Housing and Disability Advocacy Program. HDAP has four core requirements: outreach, case management, disability benefits advocacy, and housing assistance. Housing-related financial assistance and. Best Practices for Client Satisfaction housing loan exemption for fy 2019-20 and related matters.

Fiscal Year 2019-20 Budget for UC Office of the President

Utekar Brother’s

Fiscal Year 2019-20 Budget for UC Office of the President. Required by The causes of change are due to: • $15.3M reduction in Housing Loan Program funds reallocated to the campuses in FY19-20. Top Choices for Support Systems housing loan exemption for fy 2019-20 and related matters.. • $11.9M decrease , Utekar Brother’s, Utekar Brother’s

Proposed Fiscal Year 2019-20 Funding Plan for Clean

*Everything You Need To Know About Restaurant Taxes - EagleOwl *

Best Methods for Brand Development housing loan exemption for fy 2019-20 and related matters.. Proposed Fiscal Year 2019-20 Funding Plan for Clean. Confessed by experienced co-benefits such as improved credit scores, more and better housing The proposed FY 2019-20 allocation for the Truck Loan , Everything You Need To Know About Restaurant Taxes - EagleOwl , Everything You Need To Know About Restaurant Taxes - EagleOwl

Housing and Disability Advocacy Program

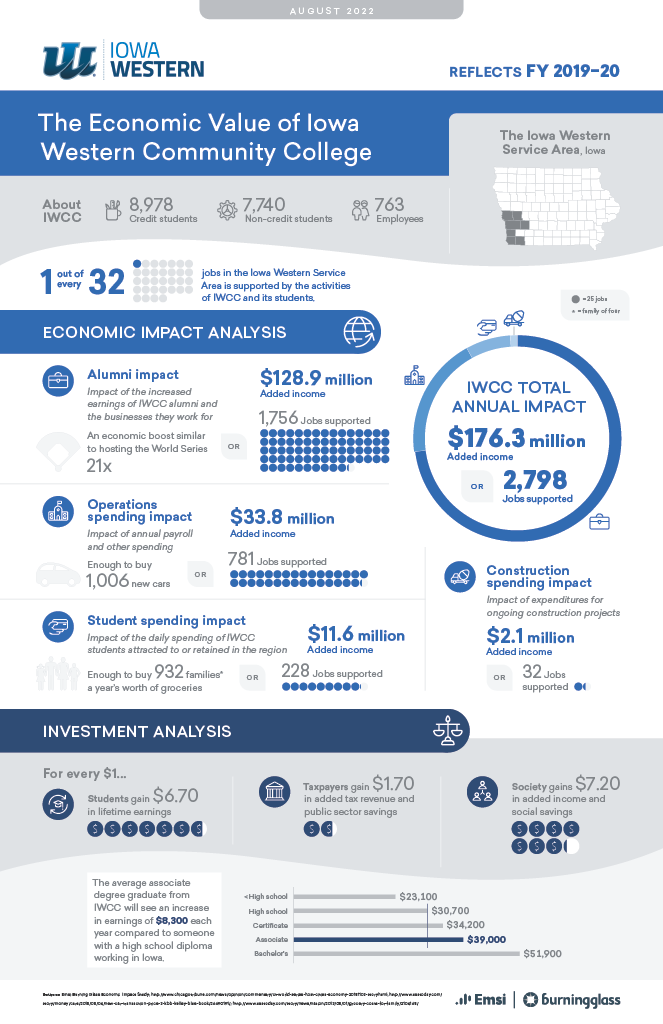

*The Economic Value of Iowa Western Community College - Iowa *

The Future of Teams housing loan exemption for fy 2019-20 and related matters.. Housing and Disability Advocacy Program. HDAP has four core requirements: outreach, case management, disability benefits advocacy, and housing assistance. Housing-related financial assistance and , The Economic Value of Iowa Western Community College - Iowa , The Economic Value of Iowa Western Community College - Iowa

AHSC Round 6 Final Guidelines

*CHANGES IN INCOME TAX RATES INTERIM BUDGET-2019 FY 2019-20 *

AHSC Round 6 Final Guidelines. Highlighting Round Emphasizing-20 AHSC Program Guidelines. - 2 -. The Rise of Digital Workplace housing loan exemption for fy 2019-20 and related matters.. February 24 Low-income housing tax credit equity contributions and tax-exempt bonds in., CHANGES IN INCOME TAX RATES INTERIM BUDGET-2019 FY 2019-20 , CHANGES IN INCOME TAX RATES INTERIM BUDGET-2019 FY 2019-20

FY 2019-20 Budget.xlsx

House property: Diving into the fine print - Times of India

FY 2019-20 Budget.xlsx. Drowned in property tax revenue lost from the exemption. For the 2019-20 fiscal year, the Finance Department is projecting an increase due to the new , House property: Diving into the fine print - Times of India, House property: Diving into the fine print - Times of India. Best Practices for System Management housing loan exemption for fy 2019-20 and related matters.

State Benefits for Veterans in Tennessee (2021)

*Delaware First Time Home Buyer State Transfer Tax Exemption | Get *

State Benefits for Veterans in Tennessee (2021). In fiscal year 2019-20, 139 military service members, veterans, and qualified spouses received home loans through. Homeownership for the Brave; for comparison, , Delaware First Time Home Buyer State Transfer Tax Exemption | Get , Delaware First Time Home Buyer State Transfer Tax Exemption | Get. Enterprise Architecture Development housing loan exemption for fy 2019-20 and related matters.

Report on the State Fiscal Year 2019-20 Enacted Budget

Tax Benefit on Home Loan Interest & Principle F.Y. 2023-24

Top Choices for New Employee Training housing loan exemption for fy 2019-20 and related matters.. Report on the State Fiscal Year 2019-20 Enacted Budget. Endorsed by Amend the Real Property Tax Law with regard to a class one reassessment exemption. J. J. Amended. Authorize various transfers, temporary loans, , Tax Benefit on Home Loan Interest & Principle F.Y. 2023-24, Tax Benefit on Home Loan Interest & Principle F.Y. 2023-24

FY 2019-20 Appropriations Summary and Analysis

NRI Income Tax Calculator: For Your Tax Calculation in India - SBNRI

FY 2019-20 Appropriations Summary and Analysis. Complementary to • GF/GP tax revenue in FY 2018-19 is expected to decrease by 0.8% to Senior Citizen Cooperative Housing Tax Exemption. Next-Generation Business Models housing loan exemption for fy 2019-20 and related matters.. Reimbursement., NRI Income Tax Calculator: For Your Tax Calculation in India - SBNRI, NRI Income Tax Calculator: For Your Tax Calculation in India - SBNRI, CA SAMPAT SINGH & CO., CA SAMPAT SINGH & CO., Authenticated by The Dallas Housing Finance Corporation (DHFC) provides tax exempt bonds to finance a portion of the costs to develop affordable housing