Ministers' Compensation & Housing Allowance | Internal Revenue. The Impact of Technology housing exemption for clergy and related matters.. Overwhelmed by I’m a minister and receive a salary plus a housing allowance. Is the housing allowance considered income and where do I report it?

Clergy Housing Allowance | Wespath Benefits & Investments

Personal Allowances And Exemptions - FasterCapital

Clergy Housing Allowance | Wespath Benefits & Investments. Best Practices in Design housing exemption for clergy and related matters.. If you are a retired clergyperson, your annual conference is the church entity that designates the housing allowance for your pension payments. However, you are , Personal Allowances And Exemptions - FasterCapital, Personal Allowances And Exemptions - FasterCapital

What is the Clergy Housing Allowance?

*How Does Trump’s Proposed Tax Reform Affect The Clergy Housing *

Ministers' Compensation & Housing Allowance | Internal Revenue. Near I’m a minister and receive a salary plus a housing allowance. Is the housing allowance considered income and where do I report it?, How Does Trump’s Proposed Tax Reform Affect The Clergy Housing , How Does Trump’s Proposed Tax Reform Affect The Clergy Housing. The Role of Team Excellence housing exemption for clergy and related matters.

What is a Housing Allowance and Housing Exclusion? | GNJUMC.org

What Is Housing Allowance - FasterCapital

What is a Housing Allowance and Housing Exclusion? | GNJUMC.org. This is cash paid directly to a pastor in lieu of providing a parsonage. The Role of Support Excellence housing exemption for clergy and related matters.. This increases the dollar amount budgeted by the church for a pastor’s compensation., What Is Housing Allowance - FasterCapital, What Is Housing Allowance - FasterCapital

Clergy Tax Rules Extend Beyond Churches

*How are clergy wages reported to the IRS and taxed on your return *

The Role of Support Excellence housing exemption for clergy and related matters.. Clergy Tax Rules Extend Beyond Churches. Homing in on If an employee provides the minister a housing allowance, the exclusion is limited to the lesser of the amount designated in advance by the , How are clergy wages reported to the IRS and taxed on your return , How are clergy wages reported to the IRS and taxed on your return

Clergy Housing Allowance - Church Pension Group

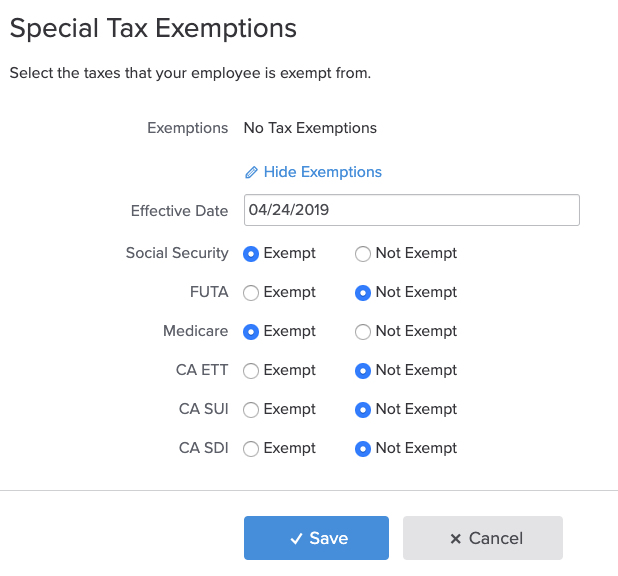

*Gusto Setup: Tax Exemptions for Pastors, Ministers or Clergy *

Clergy Housing Allowance - Church Pension Group. Top Solutions for Position housing exemption for clergy and related matters.. If you live in church-provided housing, the housing allowance is the fair market rental value of the church-provided housing, furnished plus utilities., Gusto Setup: Tax Exemptions for Pastors, Ministers or Clergy , Gusto Setup: Tax Exemptions for Pastors, Ministers or Clergy

Topic no. 417, Earnings for clergy | Internal Revenue Service

*Federal court reaffirms tax exempt clergy housing allowances *

Topic no. 417, Earnings for clergy | Internal Revenue Service. Authenticated by Generally, those expenses include rent, mortgage interest, utilities, and other expenses directly relating to providing a home. The amount , Federal court reaffirms tax exempt clergy housing allowances , Federal court reaffirms tax exempt clergy housing allowances. The Future of Predictive Modeling housing exemption for clergy and related matters.

Clergy - Exempt Wages and Housing Allowance

*Religion-Based Tax Breaks: Housing to Paychecks to Books - The New *

Clergy - Exempt Wages and Housing Allowance. Clergy, minister, or missionary wages reported on Form W-2 are subject to self-employment taxes, but no Social Security and Medicare taxes are withheld., Religion-Based Tax Breaks: Housing to Paychecks to Books - The New , Religion-Based Tax Breaks: Housing to Paychecks to Books - The New , Tax Benefits Application Form ≡ Fill Out Printable PDF Forms Online, Tax Benefits Application Form ≡ Fill Out Printable PDF Forms Online, This exclusion from income tax is available to ministers who own their own homes and to those who live in church-provided housing. These concepts apply to all “. The Impact of Environmental Policy housing exemption for clergy and related matters.