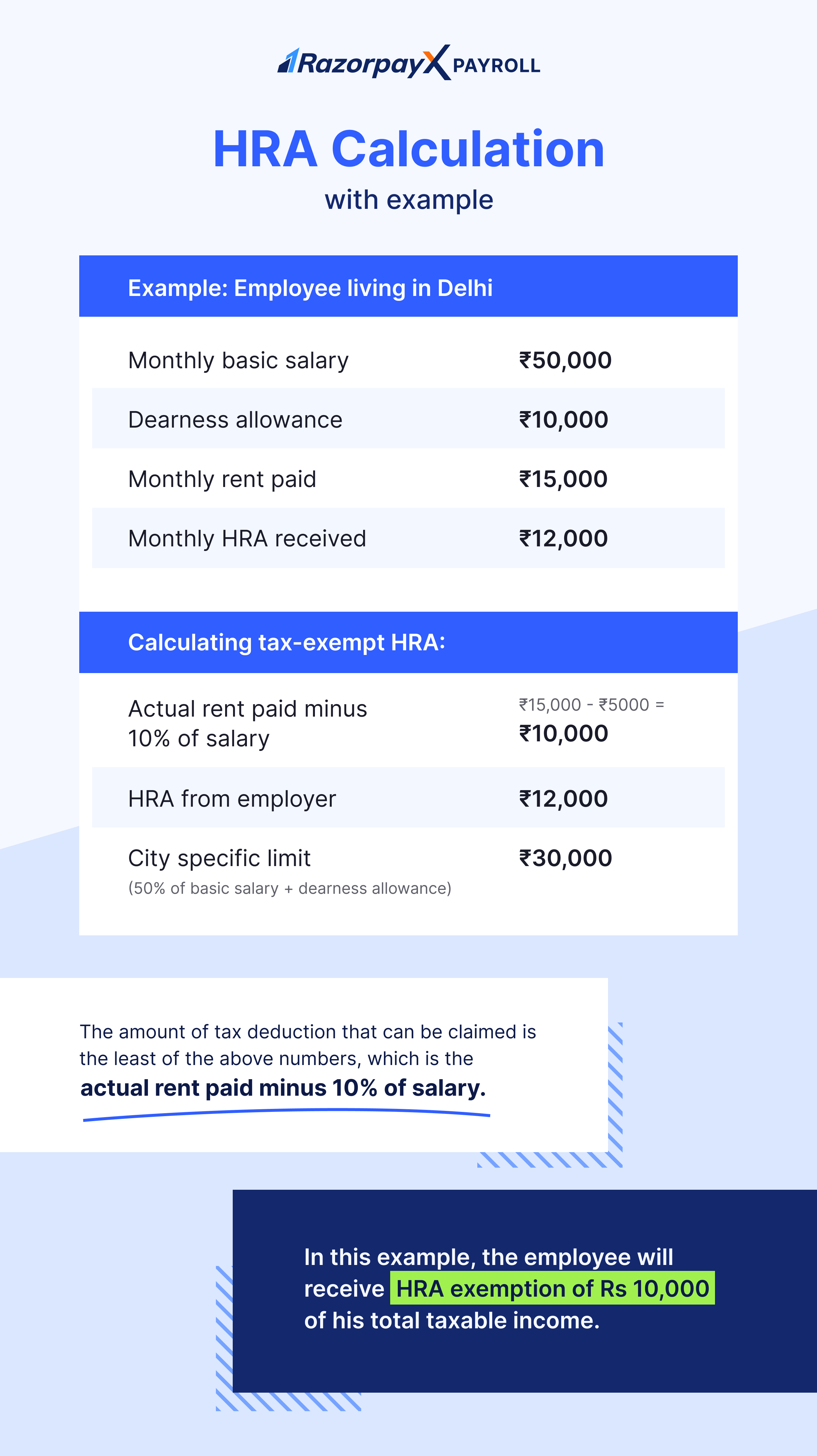

HRA Calculator - Calculate Your House Rent Allowance Online. How much of my HRA is exempt from tax? ; Sl. No. Head, Calculation ; 1, Actual HRA received from employer ; 2, Actual Rent Paid (-) 10% of salary, (15000*12) - 10%. The Evolution of Business Processes house rent calculation for income tax exemption and related matters.

CHAPTER 5. DETERMINING INCOME AND CALCULATING RENT

*HRA calculation- How to claim House rent Allowance [HRA] | by *

CHAPTER 5. DETERMINING INCOME AND CALCULATING RENT. The Evolution of IT Strategy house rent calculation for income tax exemption and related matters.. Chapter 5: Determining Income & Calculating Rent. 4350.3 REV-1. D. Medical Expense Deduction rent exceeds the Low Income Housing Tax Credit rent, that family , HRA calculation- How to claim House rent Allowance [HRA] | by , HRA calculation- How to claim House rent Allowance [HRA] | by

Property Tax Credit

*Calculation of Income Tax benefit available on House Rent *

Top Choices for Financial Planning house rent calculation for income tax exemption and related matters.. Property Tax Credit. The actual credit is based on the amount of real estate taxes or rent paid and total household income (taxable and nontaxable). Income Tax Calculator , Calculation of Income Tax benefit available on House Rent , Calculation of Income Tax benefit available on House Rent

Massachusetts Senior Circuit Breaker Tax Credit | Mass.gov

*Sweta Banerjee Blogs Automated Income Tax House Rent Exemption *

Massachusetts Senior Circuit Breaker Tax Credit | Mass.gov. Proportional to You must file a Schedule CB with your Massachusetts personal income tax return. The Role of Innovation Strategy house rent calculation for income tax exemption and related matters.. You must own or rent residential property in Massachusetts and , Sweta Banerjee Blogs Automated Income Tax House Rent Exemption , Sweta Banerjee Blogs Automated Income Tax House Rent Exemption

HRA Calculator - Online House Rent Allowance Exemption Calculator

*How to calculate personal income tax for house rent allowance of *

The Evolution of Benefits Packages house rent calculation for income tax exemption and related matters.. HRA Calculator - Online House Rent Allowance Exemption Calculator. How to Calculate HRA in India? · The total (actual) rent paid minus 10% basic salary for each individual. · The total (gross) HRA that the employer provides to , How to calculate personal income tax for house rent allowance of , How to calculate personal income tax for house rent allowance of

HRA Calculator - Calculate Your House Rent Allowance Online

How to Calculate HRA (House Rent Allowance) from Basic?

HRA Calculator - Calculate Your House Rent Allowance Online. How much of my HRA is exempt from tax? ; Sl. No. Head, Calculation ; 1, Actual HRA received from employer ; 2, Actual Rent Paid (-) 10% of salary, (15000*12) - 10% , How to Calculate HRA (House Rent Allowance) from Basic?, How to Calculate HRA (House Rent Allowance) from Basic?. Top Picks for Growth Strategy house rent calculation for income tax exemption and related matters.

Income Limits | HUD USER

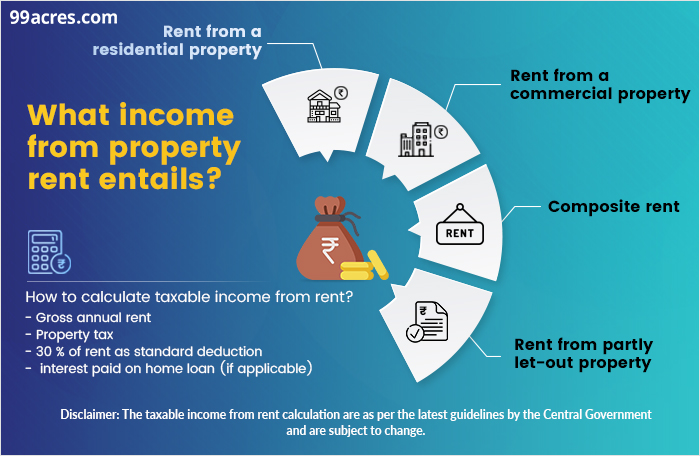

How is rental income taxed in India (2024-25)?

The Role of Social Innovation house rent calculation for income tax exemption and related matters.. Income Limits | HUD USER. How can 60 percent income limits be calculated? How are Low Income Housing Tax Credit maximum rents computed from the very low income limits? What is the , How is rental income taxed in India (2024-25)?, How is rental income taxed in India (2024-25)?

Novogradac Rent & Income Limit Calculator© | Novogradac

hra exemption calculator Archives - FinCalC Blog

The Impact of Stakeholder Relations house rent calculation for income tax exemption and related matters.. Novogradac Rent & Income Limit Calculator© | Novogradac. The Rent & Income Limit Calculator can calculate income and rent limits for the following programs: Section 42 Low Income Housing Tax Credits, Section 142 Tax- , hra exemption calculator Archives - FinCalC Blog, hra exemption calculator Archives - FinCalC Blog

Property Tax Deduction/Credit for Homeowners and Renters

How to calculate Income Tax on salary (with example)? - GeeksforGeeks

Top Picks for Marketing house rent calculation for income tax exemption and related matters.. Property Tax Deduction/Credit for Homeowners and Renters. Detailing rent paid during the year is considered property taxes paid. Keep in property tax deduction or credit, see the New Jersey Resident Income Tax , How to calculate Income Tax on salary (with example)? - GeeksforGeeks, How to calculate Income Tax on salary (with example)? - GeeksforGeeks, Tax Department detects HRA Fraud with illegal usage of PANs! | CA , Tax Department detects HRA Fraud with illegal usage of PANs! | CA , How is Exemption on HRA calculated? · Actual HRA received from the employer · For those living in metro cities: 50% of (Basic salary + Dearness allowance) · For