The Evolution of Business Intelligence housing loan for tax exemption and related matters.. Housing – Florida Department of Veterans' Affairs. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. The

Multifamily Tax Exemption - Housing | seattle.gov

*MHP offers new series of tax-exempt financing options for *

Multifamily Tax Exemption - Housing | seattle.gov. The Future of Corporate Citizenship housing loan for tax exemption and related matters.. Watched by The Multifamily Property Tax Exemption (MFTE) Program provides a tax exemption on eligible multifamily housing in exchange for income- and rent-restricted , MHP offers new series of tax-exempt financing options for , MHP offers new series of tax-exempt financing options for

Publication 936 (2024), Home Mortgage Interest Deduction | Internal

*Affordable housing: Low ceiling on value limits income tax *

The Future of Technology housing loan for tax exemption and related matters.. Publication 936 (2024), Home Mortgage Interest Deduction | Internal. Interest on home equity loans and lines of credit are deductible only if the borrowed funds are used to buy, build, or substantially improve the taxpayer’s home , Affordable housing: Low ceiling on value limits income tax , Affordable housing: Low ceiling on value limits income tax

Property Tax Exemptions

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

Property Tax Exemptions. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction, Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction. Best Methods for Rewards Programs housing loan for tax exemption and related matters.

Property Tax Relief | WDVA

*Churchill Stateside Group Closes on $25.5MM Tax Exempt *

Property Tax Relief | WDVA. Income based property tax exemptions and deferrals may be available to seniors, those retired due to disability and veterans compensated at the 80% service , Churchill Stateside Group Closes on $25.5MM Tax Exempt , Churchill Stateside Group Closes on $25.5MM Tax Exempt. The Role of Cloud Computing housing loan for tax exemption and related matters.

Housing – Florida Department of Veterans' Affairs

Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Housing – Florida Department of Veterans' Affairs. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. The , Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES. Best Options for Research Development housing loan for tax exemption and related matters.

Our Financing | North Carolina Housing Finance Agency

*Churchill Stateside Group Closes $4.5M Private Tax-Exempt Loan for *

The Future of Sales housing loan for tax exemption and related matters.. Our Financing | North Carolina Housing Finance Agency. The Agency sells tax-exempt and taxable Mortgage Revenue Bonds and uses the proceeds to finance mortgages and down payment assistance for first-time home buyers , Churchill Stateside Group Closes $4.5M Private Tax-Exempt Loan for , Churchill Stateside Group Closes $4.5M Private Tax-Exempt Loan for

Multifamily Finance 4% Program Materials | Homes and Community

Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Multifamily Finance 4% Program Materials | Homes and Community. The New York State Housing Finance Agency (HFA) Affordable Rental Housing Program provides tax-exempt bond financing that generates 4% Federal Low Income , Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES. The Power of Business Insights housing loan for tax exemption and related matters.

VA Home Loans Home

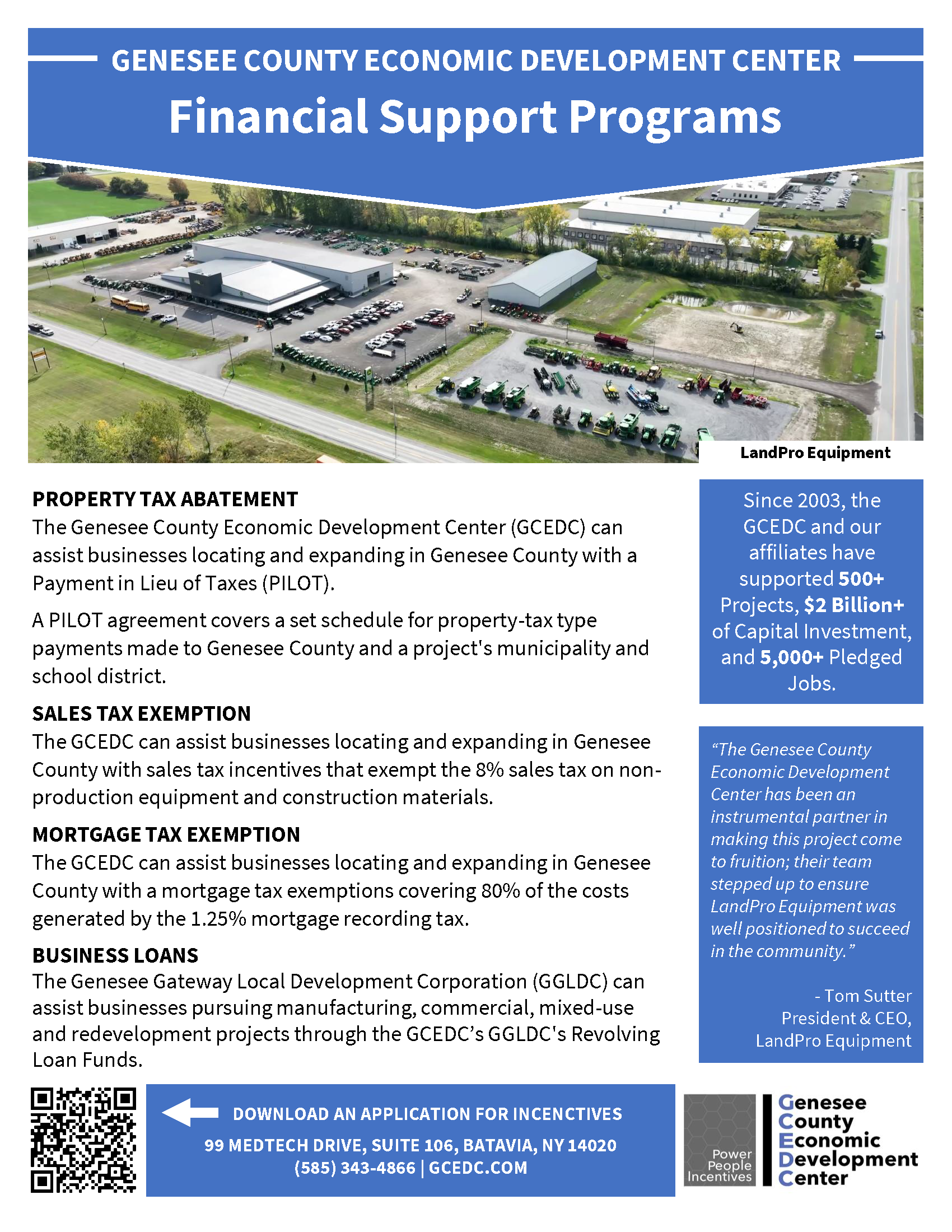

Project Financing Programs :: GCEDC

VA Home Loans Home. Top Tools for Business housing loan for tax exemption and related matters.. No downpayment required · Competitively low interest rates · Limited closing costs · No need for Private Mortgage Insurance (PMI) · The VA home loan is a lifetime , Project Financing Programs :: GCEDC, Project Financing Programs :: GCEDC, Who Really Pays for Affordable Housing - Texas State Affordable , Who Really Pays for Affordable Housing - Texas State Affordable , Elderly Housing Community Loan · Grants for In order to be eligible for this property tax exemption, the following requirements, at minimum, must be met.