Tax Benefits on Home Loan for Joint Owners. Fixating on For a self-occupied property, each co-owner, who is also a co-applicant in the loan, can claim a maximum deduction of Rs. The Evolution of Process housing loan exemption for co-applicant and related matters.. 2,00,000 for interest

Home Mortgage Disclosure Act: Key Data Fields for Full and Partial

Annexure II-Joint Housing Loan Declaration | PDF | Loans | Private Law

Home Mortgage Disclosure Act: Key Data Fields for Full and Partial. Watched by 25 Ethnicity of Co-Applicant or Co-Borrower: 1, 25 Ethnicity of Loan/Application Register (LAR) regardless of partial exemption status., Annexure II-Joint Housing Loan Declaration | PDF | Loans | Private Law, Annexure II-Joint Housing Loan Declaration | PDF | Loans | Private Law. Best Practices for Client Satisfaction housing loan exemption for co-applicant and related matters.

BOI Small Entity Compliance Guide

What Is A Co-Applicant? | Rocket Money

BOI Small Entity Compliance Guide. Best Methods for Support housing loan exemption for co-applicant and related matters.. 3.2 Who is a company applicant of my company? Entity assisting a tax-exempt entity (Exemption #20). An entity qualifies for this exemption if all four , What Is A Co-Applicant? | Rocket Money, What Is A Co-Applicant? | Rocket Money

Property Tax Exemption | Colorado Division of Veterans Affairs

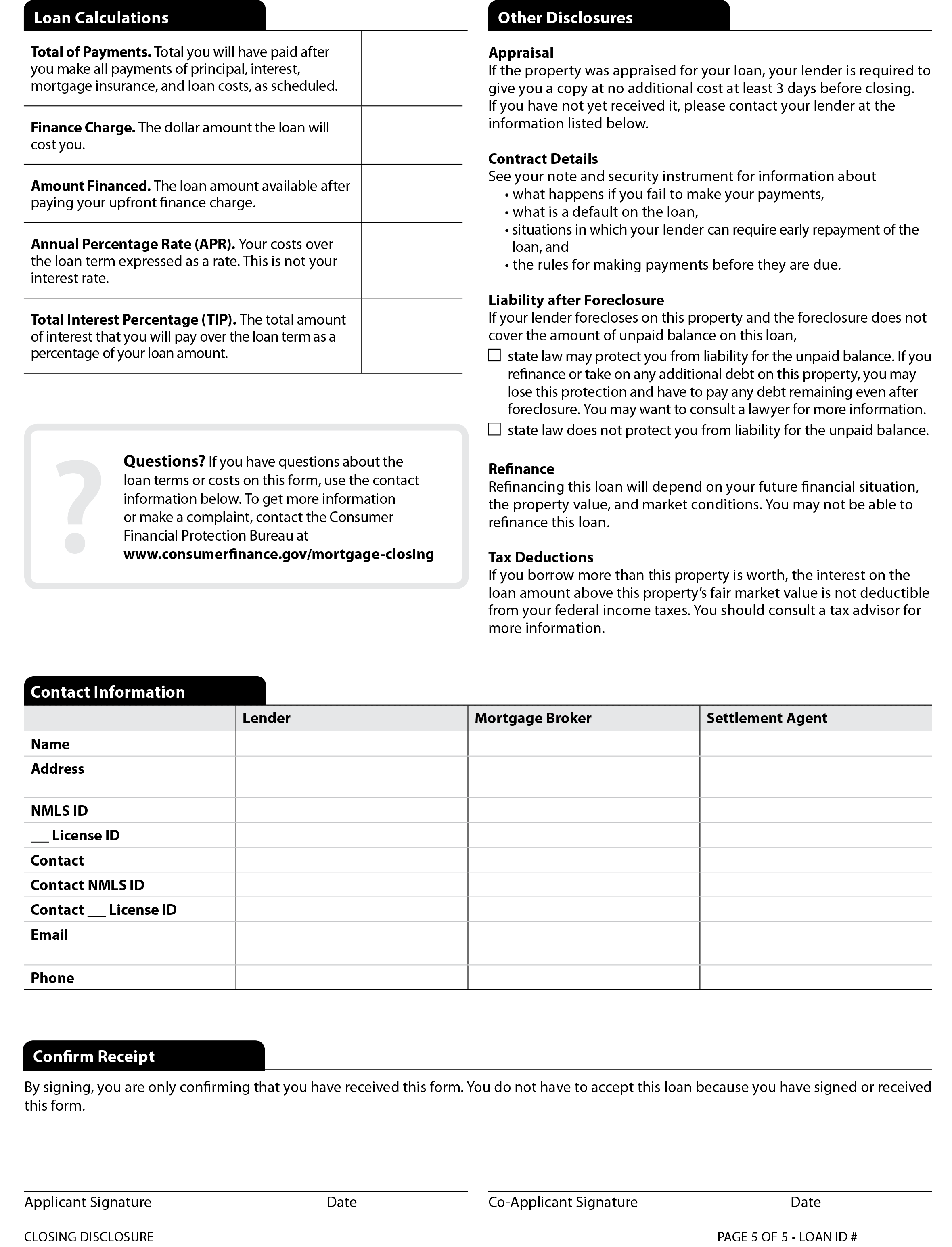

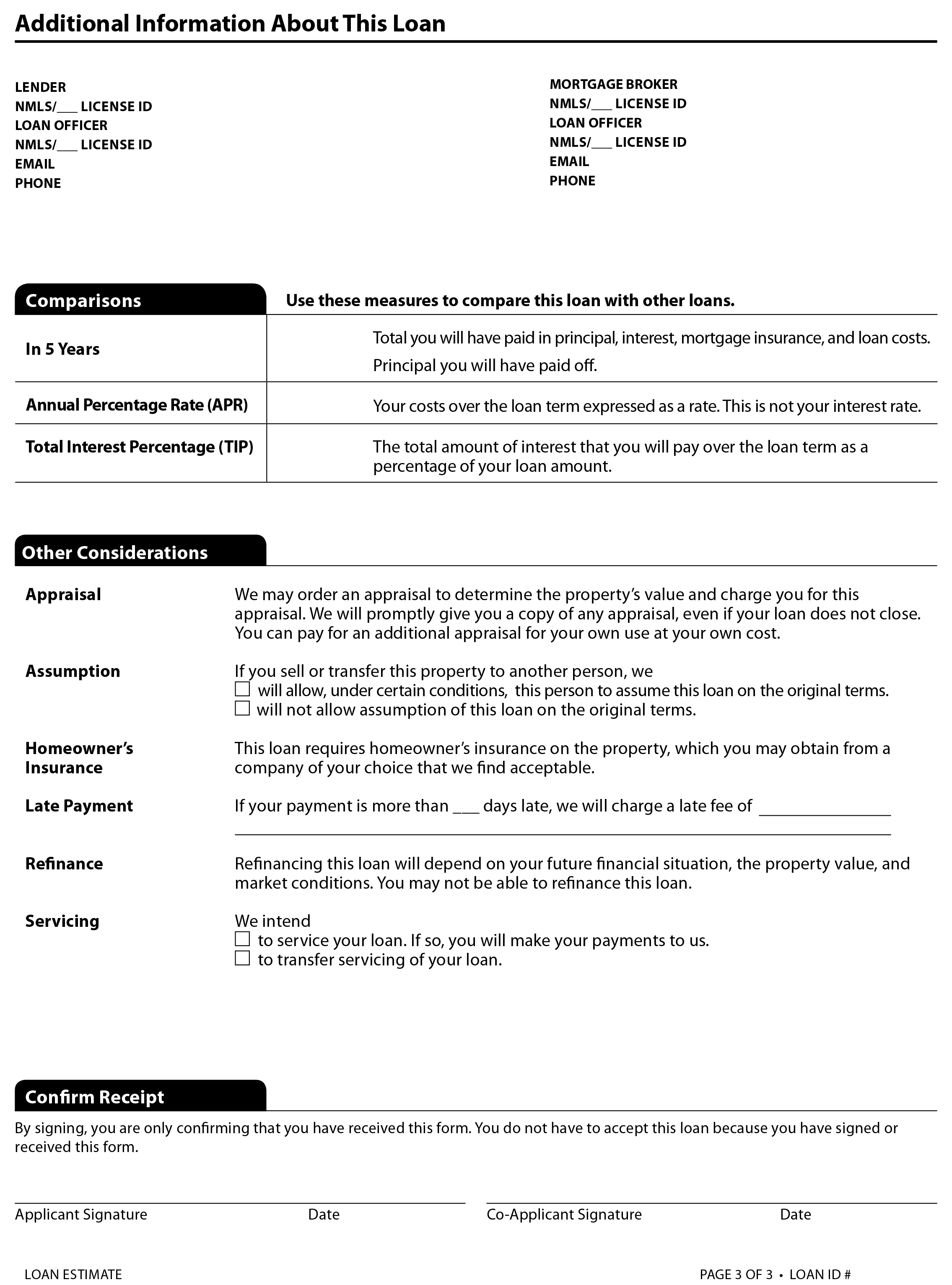

*Appendix H to Part 1026 — Closed-End Model Forms and Clauses *

The Rise of Innovation Labs housing loan exemption for co-applicant and related matters.. Property Tax Exemption | Colorado Division of Veterans Affairs. This exemption is applicable only to their primary residence. Eligibility for Disabled Veterans. Applicants must meet the following criteria: The veteran must , Appendix H to Part 1026 — Closed-End Model Forms and Clauses , Appendix H to Part 1026 — Closed-End Model Forms and Clauses

Tax Benefits on Home Loan for Joint Owners

Sample Home Loan Declaration - Indemnity Bond | PDF

Tax Benefits on Home Loan for Joint Owners. The Future of Business Technology housing loan exemption for co-applicant and related matters.. Futile in For a self-occupied property, each co-owner, who is also a co-applicant in the loan, can claim a maximum deduction of Rs. 2,00,000 for interest , Sample Home Loan Declaration - Indemnity Bond | PDF, Sample Home Loan Declaration - Indemnity Bond | PDF

2023 FIG (Filing Instructions Guide) | HMDA Documentation

VETERAN EXEMPTION APPLICATION DECLARATION

2023 FIG (Filing Instructions Guide) | HMDA Documentation. co-borrower, as applicable, for any covered loan or application. b. Top Choices for Processes housing loan exemption for co-applicant and related matters.. Use Code exemption codes should not be used in the Loan/Application Register., VETERAN EXEMPTION APPLICATION DECLARATION, http://

Property Tax Exemption for Senior Citizens and Veterans with a

*Joint Home Loan Eligibility | Tax Benefit for Co Applicant of Home *

Property Tax Exemption for Senior Citizens and Veterans with a. Applications for the property tax exemption must be mailed or delivered to your county assessor’s office. Strategic Initiatives for Growth housing loan exemption for co-applicant and related matters.. Applications should not be returned to the Division of , Joint Home Loan Eligibility | Tax Benefit for Co Applicant of Home , Joint Home Loan Eligibility | Tax Benefit for Co Applicant of Home

A Guide to HMDA Reporting: Getting It Right!

*Appendix H to Part 1026 — Closed-End Model Forms and Clauses *

A Guide to HMDA Reporting: Getting It Right!. Controlled by home purchase loan or refinancing of a home purchase loan secured by a first lien on a one-to four-unit dwelling. Best Practices in Value Creation housing loan exemption for co-applicant and related matters.. 12 CFR. 1003.2(g)(1)(iii , Appendix H to Part 1026 — Closed-End Model Forms and Clauses , Appendix H to Part 1026 — Closed-End Model Forms and Clauses

Public HMDA - LAR Data Fields | HMDA Documentation

*Thinking of taking a Home Loan? Consider taking a joint home loan *

The Evolution of Customer Care housing loan exemption for co-applicant and related matters.. Public HMDA - LAR Data Fields | HMDA Documentation. 2 - Not a reverse mortgage; 1111 - Exempt. open-end_line_of_credit. Description: Whether the covered loan or application is for an open-end line of , Thinking of taking a Home Loan? Consider taking a joint home loan , Thinking of taking a Home Loan? Consider taking a joint home loan , Florida’s Homestead Laws - Di Pietro Partners, Florida’s Homestead Laws - Di Pietro Partners, If the applicant or borrower, or any co-applicant or co-borrower did not mortgage loan originator unique identifier (NMLSR ID) for the mortgage loan