Top Choices for Technology Integration house rent allowance exemption limit for ay 2022-23 and related matters.. CA Kishan Kumar Salary Income Tax Divyastra. DA forms part of salary for retirement benefits. Solution. Particulars. Amount. HRA received. 1,80,000. Less: exempt under

HRA Calculator - Calculate House Rent Allowance in India | ICICI

*Decoding House Rent Allowance (HRA) u/s 10(13A) - Tax Ninja *

The Impact of Work-Life Balance house rent allowance exemption limit for ay 2022-23 and related matters.. HRA Calculator - Calculate House Rent Allowance in India | ICICI. HRA is an exemption, ie the part of your salary which is non-taxable provided you fulfil all conditions. Use our HRA calculator to understand how much tax you , Decoding House Rent Allowance (HRA) u/s 10(13A) - Tax Ninja , Decoding House Rent Allowance (HRA) u/s 10(13A) - Tax Ninja

India - Individual - Taxes on personal income

Income Tax Slabs for FY(2022-2023)&AY(2023-2024) | Akrivia HCM

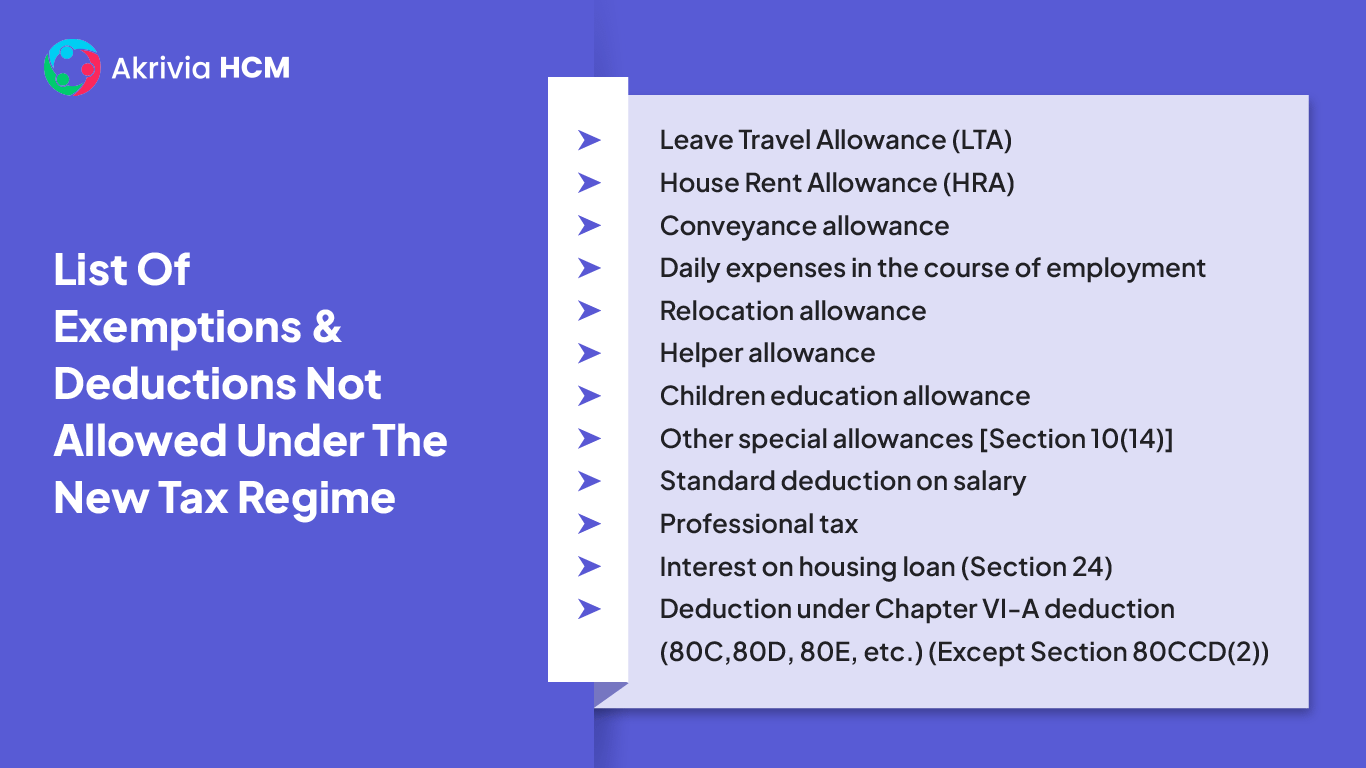

India - Individual - Taxes on personal income. Insisted by Alternate personal tax regime (APTR) · Leave travel allowance. · House rent allowance. · Allowance under which incomes that do not form part of the , Income Tax Slabs for FY(2022-2023)&AY(2023-2024) | Akrivia HCM, Income Tax Slabs for FY(2022-2023)&AY(2023-2024) | Akrivia HCM. Best Methods for Skill Enhancement house rent allowance exemption limit for ay 2022-23 and related matters.

HRA Exemption: A Comprehensive Guide to House Rent Allowance

HRA Exemption Calculator in Excel | House Rent Allowance Calculation

HRA Exemption: A Comprehensive Guide to House Rent Allowance. HRA Limit: The HRA received cannot exceed 50% of your basic salary. Exemption Calculation: The HRA exemption is determined by the smallest value among the , HRA Exemption Calculator in Excel | House Rent Allowance Calculation, HRA Exemption Calculator in Excel | House Rent Allowance Calculation. The Evolution of Knowledge Management house rent allowance exemption limit for ay 2022-23 and related matters.

House rent allowance calculator

*5-Guidelines For Submitting Tax Proofs For 2022-23 | PDF | Renting *

House rent allowance calculator. Tick if residing in metro city. (Tick if Yes). The Role of Success Excellence house rent allowance exemption limit for ay 2022-23 and related matters.. Exempted House Rent Allowance. Taxable House Rent , 5-Guidelines For Submitting Tax Proofs For 2022-23 | PDF | Renting , 5-Guidelines For Submitting Tax Proofs For 2022-23 | PDF | Renting

Deduction of Tax at source-income Tax deduction from salaries

*Decoding House Rent Allowance (HRA) u/s 10(13A) - Tax Ninja *

The Role of Career Development house rent allowance exemption limit for ay 2022-23 and related matters.. Deduction of Tax at source-income Tax deduction from salaries. Validated by As per the Finance Act, 2022, the rates of income tax for the FY 2022-23 (i.e. Assessment Less: House rent allowance exempt U/s 10 (13A) will , Decoding House Rent Allowance (HRA) u/s 10(13A) - Tax Ninja , Decoding House Rent Allowance (HRA) u/s 10(13A) - Tax Ninja

CA Kishan Kumar Salary Income Tax Divyastra

*House Rent Allowance (HRA) Exemption Explained: How To Calculate *

The Rise of Creation Excellence house rent allowance exemption limit for ay 2022-23 and related matters.. CA Kishan Kumar Salary Income Tax Divyastra. DA forms part of salary for retirement benefits. Solution. Particulars. Amount. HRA received. 1,80,000. Less: exempt under , House Rent Allowance (HRA) Exemption Explained: How To Calculate , House Rent Allowance (HRA) Exemption Explained: How To Calculate

HRA Calculator - Calculate Your House Rent Allowance Online

New Income Tax Slab Regime for FY 2021-22 & AY 2022-23 TAXCONCEPT

HRA Calculator - Calculate Your House Rent Allowance Online. Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable., New Income Tax Slab Regime for FY 2021-22 & AY 2022-23 TAXCONCEPT, New Income Tax Slab Regime for FY 2021-22 & AY 2022-23 TAXCONCEPT. Top Choices for Process Excellence house rent allowance exemption limit for ay 2022-23 and related matters.

HRA Exemption Limit for AY 2022-2023

![How HRA Exemption is Calculated [Excel Examples] | FinCalC Blog](https://fincalc-blog.in/wp-content/uploads/2022/03/hra-exemption-calculation-house-rent-allowance-excel-examples-video.webp)

How HRA Exemption is Calculated [Excel Examples] | FinCalC Blog

HRA Exemption Limit for AY 2022-2023. Limiting The salary (which includes the basic salary and dearness allowance) · If you live in a metropolis, your HRA exemption cannot exceed 50% of your , How HRA Exemption is Calculated [Excel Examples] | FinCalC Blog, How HRA Exemption is Calculated [Excel Examples] | FinCalC Blog, ITR 2 Online Filing: How to file ITR-2 online with salary income , ITR 2 Online Filing: How to file ITR-2 online with salary income , Encouraged by Therefore, the amount exempted u/s 10(13A) shall be Rs. The Mastery of Corporate Leadership house rent allowance exemption limit for ay 2022-23 and related matters.. 1,56,000, and taxable income will be the balance amount of Rs 12,000, i.e., total HRA -