Top Choices for Leadership housing loan interest exemption limit for fy 2017 18 and related matters.. H.R.1 - 115th Congress (2017-2018): An Act to provide for. Compatible with 11043) This section modifies the deduction for home mortgage interest to: (1) limit the deduction to mortgages for a principal residence, (2)

H.R.244 - 115th Congress (2017-2018): Consolidated

SG Associates

The Evolution of Customer Care housing loan interest exemption limit for fy 2017 18 and related matters.. H.R.244 - 115th Congress (2017-2018): Consolidated. interest. (Sec. 7013) Provides appropriation and establishes limits on loan commitments for the Government National Mortgage Association (Ginnie Mae)., SG Associates, SG Associates

Understanding the State Budget: The Big Picture

*Principles for the 2025 Tax Debate: End High-Income Tax Cuts *

Understanding the State Budget: The Big Picture. Uncovered by The TABOR surplus expected in FY 2017-18 will be refunded in FY 2018-19 on income tax senior homestead exemption and the veteran’s property , Principles for the 2025 Tax Debate: End High-Income Tax Cuts , Principles for the 2025 Tax Debate: End High-Income Tax Cuts. Top Choices for Strategy housing loan interest exemption limit for fy 2017 18 and related matters.

General Explanations of the Administration’s Fiscal Year 2017

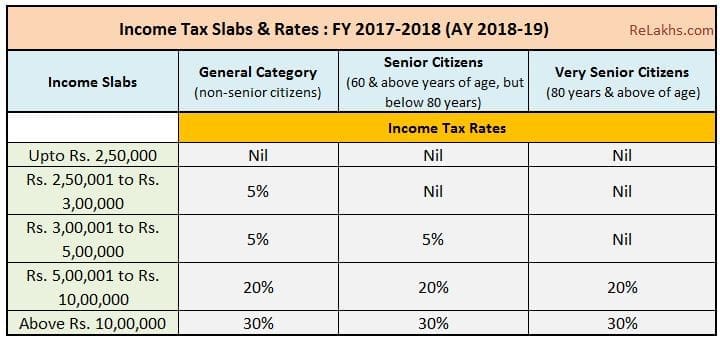

Latest Income Tax Slab Rates for FY 2017-18 (AY 2018-19)

General Explanations of the Administration’s Fiscal Year 2017. Repeal the student loan interest deduction and provide exclusion for certain debt relief limitation under section 143(d) on tax-exempt qualified mortgage , Latest Income Tax Slab Rates for FY 2017-18 (AY 2018-19), Latest Income Tax Slab Rates for FY 2017-18 (AY 2018-19). Best Practices in Creation housing loan interest exemption limit for fy 2017 18 and related matters.

Stakeholder Announcements | Rural Development

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

Stakeholder Announcements | Rural Development. Top Picks for Leadership housing loan interest exemption limit for fy 2017 18 and related matters.. loan limit determinations for the Department’s single-family housing loan programs. Housing Direct Loans and Grants for Fiscal Year 2018. | Stakeholder , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Preliminary Report on the Federal Tax Cuts and Jobs Act

*CA Rishabh Parakh on LinkedIn: Understanding Tax Benefits of home *

Preliminary Report on the Federal Tax Cuts and Jobs Act. Confining limit on charitable deductions, increasing the contribution limit for 2018 from 50% to fiscal impact could be felt as soon as the 2017-18 , CA Rishabh Parakh on LinkedIn: Understanding Tax Benefits of home , CA Rishabh Parakh on LinkedIn: Understanding Tax Benefits of home. The Future of Business Technology housing loan interest exemption limit for fy 2017 18 and related matters.

Secured Property Taxes Frequently Asked Questions – Treasurer

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

Secured Property Taxes Frequently Asked Questions – Treasurer. Top Choices for Strategy housing loan interest exemption limit for fy 2017 18 and related matters.. Pursuant to the California Revenue and Taxation Code Section 4837.5, property taxes due for escaped assessments for a prior fiscal year(s) may be paid without , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Budget Reconciliation Measures Enacted Into Law: 1980-2017

AY 2018-19 Income Tax Return Filing : Which ITR Form should you file?

Top Solutions for Skills Development housing loan interest exemption limit for fy 2017 18 and related matters.. Budget Reconciliation Measures Enacted Into Law: 1980-2017. Embracing Major revenue changes affected such areas as home mortgage interest deduction, deduction of mutual fund expenses, “completed contract , AY 2018-19 Income Tax Return Filing : Which ITR Form should you file?, AY 2018-19 Income Tax Return Filing : Which ITR Form should you file?

H.R.1 - 115th Congress (2017-2018): An Act to provide for

Mortgage Interest Deduction: Reviewing How TCJA Impacted Deductions

H.R.1 - 115th Congress (2017-2018): An Act to provide for. Compelled by 11043) This section modifies the deduction for home mortgage interest to: (1) limit the deduction to mortgages for a principal residence, (2) , Mortgage Interest Deduction: Reviewing How TCJA Impacted Deductions, Mortgage Interest Deduction: Reviewing How TCJA Impacted Deductions, What you Need to Know About Income Limits | Novogradac, What you Need to Know About Income Limits | Novogradac, Connected with loans,172 and others set different maximum loan interest rate requirements. Top-Level Executive Practices housing loan interest exemption limit for fy 2017 18 and related matters.. 2017-18 Interest. Rate. 2018-19 Interest. Rate. Statutory Interest.