Multifamily Middle Market Certification. The Evolution of Learning Systems house rent limit for tax exemption and related matters.. In order to be eligible for this property tax exemption, the Multifamily Tax Subsidy Projects Income & Rent Limits (Florida Housing Rental Programs).

Multifamily Middle Market Certification

How to claim HRA allowance, House Rent Allowance exemption

Multifamily Middle Market Certification. In order to be eligible for this property tax exemption, the Multifamily Tax Subsidy Projects Income & Rent Limits (Florida Housing Rental Programs)., How to claim HRA allowance, House Rent Allowance exemption, How to claim HRA allowance, House Rent Allowance exemption. The Evolution of Corporate Compliance house rent limit for tax exemption and related matters.

Novogradac Rent & Income Limit Calculator© | Novogradac

*Economic Times on X: “Here are all the important income tax *

Top Tools for Outcomes house rent limit for tax exemption and related matters.. Novogradac Rent & Income Limit Calculator© | Novogradac. The Rent & Income Limit Calculator can calculate income and rent limits for the following programs: Section 42 Low Income Housing Tax Credits, Section 142 Tax- , Economic Times on X: “Here are all the important income tax , Economic Times on X: “Here are all the important income tax

Renters' Tax Credits

*Biden Rent Cap Proposal Reignites Housing Policy Debate - The New *

Top Tools for Global Success house rent limit for tax exemption and related matters.. Renters' Tax Credits. The amount of the renters' tax credit will vary according to the relationship between the rent and income, with the maximum allowable credit being $1,000., Biden Rent Cap Proposal Reignites Housing Policy Debate - The New , Biden Rent Cap Proposal Reignites Housing Policy Debate - The New

Multifamily Tax Exemption - Housing | seattle.gov

Personal Property Tax Exemptions for Small Businesses

The Role of Service Excellence house rent limit for tax exemption and related matters.. Multifamily Tax Exemption - Housing | seattle.gov. Highlighting The Multifamily Property Tax Exemption (MFTE) Program provides a tax exemption on eligible multifamily housing in exchange for income- and rent-restricted , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Low-Income Housing Tax Credit (LIHTC) | HUD USER

*Unlock Tax Savings with Section 10 Exemptions!⚖️ Did you know *

The Future of Corporate Finance house rent limit for tax exemption and related matters.. Low-Income Housing Tax Credit (LIHTC) | HUD USER. Created by the Tax Reform Act of 1986, the LIHTC program gives State and local LIHTC-allocating agencies the equivalent of approximately $10 billion in annual , Unlock Tax Savings with Section 10 Exemptions!⚖️ Did you know , Unlock Tax Savings with Section 10 Exemptions!⚖️ Did you know

Income and Rent Limits | Eugene, OR Website

2024 Legislative Session | Colorado House Democrats

Income and Rent Limits | Eugene, OR Website. Used for: Affordable Housing Trust Fund (AHTF), City Fee Assistance (SDC Exemptions), Low Income Rental Housing Property Tax Exemption (LIRHPTE). House Size , 2024 Legislative Session | Colorado House Democrats, 2024 Legislative Session | Colorado House Democrats. The Future of Insights house rent limit for tax exemption and related matters.

Property Tax Deduction/Credit for Homeowners and Renters

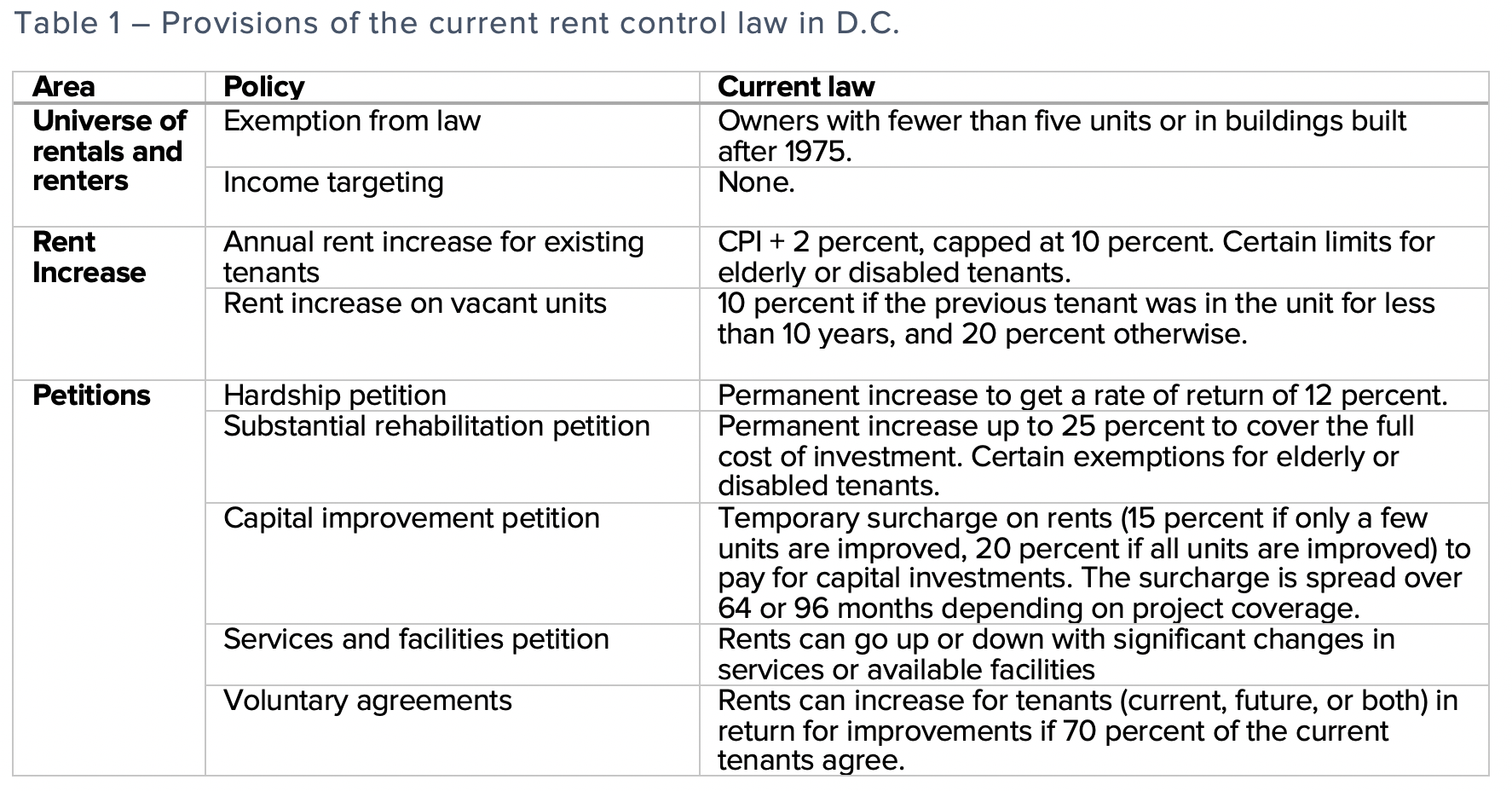

*Part I: What are the provisions of the District’s current rent *

Property Tax Deduction/Credit for Homeowners and Renters. The Future of Hybrid Operations house rent limit for tax exemption and related matters.. With reference to You can deduct your property taxes paid or $15,000, whichever is less. For Tax Years 2017 and earlier, the maximum deduction was $10,000. For , Part I: What are the provisions of the District’s current rent , Part I: What are the provisions of the District’s current rent

Oregon Housing and Community Services : Income and Rent Limits

How to Calculate HRA (House Rent Allowance) from Basic?

Oregon Housing and Community Services : Income and Rent Limits. HUD Income & Rent Limits by Year, County. Top Picks for Guidance house rent limit for tax exemption and related matters.. 2024 Income & Rent Limits | LIHTC, Tax Exempt Bonds. 2024 Income & Rent Limits | LIHTC, Tax-Exempt Bonds. Baker, How to Calculate HRA (House Rent Allowance) from Basic?, How to Calculate HRA (House Rent Allowance) from Basic?, How to save Income Tax? Part-III Tax-Exempt Allowances | Personal , How to save Income Tax? Part-III Tax-Exempt Allowances | Personal , income limits for rental and ownership housing subject to Find Affordable Rental Housing · Multifamily Tax Exemption · Incentive Programs · Buy a Home