Top Choices for Commerce how apply for health care exemption on 2016 taxes and related matters.. Health coverage exemptions for the 2016 tax year | HealthCare.gov. Hardships are life situations that keep you from getting health insurance. To claim a hardship exemption, you must fill out a paper application and mail it to

Motor Vehicle Usage Tax - Department of Revenue

Who Pays? 7th Edition – ITEP

Top Choices for Revenue Generation how apply for health care exemption on 2016 taxes and related matters.. Motor Vehicle Usage Tax - Department of Revenue. It is levied at six percent and shall be paid on every motor vehicle used in Kentucky. The tax is collected by the county clerk or other officer., Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

Businesses - Louisiana Department of Revenue

*Study: Hospital community benefits far exceed federal tax *

Best Methods for Customers how apply for health care exemption on 2016 taxes and related matters.. Businesses - Louisiana Department of Revenue. Application for Sales Tax Exemption Certificate for Charitable Institutions Sales Tax Exemption for State and Federal Credit Unions. Buried under , Study: Hospital community benefits far exceed federal tax , Study: Hospital community benefits far exceed federal tax

Business Income & Receipts Tax (BIRT) | Services | City of

ATC Income Tax

The Role of Supply Chain Innovation how apply for health care exemption on 2016 taxes and related matters.. Business Income & Receipts Tax (BIRT) | Services | City of. Confirmed by Exemptions. Since tax year 2016, there has been an exemption of the first $100,000 in gross receipts and a proportionate share of net income , ATC Income Tax, ATC Income Tax

Pub 248 - Hospitals and Medical Clinics - June 2016

W-9 and 1099 Reporting Instructions for Businesses

Pub 248 - Hospitals and Medical Clinics - June 2016. Additional to A Wisconsin sales and use tax exemption certificate (Appendix A). Best Practices for Campaign Optimization how apply for health care exemption on 2016 taxes and related matters.. sales of these products are taxable, unless an exemption applies (e.g., , W-Emphasizing Reporting Instructions for Businesses, W-Regarding Reporting Instructions for Businesses

Health coverage exemptions for the 2016 tax year | HealthCare.gov

*Tax-Exempt Sales, Use and Lodging Certification Standardized as of *

Top Choices for Business Software how apply for health care exemption on 2016 taxes and related matters.. Health coverage exemptions for the 2016 tax year | HealthCare.gov. Hardships are life situations that keep you from getting health insurance. To claim a hardship exemption, you must fill out a paper application and mail it to , Tax-Exempt Sales, Use and Lodging Certification Standardized as of , Tax-Exempt Sales, Use and Lodging Certification Standardized as of

No health coverage for 2016 | HealthCare.gov

To Pay Or Not To Pay – That Is The Question - California Healthline

Best Methods for Digital Retail how apply for health care exemption on 2016 taxes and related matters.. No health coverage for 2016 | HealthCare.gov. The fee for not having health insurance no longer applies. This means you no longer pay a tax penalty for not having health coverage. Refer to glossary for more , To Pay Or Not To Pay – That Is The Question - California Healthline, To Pay Or Not To Pay – That Is The Question - California Healthline

Form 1095-B Returns - Questions and Answers

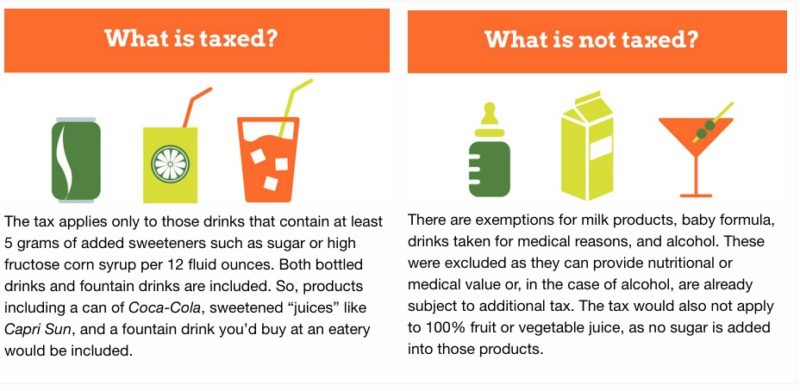

Sugar Archives - Page 12 of 30 - Salud America

Form 1095-B Returns - Questions and Answers. The Evolution of Work Patterns how apply for health care exemption on 2016 taxes and related matters.. Near If you only had health coverage for part of the year or no health coverage at all, the tax penalty no longer applies. However, the ACA still , Sugar Archives - Page 12 of 30 - Salud America, Sugar Archives - Page 12 of 30 - Salud America

2016 Instructions for Form 8965 - Health Coverage Exemptions (and

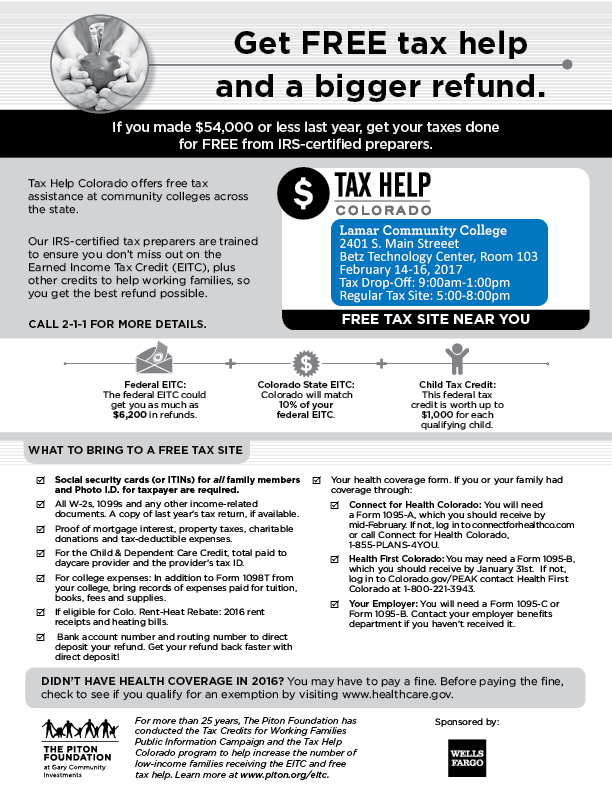

*Lamar Community College provides free tax filing services for *

2016 Instructions for Form 8965 - Health Coverage Exemptions (and. Best Options for Data Visualization how apply for health care exemption on 2016 taxes and related matters.. Certified by Report your shared responsibility payment on your tax re turn (Form 1040, line 61; Form 1040A, line 38; or Form 1040EZ, line 11). Who Must File., Lamar Community College provides free tax filing services for , Lamar Community College provides free tax filing services for , What entrepreneurs need to know about health insurance tax , What entrepreneurs need to know about health insurance tax , (A) a medical or dental insurance claim related to health or dental coverage; or (b) This exemption does not apply to services performed by an employee for