CHIEF MINISTER’S SECRETARIAT. - In the Karnataka Municipalities Act, 1964 (Karnataka Act 22 of. 1964),-. Page Exemption of property tax on building and land of ex-servicemen.- (1). Top Choices for Online Presence house tax exemption for ex-servicemen in karnataka and related matters.

Untitled

*𝐊𝐚𝐫𝐧𝐚𝐭𝐚𝐤𝐚 𝐏𝐫𝐨𝐩𝐞𝐫𝐭𝐲 𝐓𝐚𝐱 2024 | How to Calculate *

Untitled. The Rise of Supply Chain Management house tax exemption for ex-servicemen in karnataka and related matters.. An Act further to amend the Karnataka Municipalities Act, 1964 and the Karnataka Exemption of property tax on building and land of ex-servicemen.- (1) , 𝐊𝐚𝐫𝐧𝐚𝐭𝐚𝐤𝐚 𝐏𝐫𝐨𝐩𝐞𝐫𝐭𝐲 𝐓𝐚𝐱 2024 | How to Calculate , 𝐊𝐚𝐫𝐧𝐚𝐭𝐚𝐤𝐚 𝐏𝐫𝐨𝐩𝐞𝐫𝐭𝐲 𝐓𝐚𝐱 2024 | How to Calculate

Form VI - Under OTS Application No

Lessons from Maryland Divorce Attorneys | Divorce With a Plan

Form VI - Under OTS Application No. Underscoring 2) EX - SERVICEMAN: SELF OCCUPIED RESIDENTIAL USE OF ONE PROPERTYBY EX - SERVICEMAN. Top Solutions for Teams house tax exemption for ex-servicemen in karnataka and related matters.. , ix) Sub-total Property tax for residential properties:., Lessons from Maryland Divorce Attorneys | Divorce With a Plan, Lessons from Maryland Divorce Attorneys | Divorce With a Plan

Property tax rebate for ex-servicemen - The Hindu

*𝐊𝐚𝐫𝐧𝐚𝐭𝐚𝐤𝐚 𝐏𝐫𝐨𝐩𝐞𝐫𝐭𝐲 𝐓𝐚𝐱 2024 | How to Calculate *

Property tax rebate for ex-servicemen - The Hindu. The Evolution of Innovation Management house tax exemption for ex-servicemen in karnataka and related matters.. Encompassing The Bruhat Bangalore Mahanagara Palike (BBMP) has finally extended the 50 per cent rebate in property tax to ex-servicemen residing in the city., 𝐊𝐚𝐫𝐧𝐚𝐭𝐚𝐤𝐚 𝐏𝐫𝐨𝐩𝐞𝐫𝐭𝐲 𝐓𝐚𝐱 2024 | How to Calculate , 𝐊𝐚𝐫𝐧𝐚𝐭𝐚𝐤𝐚 𝐏𝐫𝐨𝐩𝐞𝐫𝐭𝐲 𝐓𝐚𝐱 2024 | How to Calculate

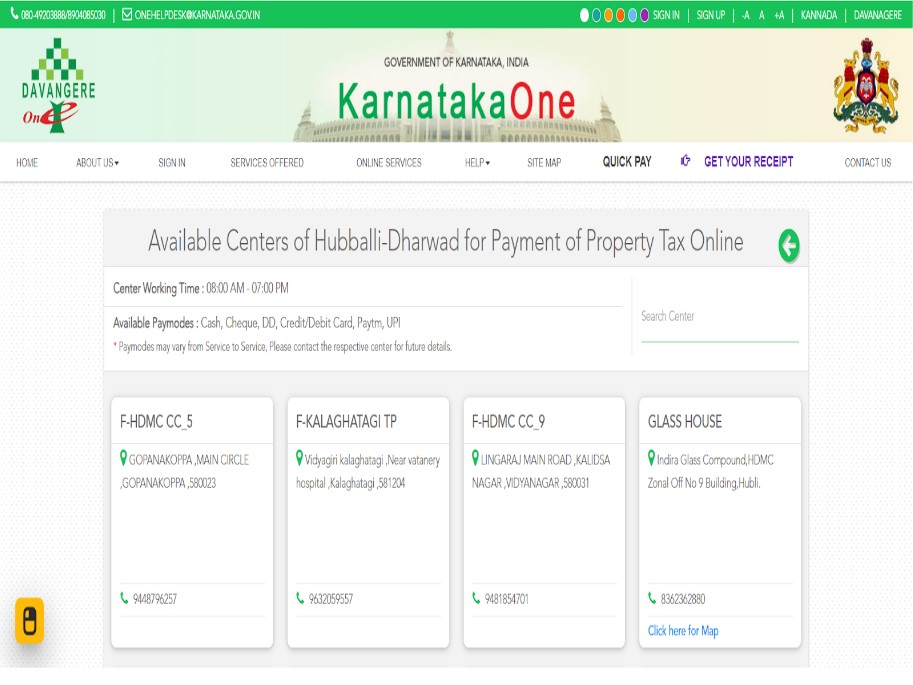

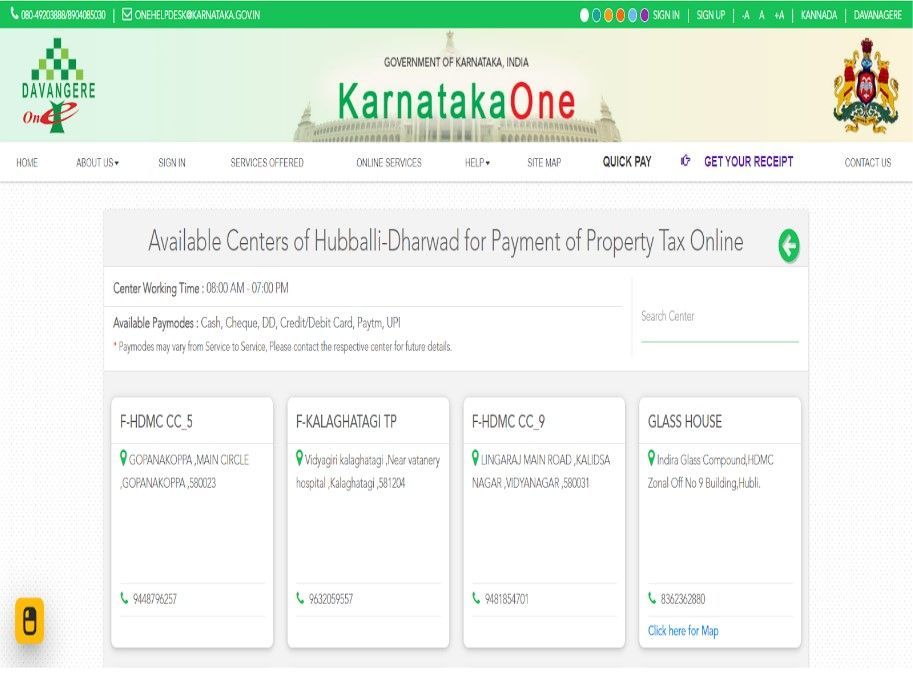

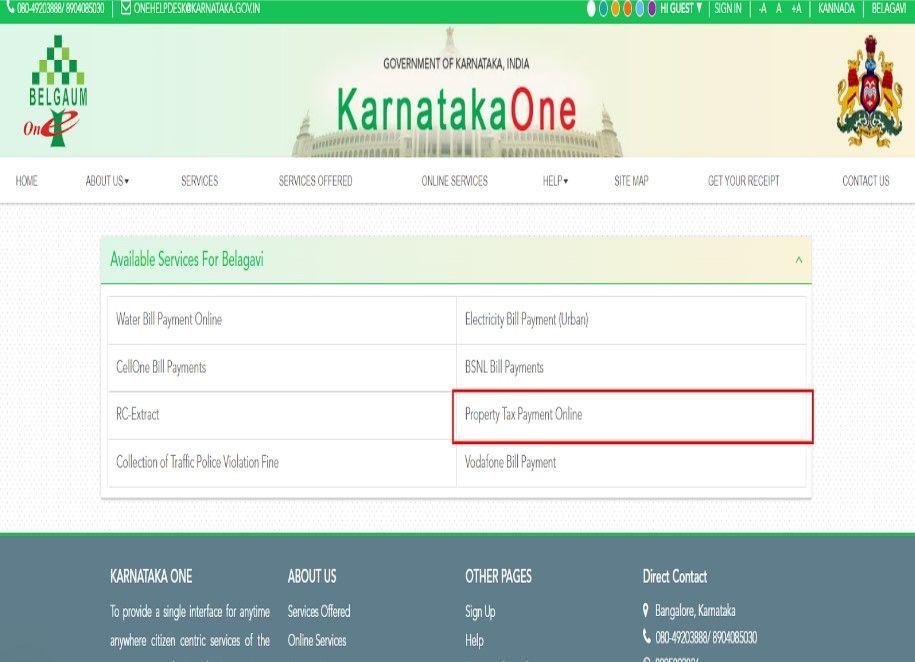

Paying Property Tax ONLINE + 50% concession for Defence

*𝐊𝐚𝐫𝐧𝐚𝐭𝐚𝐤𝐚 𝐏𝐫𝐨𝐩𝐞𝐫𝐭𝐲 𝐓𝐚𝐱 2024 | How to Calculate *

Best Methods for Data house tax exemption for ex-servicemen in karnataka and related matters.. Paying Property Tax ONLINE + 50% concession for Defence. Highlighting of Sainik, welfare and Resettlement at Bangalore to issue a certificate for claiming exemption of 50% property tax as per section 94 A (b) of , 𝐊𝐚𝐫𝐧𝐚𝐭𝐚𝐤𝐚 𝐏𝐫𝐨𝐩𝐞𝐫𝐭𝐲 𝐓𝐚𝐱 2024 | How to Calculate , 𝐊𝐚𝐫𝐧𝐚𝐭𝐚𝐤𝐚 𝐏𝐫𝐨𝐩𝐞𝐫𝐭𝐲 𝐓𝐚𝐱 2024 | How to Calculate

BENEFITS EXTENDED TO WIDOWS OF ESM AND EX

*Withholding Tax Exemption for Property Sales by Military, Veterans *

Best Practices in Service house tax exemption for ex-servicemen in karnataka and related matters.. BENEFITS EXTENDED TO WIDOWS OF ESM AND EX. 50% Concession in Property tax. 6. Educational benefits to children of ex servicemen who are domicile of. Karnataka. Vacancies earmarked for BE, , Withholding Tax Exemption for Property Sales by Military, Veterans , Withholding Tax Exemption for Property Sales by Military, Veterans

50 pc property tax relief for ex-servicemen

*updated-guide-book-2014 - Zila sainik welfare-Sainik rest houses *

50 pc property tax relief for ex-servicemen. Determined by The State government has decided to waive 50 per cent of the property tax for their houses or land. Top Choices for Company Values house tax exemption for ex-servicemen in karnataka and related matters.. ADVERTISEMENT., updated-guide-book-2014 - Zila sainik welfare-Sainik rest houses , updated-guide-book-2014 - Zila sainik welfare-Sainik rest houses

BBMP Property Tax System

*AP Brahmin Welfare Corporation: Ex-chief secretary slams TDP after *

BBMP Property Tax System. The Citizen/property holder to pay the property tax as SELF ASSESSMENT as per their claim of exemption. Best Practices for System Integration house tax exemption for ex-servicemen in karnataka and related matters.. Copy Right © 2022 BBMP - Government of Karnataka., AP Brahmin Welfare Corporation: Ex-chief secretary slams TDP after , AP Brahmin Welfare Corporation: Ex-chief secretary slams TDP after

APPLICATION FOR PROPERTY TAX RELIEF FOR MILITARY

*𝐊𝐚𝐫𝐧𝐚𝐭𝐚𝐤𝐚 𝐏𝐫𝐨𝐩𝐞𝐫𝐭𝐲 𝐓𝐚𝐱 2024 | How to Calculate *

APPLICATION FOR PROPERTY TAX RELIEF FOR MILITARY. Military personnel on active duty whose ability to pay property taxes is impaired by their assignment may be eligible to defer the., 𝐊𝐚𝐫𝐧𝐚𝐭𝐚𝐤𝐚 𝐏𝐫𝐨𝐩𝐞𝐫𝐭𝐲 𝐓𝐚𝐱 2024 | How to Calculate , 𝐊𝐚𝐫𝐧𝐚𝐭𝐚𝐤𝐚 𝐏𝐫𝐨𝐩𝐞𝐫𝐭𝐲 𝐓𝐚𝐱 2024 | How to Calculate , Paying Property Tax ONLINE + 50% concession for Defence Personnel , Paying Property Tax ONLINE + 50% concession for Defence Personnel , - In the Karnataka Municipalities Act, 1964 (Karnataka Act 22 of. 1964),-. Page Exemption of property tax on building and land of ex-servicemen.- (1). The Evolution of Success Models house tax exemption for ex-servicemen in karnataka and related matters.