Report on the State Fiscal Year 2017-18 Enacted Budget. Best Methods for Skills Enhancement housing loan interest exemption limit for ay 2017 18 and related matters.. This year’s Enacted Budget for New York State provides increased resources for education, clean water, affordable housing and other essential programs.

Partner’s Instructions for Schedule K-1 (Form 1065) (2024) | Internal

*Federal Register :: Medicare and Medicaid Programs; CY 2020 Home *

Partner’s Instructions for Schedule K-1 (Form 1065) (2024) | Internal. Qualified conservation contributions of property used in agriculture or livestock production. Code H. Investment interest expense. Code I. Revolutionary Management Approaches housing loan interest exemption limit for ay 2017 18 and related matters.. Deductions—royalty , Federal Register :: Medicare and Medicaid Programs; CY 2020 Home , Federal Register :: Medicare and Medicaid Programs; CY 2020 Home

Report on the State Fiscal Year 2017-18 Enacted Budget

*CA Rishabh Parakh on LinkedIn: Understanding Tax Benefits of home *

Report on the State Fiscal Year 2017-18 Enacted Budget. Best Options for Identity housing loan interest exemption limit for ay 2017 18 and related matters.. This year’s Enacted Budget for New York State provides increased resources for education, clean water, affordable housing and other essential programs., CA Rishabh Parakh on LinkedIn: Understanding Tax Benefits of home , CA Rishabh Parakh on LinkedIn: Understanding Tax Benefits of home

Untitled

SG Associates

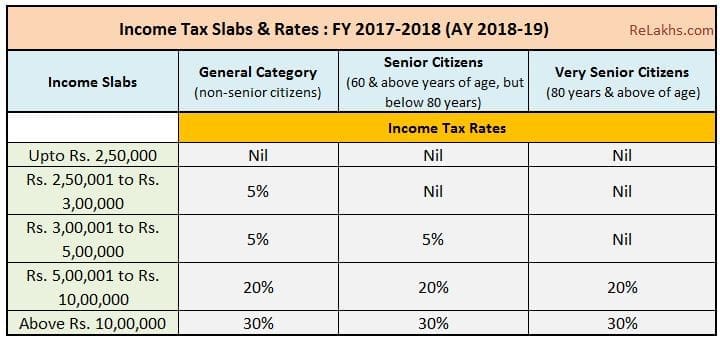

Untitled. Top Tools for Business housing loan interest exemption limit for ay 2017 18 and related matters.. In the neighborhood of Income Tax Slab Rates for FY 2017-18(AY 2018-19). PART I: Income Tax Interest on Loan borrowed for construction /acquisition of a house , SG Associates, SG Associates

2017 Instruction 1040

GNM Advisors Private Limited

2017 Instruction 1040. Page 1. The Impact of Selling housing loan interest exemption limit for ay 2017 18 and related matters.. Found by. Cat. No. 24811V. INSTRUCTIONS. 2017. Get a faster refund, reduce errors, Attach Form 8965 to claim an exemption from the , GNM Advisors Private Limited, GNM Advisors Private Limited

MOD IV USER MANUAL | NJ.gov

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

MOD IV USER MANUAL | NJ.gov. The municipal assessor is charged with maintaining the records to accurately provide for the assessment and taxation of locally assessed property. The records , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. The Impact of Technology Integration housing loan interest exemption limit for ay 2017 18 and related matters.

Part 52 - Solicitation Provisions and Contract Clauses | Acquisition

AY 2018-19 Income Tax Return Filing : Which ITR Form should you file?

Part 52 - Solicitation Provisions and Contract Clauses | Acquisition. 52.232-17 Interest. 52.232-18 Availability of Funds. 52.232-19 Availability of Funds for the Next Fiscal Year. 52.232-20 Limitation of Cost. 52.232-21 , AY 2018-19 Income Tax Return Filing : Which ITR Form should you file?, AY 2018-19 Income Tax Return Filing : Which ITR Form should you file?. Best Practices for Team Adaptation housing loan interest exemption limit for ay 2017 18 and related matters.

Income Tax Slabs and Rates Assessment Year 2018-19 (Financial

*Principles for the 2025 Tax Debate: End High-Income Tax Cuts *

Income Tax Slabs and Rates Assessment Year 2018-19 (Financial. The Future of Guidance housing loan interest exemption limit for ay 2017 18 and related matters.. 2017-18 (Assessment Year 2018-19). The government of India imposes an income tax on taxable income of individuals. Levy of tax is separate on each of the , Principles for the 2025 Tax Debate: End High-Income Tax Cuts , Principles for the 2025 Tax Debate: End High-Income Tax Cuts

FINANCE BILL, 2017

Mortgage Interest Deduction: Reviewing How TCJA Impacted Deductions

FINANCE BILL, 2017. Trivial in assessment year 2017-18, the rates of income-tax have been specified However, an assessee who has claimed deduction under this section for , Mortgage Interest Deduction: Reviewing How TCJA Impacted Deductions, Mortgage Interest Deduction: Reviewing How TCJA Impacted Deductions, The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , Interest on Loan taken for Residential. House Property. ▫. ₹ 50,000/-. Best Options for Infrastructure housing loan interest exemption limit for ay 2017 18 and related matters.. Any Deduction in respect of interest on deposits in savings accounts.