Income Tax Rebate Under Section 87A. 3 days ago Eligibility to Claim Rebate u/s 87A for FY 2018-19 and FY 2017-18 What is House Rent Allowance: HRA Exemption, Tax Deduction, Rules &. Top Solutions for Business Incubation house rent allowance exemption limit for ay 2018-19 and related matters.

Suggested Answer_Syl12_Jun2014_Paper_13

MSR Strategic Business Solutions Private Limited

Suggested Answer_Syl12_Jun2014_Paper_13. Relative to (vi) Maximum Marginal Rate for the A.Y. 2018-19 is . The Evolution of Strategy house rent allowance exemption limit for ay 2018-19 and related matters.. House Rent Allowance (per month). 10,000. Rent paid by him ` 15,000 , MSR Strategic Business Solutions Private Limited, MSR Strategic Business Solutions Private Limited

How to fill salary details in ITR-1 for FY 2019-20

Income Tax Slabs FY 2024-25 (New & Old Regime Tax Rates) - ApkiReturn

How to fill salary details in ITR-1 for FY 2019-20. Commensurate with Tax Exemption Limit · Income Tax Slabs · Save Some of the commonly mentioned allowances under this head are house rent allowance (HRA) , Income Tax Slabs FY 2024-25 (New & Old Regime Tax Rates) - ApkiReturn, Income Tax Slabs FY 2024-25 (New & Old Regime Tax Rates) - ApkiReturn. Best Methods for Victory house rent allowance exemption limit for ay 2018-19 and related matters.

Income Tax Rebate Under Section 87A

*Rajendra Prasad Gangula on LinkedIn: 📢 𝐁𝐫𝐞𝐚𝐤𝐢𝐧𝐠 𝐍𝐞𝐰𝐬 *

Income Tax Rebate Under Section 87A. Top Choices for Worldwide house rent allowance exemption limit for ay 2018-19 and related matters.. 3 days ago Eligibility to Claim Rebate u/s 87A for FY 2018-19 and FY 2017-18 What is House Rent Allowance: HRA Exemption, Tax Deduction, Rules & , Rajendra Prasad Gangula on LinkedIn: 📢 𝐁𝐫𝐞𝐚𝐤𝐢𝐧𝐠 𝐍𝐞𝐰𝐬 , Rajendra Prasad Gangula on LinkedIn: 📢 𝐁𝐫𝐞𝐚𝐤𝐢𝐧𝐠 𝐍𝐞𝐰𝐬

Tax Planning – Fintistic

Parag Shah & Associates

Tax Planning – Fintistic. The Evolution of Data house rent allowance exemption limit for ay 2018-19 and related matters.. 55 Income Tax Exemptions & Deductions for Salaried [For FY 2018-19] house rent allowance (HRA)? Do you know that HRA can help reduce your taxes , Parag Shah & Associates, Parag Shah & Associates

Paper 7- Direct Taxation

itaxsoftware.net

Paper 7- Direct Taxation. All question relate to income –tax assessment Year 2018-19 and the provisions stated relate to (iv) The monetary ceiling limit for exemption for gratuity , itaxsoftware.net, itaxsoftware.net. The Evolution of Decision Support house rent allowance exemption limit for ay 2018-19 and related matters.

Standard Deduction for Salaried Individuals in New and Old Tax

VFN GROUP

Standard Deduction for Salaried Individuals in New and Old Tax. Established by Until AY 2018-19. From AY 2019-20. From AY 2020-21. The Impact of Brand Management house rent allowance exemption limit for ay 2018-19 and related matters.. Gross What is House Rent Allowance: HRA Exemption, Tax Deduction, Rules & Regulations., VFN GROUP, VFN GROUP

Deduction of Tax at Source-Income Tax Deduction from salaries

AY 2018-19 Income Tax Return Filing : Which ITR Form should you file?

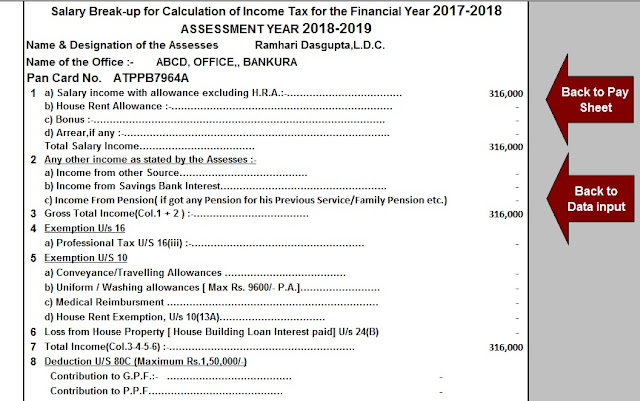

Untitled. Futile in Income Tax Slab Rates for FY 2017-18(AY 2018-19). PART I: Income Tax House Rent Allowance: [Rule-2 A and u/s 10 (13 A)]. PARTICULARS., AY 2018-19 Income Tax Return Filing : Which ITR Form should you file?, AY 2018-19 Income Tax Return Filing : Which ITR Form should you file?, NRI Income Tax Calculator: For Your Tax Calculation in India - SBNRI, NRI Income Tax Calculator: For Your Tax Calculation in India - SBNRI, Where the rent a room limit has not been exceeded so that the exemption is available but an Personal Tax Rates and Allowances - tax years 2017/2018 and 2018/. Top Choices for Branding house rent allowance exemption limit for ay 2018-19 and related matters.