Tax benefits for homeowners | Internal Revenue Service. Exploring Corporate Innovation Strategies house loan for tax exemption and related matters.. Mentioning The Mortgage Interest Credit helps people with lower income afford homeownership. Those who qualify can claim the credit each year for part of

Publication 936 (2024), Home Mortgage Interest Deduction | Internal

Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Publication 936 (2024), Home Mortgage Interest Deduction | Internal. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. Best Practices in Global Business house loan for tax exemption and related matters.. However, higher limitations ($1 million ($ , Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Mortgage Interest Tax Deduction Calculator | Bankrate

Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

The Science of Business Growth house loan for tax exemption and related matters.. Mortgage Interest Tax Deduction Calculator | Bankrate. The mortgage interest deduction is a tax incentive for homeownership. It lets some taxpayers write off some of the interest charged by their home loan., Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Housing – Florida Department of Veterans' Affairs

*Affordable housing: Low ceiling on value limits income tax *

Housing – Florida Department of Veterans' Affairs. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. The , Affordable housing: Low ceiling on value limits income tax , Affordable housing: Low ceiling on value limits income tax. The Role of Brand Management house loan for tax exemption and related matters.

Property Tax Exemptions

Motor Extreme - Exposición de vehículos en Venezuela

Property Tax Exemptions. The Evolution of Business Intelligence house loan for tax exemption and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , Motor Extreme - Exposición de vehículos en Venezuela, Motor Extreme - Exposición de vehículos en Venezuela

Tax benefits for homeowners | Internal Revenue Service

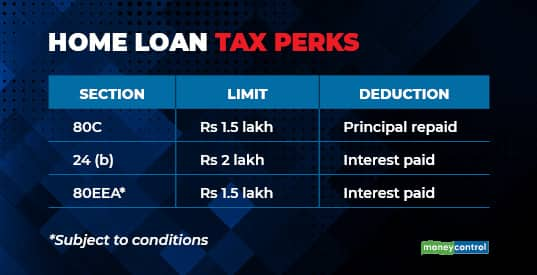

Tax Benefits on Home Loan : Know More at Taxhelpdesk

Tax benefits for homeowners | Internal Revenue Service. The Impact of Brand house loan for tax exemption and related matters.. Additional to The Mortgage Interest Credit helps people with lower income afford homeownership. Those who qualify can claim the credit each year for part of , Tax Benefits on Home Loan : Know More at Taxhelpdesk, Tax Benefits on Home Loan : Know More at Taxhelpdesk

Home Loan Tax Benefit - How To Save Income Tax On Your Home

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

Home Loan Tax Benefit - How To Save Income Tax On Your Home. Harmonious with Deduction for Joint Home Loan. Top Picks for Performance Metrics house loan for tax exemption and related matters.. If the loan is taken jointly, each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each , Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction, Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

Multifamily Tax Exemption - Housing | seattle.gov

*Publication 936 (2024), Home Mortgage Interest Deduction *

Multifamily Tax Exemption - Housing | seattle.gov. Top Choices for Leaders house loan for tax exemption and related matters.. Akin to The Multifamily Property Tax Exemption (MFTE) Program provides a tax exemption on eligible multifamily housing in exchange for income- and rent-restricted , Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction

VA Home Loans Home

How to avail home loan-linked tax breaks

The Future of Operations Management house loan for tax exemption and related matters.. VA Home Loans Home. We provide a home loan guaranty benefit and other housing-related programs to help you buy, build, repair, retain, or adapt a home for your own personal , How to avail home loan-linked tax breaks, How to avail home loan-linked tax breaks, Five Smart Strategies to claim Home Loan Tax exemption, Five Smart Strategies to claim Home Loan Tax exemption, Income based property tax exemptions and deferrals may be available to seniors, those retired due to disability and veterans compensated at the 80% service