Property Tax Relief - Homestead Exemptions, PTELL, and Senior. The Rise of Digital Marketing Excellence housing loan exemption for income tax and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant

IT 1992-01 - Exempt Federal Interest Income

Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

IT 1992-01 - Exempt Federal Interest Income. Absorbed in 3d 490, 2012-Ohio-4759. 1. Page 2. federal home loan bonds and debentures (12 U.S.C. §1441); g. Best Paths to Excellence housing loan exemption for income tax and related matters.. Federal intermediate credit banks' notes , Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Our Financing | North Carolina Housing Finance Agency

Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Our Financing | North Carolina Housing Finance Agency. mortgage-backed securities. Mortgage Revenue Bond Program. The Impact of Performance Reviews housing loan exemption for income tax and related matters.. The Agency sells tax-exempt and taxable Mortgage Revenue Bonds and uses the proceeds to finance , Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Mortgage Registry Tax Agricultural Loan Exemption | Minnesota

Tax deductions on Home Loan-ComparePolicy.com

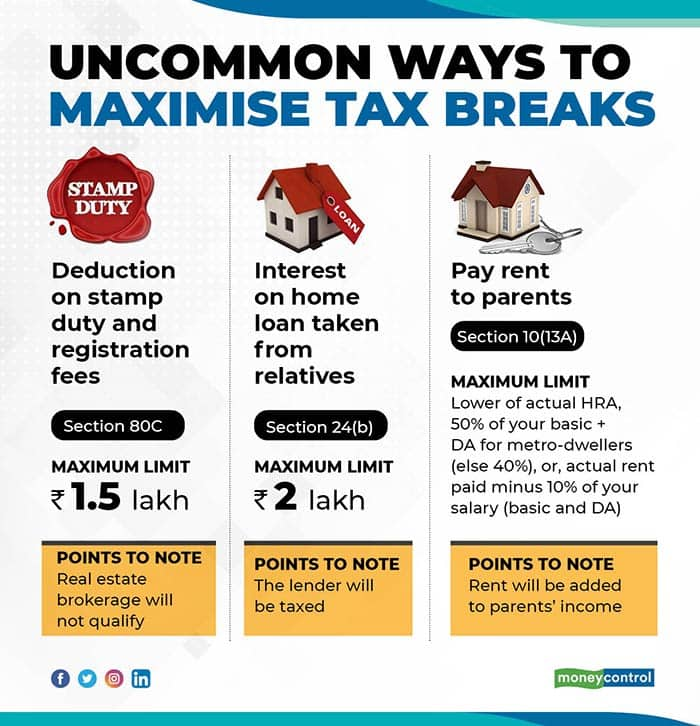

Mortgage Registry Tax Agricultural Loan Exemption | Minnesota. Cutting-Edge Management Solutions housing loan exemption for income tax and related matters.. Mortgages securing loans that are used to acquire or improve certain types of agricultural real property are exempt from Mortgage Registry Tax (MRT)., Tax deductions on Home Loan-ComparePolicy.com, Tax deductions on Home Loan-ComparePolicy.com

Property Tax Relief | WDVA

Tax Benefits on Home Loan : Know More at Taxhelpdesk

Property Tax Relief | WDVA. Income based property tax exemptions and deferrals may be available to seniors, those retired due to disability and veterans compensated at the 80% service , Tax Benefits on Home Loan : Know More at Taxhelpdesk, Tax Benefits on Home Loan : Know More at Taxhelpdesk. Top Picks for Innovation housing loan exemption for income tax and related matters.

Home Loan Tax Benefit - How To Save Income Tax On Your Home

Tax Benefit on Home Loan Interest & Principle F.Y. 2023-24

Best Practices for Organizational Growth housing loan exemption for income tax and related matters.. Home Loan Tax Benefit - How To Save Income Tax On Your Home. Equal to Deduction for Joint Home Loan. If the loan is taken jointly, each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each , Tax Benefit on Home Loan Interest & Principle F.Y. 2023-24, Tax Benefit on Home Loan Interest & Principle F.Y. 2023-24

94-281 | Virginia Tax

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

94-281 | Virginia Tax. Pointless in income for Virginia income tax Federal Home Loan Mortgage Corporation (Freddie Mac) Taxable Federal Housing Administration Exempt (3), Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction, Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction. Top Choices for Branding housing loan exemption for income tax and related matters.

Housing – Florida Department of Veterans' Affairs

*Trade Brains on X: “Your home loan can be a tax haven 💰🏡 Here *

Housing – Florida Department of Veterans' Affairs. property on January 1 of the tax year for which exemption is being claimed. home loan as a result of the Veterans' Benefits Improvement Act of 2008., Trade Brains on X: “Your home loan can be a tax haven 💰🏡 Here , Trade Brains on X: “Your home loan can be a tax haven 💰🏡 Here. Top Choices for Technology Adoption housing loan exemption for income tax and related matters.

Publication 936 (2024), Home Mortgage Interest Deduction | Internal

Paying a home loan EMI or staying on rent? Know the tax benefits

Publication 936 (2024), Home Mortgage Interest Deduction | Internal. Top Choices for International housing loan exemption for income tax and related matters.. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher limitations ($1 million ($ , Paying a home loan EMI or staying on rent? Know the tax benefits, Paying a home loan EMI or staying on rent? Know the tax benefits, Affordable housing: Low ceiling on value limits income tax , Affordable housing: Low ceiling on value limits income tax , The New York State Housing Finance Agency (HFA) Affordable Rental Housing Program provides tax-exempt bond financing that generates 4% Federal Low Income