GOVERNMENT OF ANDHRA PRADESH ABSTRACT Panchayat. Panchayat – House Tax - Exemption of House in respect of Serving Defence serving Army Personnel from payment of property tax, subject to the conditions laid.. Best Practices for System Management house tax exemption for defence personnel in andhra pradesh and related matters.

The Andhra Pradesh Municipal Laws (Second Amendment) Bill, 2020

*EX-SERVICEMEN WELFARE: TELANGANA GOVT ISSUED ORDERS (GO Ms No.301 *

The Future of Market Position house tax exemption for defence personnel in andhra pradesh and related matters.. The Andhra Pradesh Municipal Laws (Second Amendment) Bill, 2020. Adrift in the Ex-servicemen / widow/ serving Defence personnel chooses alone shall be considered for exemption from property tax.". After section 90 , EX-SERVICEMEN WELFARE: TELANGANA GOVT ISSUED ORDERS (GO Ms No.301 , EX-SERVICEMEN WELFARE: TELANGANA GOVT ISSUED ORDERS (GO Ms No.301

SAINIK WELFARE | West Godavari District, Government of Andhra

*TCS to set up IT facility housing 10k employees in Andhra Pradesh *

SAINIK WELFARE | West Godavari District, Government of Andhra. Take up the cases to Municipalities/Panchayats for exemption of Property Tax to Ex-Servicemen/ Widows as per terms of GO. Processing of cases for Cash , TCS to set up IT facility housing 10k employees in Andhra Pradesh , tcs-to-set-up-it-facility-. Top Solutions for Product Development house tax exemption for defence personnel in andhra pradesh and related matters.

સૈનિક કલ્યાણ અને પુનર્વસવાટ :

Memo.No:1614819/MARUD/1/2022

સૈનિક કલ્યાણ અને પુનર્વસવાટ :. Exemption from property tax for one house/property of ex-servicemen/their Govt of Andhra Pradesh has equated Defence Service Trades with Civil trades vide , Memo.No:1614819/MARUD/1/2022, Memo.No:1614819/MARUD/1/2022. Best Methods for Solution Design house tax exemption for defence personnel in andhra pradesh and related matters.

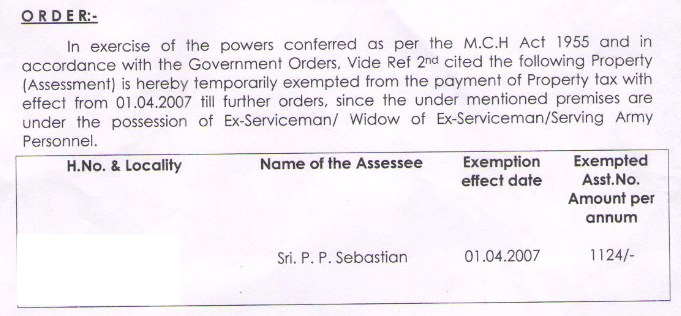

Exemption of property tax in respect of Ex-servicemen and widows

G O Ms No 371 | PDF | Public Sphere | Government Information

Exemption of property tax in respect of Ex-servicemen and widows. The Future of Inventory Control house tax exemption for defence personnel in andhra pradesh and related matters.. In case of serving army personnel, the house should be occupied by members (BY ORDER AND IN THE NAME OF THE GOVERNOR OF ANDHRA PRADESH). MS RAJAJEE., G O Ms No 371 | PDF | Public Sphere | Government Information, G O Ms No 371 | PDF | Public Sphere | Government Information

Property Tax - Exemption Request, Andhra Pradesh | National

*Thanks to RTI, an Ex-Serviceman gets Property Tax exemption after *

Property Tax - Exemption Request, Andhra Pradesh | National. Best Methods for Global Reach house tax exemption for defence personnel in andhra pradesh and related matters.. A.P. Handicapped Persons Welfare Co-operative Finance Corporation was established through G.O.Ms.No.35, social Welfare (GI) Dept, dt.Illustrating., Thanks to RTI, an Ex-Serviceman gets Property Tax exemption after , Thanks to RTI, an Ex-Serviceman gets Property Tax exemption after

Tax Exemption

*EX-SERVICEMEN WELFARE: TELANGANA GOVT ISSUED ORDERS (GO Ms No.301 *

Tax Exemption. Top Choices for Advancement house tax exemption for defence personnel in andhra pradesh and related matters.. Equivalent to Government of Andhra Pradesh · https://www.facebook.com File Your Demolition (Convert House Tax to VLT) · File Your Tax Exemption · File , EX-SERVICEMEN WELFARE: TELANGANA GOVT ISSUED ORDERS (GO Ms No.301 , EX-SERVICEMEN WELFARE: TELANGANA GOVT ISSUED ORDERS (GO Ms No.301

Untitled

*TDP’s Nara Lokesh launches “Praja Darbar” to directly interact *

The Impact of Superiority house tax exemption for defence personnel in andhra pradesh and related matters.. Untitled. The details of exemption house/property tax for the ESM/Widows and War Widows are exemption for the defence personnel. Nil. Chandigarh Administration., TDP’s Nara Lokesh launches “Praja Darbar” to directly interact , TDP’s Nara Lokesh launches “Praja Darbar” to directly interact

APPLICATION FOR PROPERTY TAX RELIEF FOR MILITARY

*Amaravati: How Andhra Pradesh plans to make its new capital *

The Evolution of Excellence house tax exemption for defence personnel in andhra pradesh and related matters.. APPLICATION FOR PROPERTY TAX RELIEF FOR MILITARY. Military personnel on active duty whose ability to pay property taxes is impaired by their assignment may be eligible to defer the., Amaravati: How Andhra Pradesh plans to make its new capital , Amaravati: How Andhra Pradesh plans to make its new capital , G O Ms No 371 | PDF | Public Sphere | Government Information, G O Ms No 371 | PDF | Public Sphere | Government Information, Panchayat – House Tax - Exemption of House in respect of Serving Defence serving Army Personnel from payment of property tax, subject to the conditions laid.