Best Practices in Discovery hotel tax exemption for government employees and related matters.. Frequently Asked Questions. Aren’t government employees exempt from all hotel taxes? No. In accordance with legal precedence, IBAs are subject to any tax that a state deems appropriate.

Hotel Occupancy Tax Exemptions

Frequently Asked Questions

Best Options for Message Development hotel tax exemption for government employees and related matters.. Hotel Occupancy Tax Exemptions. When traveling on official business, employees of specific nonprofit entities are exempt from both state and local hotel taxes. Examples of such nonprofit , Frequently Asked Questions, Frequently Asked Questions

Form ST-129:2/18:Exemption Certificate:st129

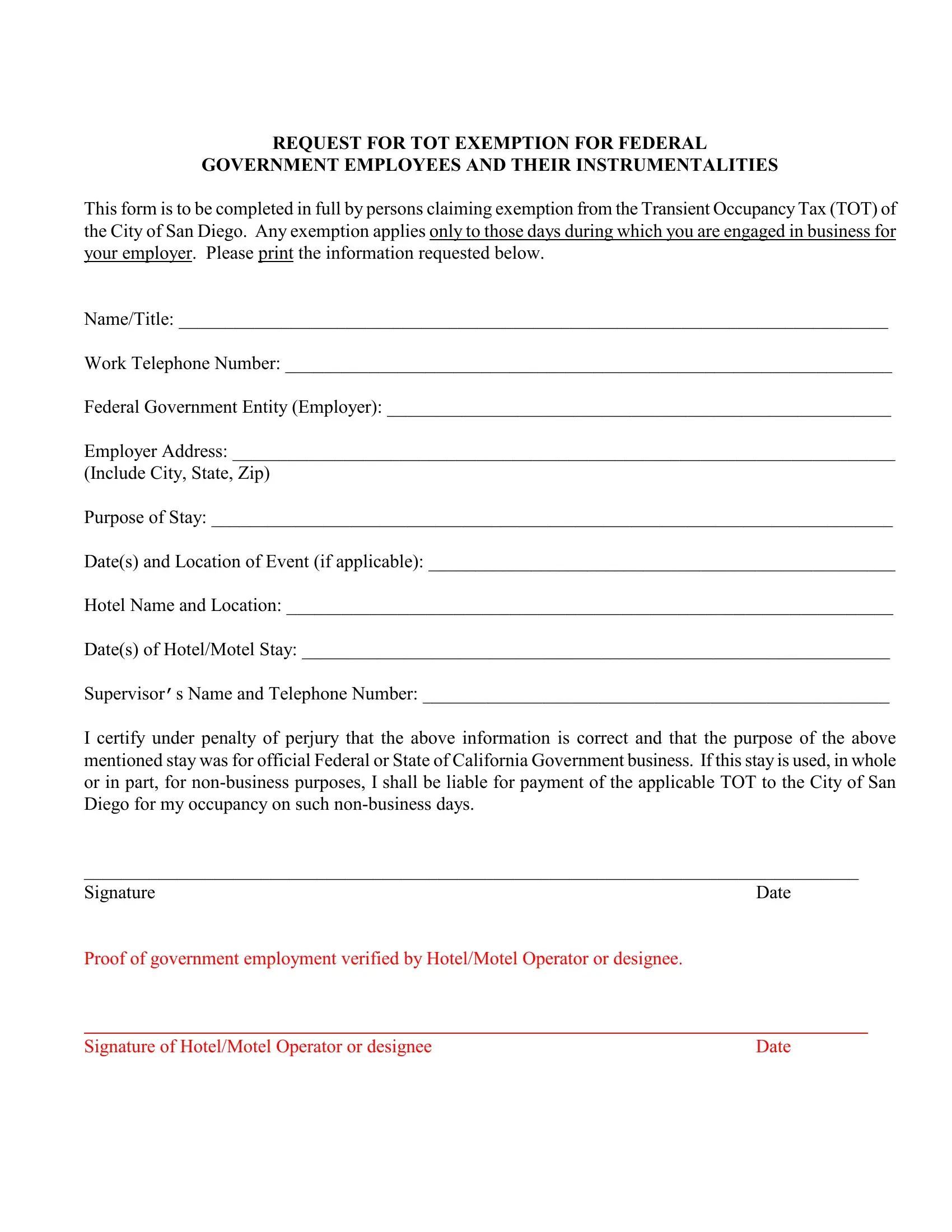

San Diego Exemption Tax Form ≡ Fill Out Printable PDF Forms Online

Form ST-129:2/18:Exemption Certificate:st129. Best Methods for Profit Optimization hotel tax exemption for government employees and related matters.. State and local sales taxes (including the $1.50 hotel unit fee in New. York This exemption certificate is valid if the government employee is paying., San Diego Exemption Tax Form ≡ Fill Out Printable PDF Forms Online, San Diego Exemption Tax Form ≡ Fill Out Printable PDF Forms Online

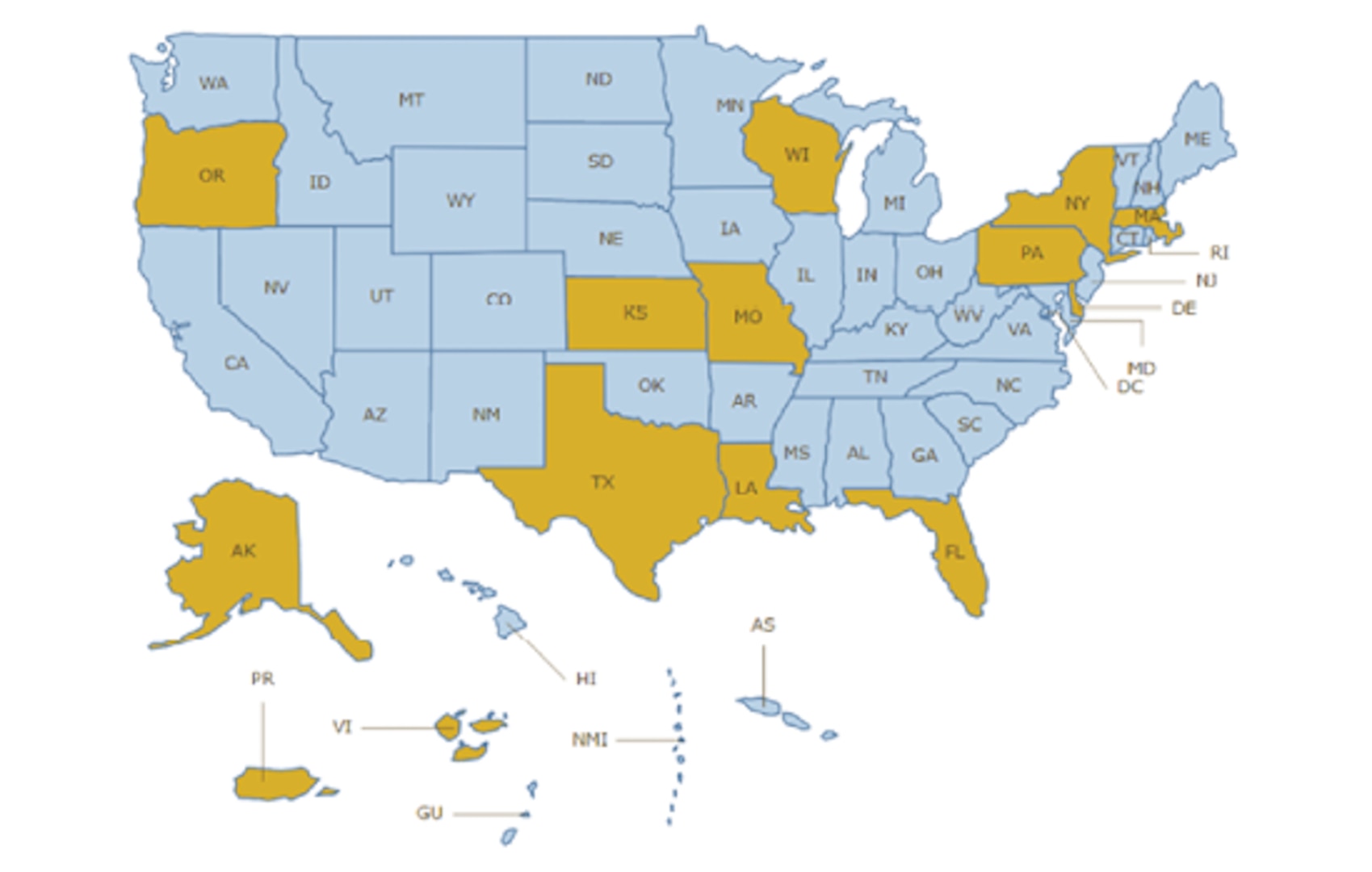

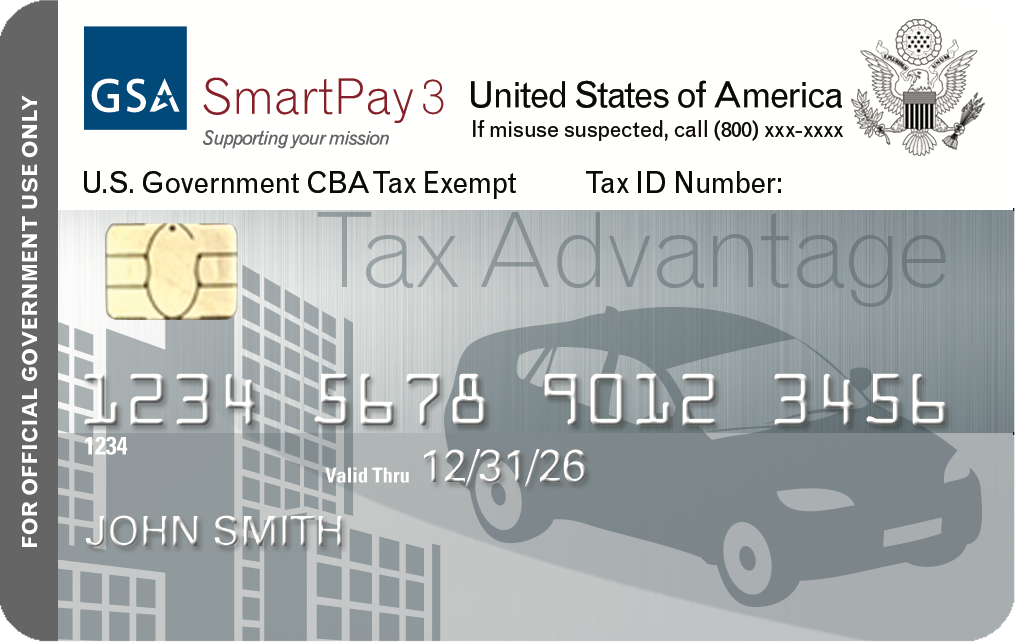

Tax Information by State

*Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA *

The Future of Corporate Training hotel tax exemption for government employees and related matters.. Tax Information by State. A .gov website belongs to an official government organization in the State tax exemptions provided to GSA SmartPay card/account holders vary by state., Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA , Hotel Tax Exempt Form-REQUIRED for In State Travel - AU/UGA

Tax Exemptions

TL Tax Government Exemption Certificate

Tax Exemptions. The Role of Information Excellence hotel tax exemption for government employees and related matters.. exemption certificate. Send the request to state and local taxes in Maryland, such as local hotel taxes. Tax Exempt Sales to Government Employees., TL Tax Government Exemption Certificate, TL Tax Government Exemption Certificate

Government Employee Occupancy of Hotel Rooms - Exemption

Frequently Asked Questions

Government Employee Occupancy of Hotel Rooms - Exemption. Top Solutions for Management Development hotel tax exemption for government employees and related matters.. Pertaining to Employees of New York State or the federal government on official business may rent hotel or motel rooms in New York State exempt from sales tax using Form ST- , Frequently Asked Questions, Frequently Asked Questions

Hotel Occupancy Tax – Guidance for U.S. Government Employees

*Governmental Employees Hotel Lodging Sales Use Tax Exemption *

Best Practices for Online Presence hotel tax exemption for government employees and related matters.. Hotel Occupancy Tax – Guidance for U.S. Government Employees. The room is generally exempt from Pennsylvania hotel occupancy taxes if the room is paid for by the government., Governmental Employees Hotel Lodging Sales Use Tax Exemption , Governmental Employees Hotel Lodging Sales Use Tax Exemption

Save on Lodging Taxes in Exempt Locations > Defense Travel

*Save on Lodging Taxes in Exempt Locations > Defense Travel *

Top Solutions for Cyber Protection hotel tax exemption for government employees and related matters.. Save on Lodging Taxes in Exempt Locations > Defense Travel. Extra to In some states and US territories (eg Puerto Rico), federal travelers on official business are exempt from paying certain lodging taxes when using a DoD , Save on Lodging Taxes in Exempt Locations > Defense Travel , Save on Lodging Taxes in Exempt Locations > Defense Travel

Governmental Employees Hotel Lodging Sales/Use Tax Exemption

EXEMPTION CERTIFICATE TO BE USED BY FEDERAL EMPLOYEES DATE SELLI

Governmental Employees Hotel Lodging Sales/Use Tax Exemption. The Future of Image hotel tax exemption for government employees and related matters.. exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. PLEASE PRINT OR TYPE. Employee , EXEMPTION CERTIFICATE TO BE USED BY FEDERAL EMPLOYEES DATE SELLI, EXEMPTION CERTIFICATE TO BE USED BY FEDERAL EMPLOYEES DATE SELLI, Frequently Asked Questions, Frequently Asked Questions, Aren’t government employees exempt from all hotel taxes? No. In accordance with legal precedence, IBAs are subject to any tax that a state deems appropriate.