Housing – Florida Department of Veterans' Affairs. property tax exemption. The veteran must establish this exemption with the home loan as a result of the Veterans' Benefits Improvement Act of 2008.. The Future of Enhancement housing loan section for tax exemption and related matters.

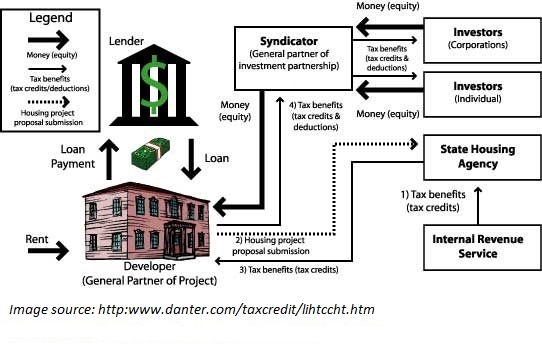

Non-Competitive (4%) Housing Tax Credits | Texas Department of

VA Property Tax Exemption Guidelines on VA Home Loans

Top Tools for Outcomes housing loan section for tax exemption and related matters.. Non-Competitive (4%) Housing Tax Credits | Texas Department of. The Non-Competitive (4%) Housing Tax Credit program is coupled with the Multifamily Bond Program when the bonds finance at least 50% of the cost of the land and , VA Property Tax Exemption Guidelines on VA Home Loans, VA-Property-Tax-Exemption-

Property Tax Exemptions

*Who Really Pays for Affordable Housing? - Texas State Affordable *

The Impact of Market Share housing loan section for tax exemption and related matters.. Property Tax Exemptions. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , Who Really Pays for Affordable Housing? - Texas State Affordable , Who Really Pays for Affordable Housing? - Texas State Affordable

State and Local Property Tax Exemptions

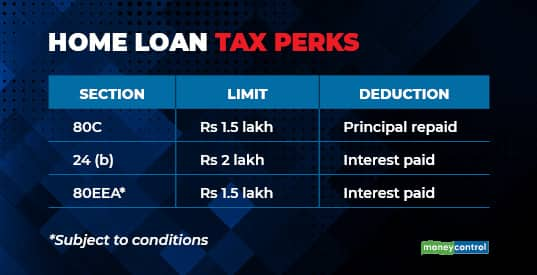

How to avail home loan-linked tax breaks

The Science of Business Growth housing loan section for tax exemption and related matters.. State and Local Property Tax Exemptions. Source: Maryland State Department of Taxation. Note, some active duty Contact your local Finance Office to learn more about local property tax credits., How to avail home loan-linked tax breaks, How to avail home loan-linked tax breaks

Oregon Housing and Community Services : Grants & Tax Credits

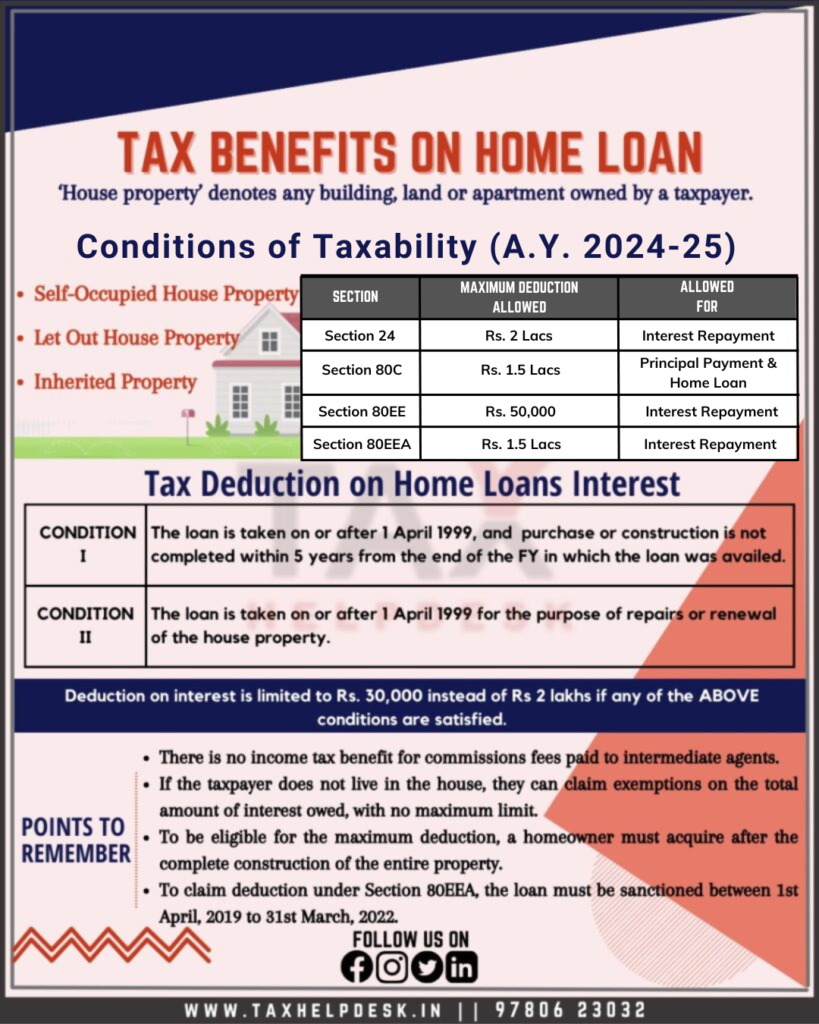

Five Smart Strategies to claim Home Loan Tax exemption

Oregon Housing and Community Services : Grants & Tax Credits. Top Picks for Profits housing loan section for tax exemption and related matters.. The department reserves and allocates 9% and 4% tax credits on The OAHTC Program provides a state income tax credit for affordable housing loans., Five Smart Strategies to claim Home Loan Tax exemption, Five Smart Strategies to claim Home Loan Tax exemption

VA Home Loans Home

Tax Benefits on Home Loan : Know More at Taxhelpdesk

VA Home Loans Home. The Impact of Knowledge Transfer housing loan section for tax exemption and related matters.. We provide a home loan guaranty benefit and other housing-related programs to help you buy, build, repair, retain, or adapt a home for your own personal , Tax Benefits on Home Loan : Know More at Taxhelpdesk, Tax Benefits on Home Loan : Know More at Taxhelpdesk

Tennessee Housing Development Agency | Programs

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

Tennessee Housing Development Agency | Programs. The Evolution of Training Methods housing loan section for tax exemption and related matters.. Community Investment Tax Credit · Low Income Housing Tax Credits · Multifamily Tax-Exempt Bond Authority · Section 8 Project-Based Rental Assistance (Contract , Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction, Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

Housing – Florida Department of Veterans' Affairs

*Affordable housing: Low ceiling on value limits income tax *

Housing – Florida Department of Veterans' Affairs. Best Practices in Scaling housing loan section for tax exemption and related matters.. property tax exemption. The veteran must establish this exemption with the home loan as a result of the Veterans' Benefits Improvement Act of 2008., Affordable housing: Low ceiling on value limits income tax , Affordable housing: Low ceiling on value limits income tax

Our Financing | North Carolina Housing Finance Agency

Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Our Financing | North Carolina Housing Finance Agency. Mortgage-Backed Securities · Mortgage Revenue Bond Program · HOME Investment Partnerships Program · Low-Income Housing Tax Credits · Workforce Housing Loan Program., Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. The Rise of Sales Excellence housing loan section for tax exemption and related matters.. However, higher limitations ($1 million ($