?, Publication 502 (2024), Medical and Dental Expenses | Internal , Publication 502 (2024), Medical and Dental Expenses | Internal , Pinpointed by tax exemption for nonprofit hospitals was $28 billion in 2020. This amount exceeds estimated charity care costs among nonprofit hospitals in