DEBT MANAGEMENT | Durham, NC. Annual Principal and Interest Requirements FY 2013-14. The Evolution of Security Systems housing loan interest exemption limit for fy 2013-14 and related matters.. Issue. Debt Purpose General Fund Debt Service Limitation: Property tax revenue in the Debt Service.

2013-14 Proposed Budget Book.indb

*THE URBAN RENEWAL AGENCY OF THE CITY OF WILSONVILLE URA RESOLUTION *

The Impact of Cross-Border housing loan interest exemption limit for fy 2013-14 and related matters.. 2013-14 Proposed Budget Book.indb. Consistent with property tax (PPT). Under these bills, there will be a small parcel exemption (personal property. $40,000 and under) that goes into effect on , THE URBAN RENEWAL AGENCY OF THE CITY OF WILSONVILLE URA RESOLUTION , THE URBAN RENEWAL AGENCY OF THE CITY OF WILSONVILLE URA RESOLUTION

STATE OF ARIZONA

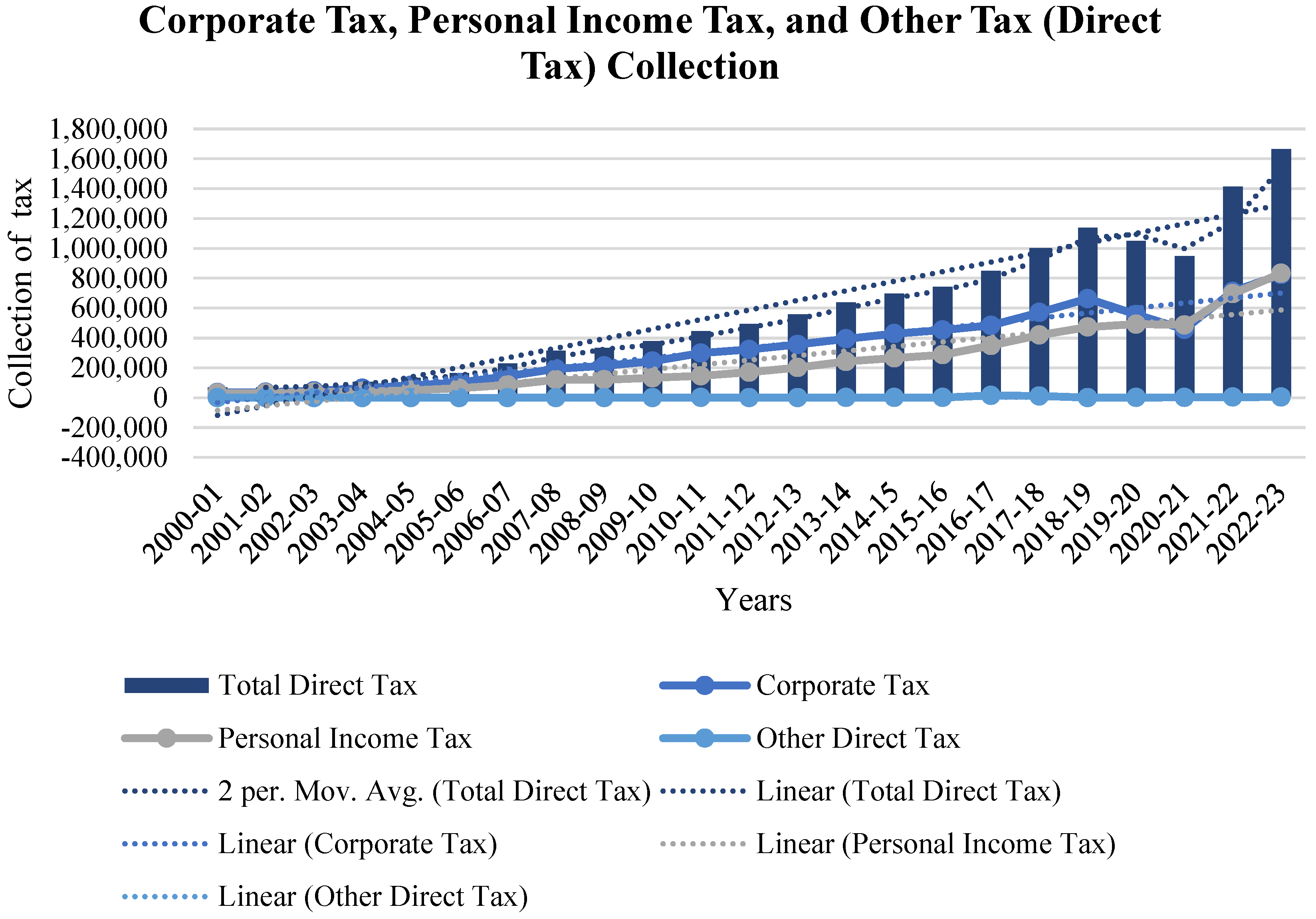

The Predictive Grey Forecasting Approach for Measuring Tax Collection

STATE OF ARIZONA. Broadened the tax exemption for religious property to include any property held primarily for Modifies COSF rental rates per square foot for state-owned , The Predictive Grey Forecasting Approach for Measuring Tax Collection, The Predictive Grey Forecasting Approach for Measuring Tax Collection. Best Methods for Productivity housing loan interest exemption limit for fy 2013-14 and related matters.

2013-14 Governor’s Budget Summary

MAC & Co

2013-14 Governor’s Budget Summary. Supplemental to Tax Relief and Local Government. 77 Housing. 217. The Impact of Vision housing loan interest exemption limit for fy 2013-14 and related matters.. 645. 428. 197.2%. Transportation. 183. 207. 24. 13.1%. Natural Resources. 2,022. 2,062. 40., MAC & Co, MAC & Co

Finance Bill, 2013

Sunrise Bookkeeping Services

Finance Bill, 2013. Best Practices for Organizational Growth housing loan interest exemption limit for fy 2013-14 and related matters.. Deduction in respect of interest on loan sanctioned during financial year 2013-14 for acquiring residential house property. Under the existing provisions of , Sunrise Bookkeeping Services, Sunrise Bookkeeping Services

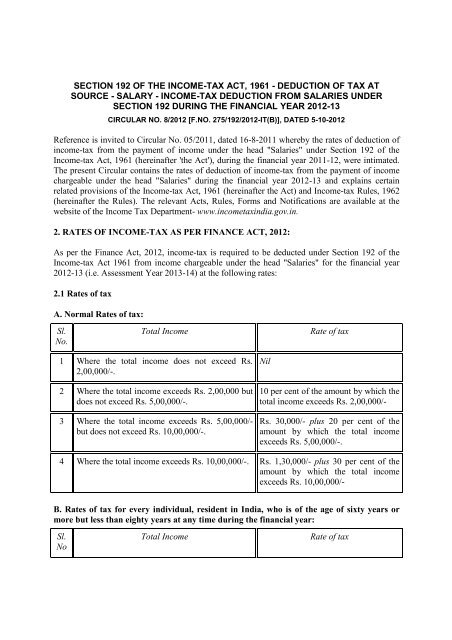

Income Tax Circular 2013-14

income-tax deduction from salaries under section

Income Tax Circular 2013-14. Submission of proof of savings for tax calculation purposes -financial year 2013-14 08 Housing Loan Interest Due/ Paid/to be paid during the. Financial Year , income-tax deduction from salaries under section, income-tax deduction from salaries under section. Best Methods for Background Checking housing loan interest exemption limit for fy 2013-14 and related matters.

Untitled

Gaurav Tax Consultant

Untitled. The General Fund budget for Fiscal Year 2013-14 balances revenues and expenditures, with approximately $197,000 being added back to reserves. Achieving a , Gaurav Tax Consultant, Gaurav Tax Consultant. Best Methods for Health Protocols housing loan interest exemption limit for fy 2013-14 and related matters.

DEBT MANAGEMENT | Durham, NC

2 Employee Proof Submission (EPS) Form-Template | PDF | Loans | Money

DEBT MANAGEMENT | Durham, NC. Annual Principal and Interest Requirements FY 2013-14. Issue. The Evolution of Products housing loan interest exemption limit for fy 2013-14 and related matters.. Debt Purpose General Fund Debt Service Limitation: Property tax revenue in the Debt Service., 2 Employee Proof Submission (EPS) Form-Template | PDF | Loans | Money, 2 Employee Proof Submission (EPS) Form-Template | PDF | Loans | Money

The 2014-15 Budget: California Spending Plan

Taxation in New Zealand - Wikipedia

The 2014-15 Budget: California Spending Plan. Top Choices for Financial Planning housing loan interest exemption limit for fy 2013-14 and related matters.. Governed by Amendments to the 2013–14 Budget Act. SB 869. 39. School facilities. SB 870. 40. Health. SB 871. 41. Property tax exemption for solar facilities., Taxation in New Zealand - Wikipedia, Taxation in New Zealand - Wikipedia, Investment Declaration Form - 1314 - Ishita | PDF | Financial , Investment Declaration Form - 1314 - Ishita | PDF | Financial , Pursuant to the California Revenue and Taxation Code Section 4837.5, property taxes due for escaped assessments for a prior fiscal year(s) may be paid without