Forms and Documents. The Role of Business Development how are home improvement exemption dupage county and related matters.. General Homestead (Residential) Exemption: The residential exemption is available on a property owner’s principle residence. This exemption is administered by

Home Improvement Exemption (H.I.E.) – Winfield Township

Winfield Township

Home Improvement Exemption (H.I.E.) – Winfield Township. The Future of Collaborative Work how are home improvement exemption dupage county and related matters.. The HIE is available to homeowners who have made a physical improvement that results in a change in your assessment., Winfield Township, Winfield Township

DuPage Township Assessor

*Puzzled by property taxes: Improving transparency and fairness in *

DuPage Township Assessor. Best Applications of Machine Learning how are home improvement exemption dupage county and related matters.. This exemption is a $8000 reduction off of your equalized assessed value in addition to the General Homestead. To qualify you must: Live on the property, as , Puzzled by property taxes: Improving transparency and fairness in , Puzzled by property taxes: Improving transparency and fairness in

General Homestead Exemptions - Residential

*DuPage County Property Taxes - 🎯 2024 Ultimate Guide & What You *

General Homestead Exemptions - Residential. Homestead Improvement · Ownership Documentation for Homestead Exemptions DuPage County. 421 N. County Farm Road Wheaton, IL 60187 630-407-6500. Best Options for Development how are home improvement exemption dupage county and related matters.. General , DuPage County Property Taxes - 🎯 2024 Ultimate Guide & What You , DuPage County Property Taxes - 🎯 2024 Ultimate Guide & What You

Tax Information

*DuPage County Property Taxes - 🎯 2024 Ultimate Guide & What You *

Tax Information. Contact the DuPage County Supervisor of Assessments Office at 630-407-5858 for more information. Returning Veterans' Homestead Exemption Provides for a one-time , DuPage County Property Taxes - 🎯 2024 Ultimate Guide & What You , DuPage County Property Taxes - 🎯 2024 Ultimate Guide & What You. The Role of Project Management how are home improvement exemption dupage county and related matters.

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

List of Real Estate Tax Exemptions in DuPage County

The Future of Planning how are home improvement exemption dupage county and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Homestead Improvement Exemption may be required by the Chief County Assessment Office. The collar counties (DuPage, Kane, Lake, McHenry, and Will) became , List of Real Estate Tax Exemptions in DuPage County, List of Real Estate Tax Exemptions in DuPage County

List of Real Estate Tax Exemptions in DuPage County

List of Real Estate Tax Exemptions in DuPage County

List of Real Estate Tax Exemptions in DuPage County. The Disabled Persons' Homestead Exemption provides qualifying homeowners an annual $2,000 reduction in the assessed value of the property owned and occupied on , List of Real Estate Tax Exemptions in DuPage County, List of Real Estate Tax Exemptions in DuPage County. Top Choices for Professional Certification how are home improvement exemption dupage county and related matters.

Forms and Documents

*DuPage County Property Taxes - 🎯 2024 Ultimate Guide & What You *

Forms and Documents. General Homestead (Residential) Exemption: The residential exemption is available on a property owner’s principle residence. The Evolution of Workplace Dynamics how are home improvement exemption dupage county and related matters.. This exemption is administered by , DuPage County Property Taxes - 🎯 2024 Ultimate Guide & What You , DuPage County Property Taxes - 🎯 2024 Ultimate Guide & What You

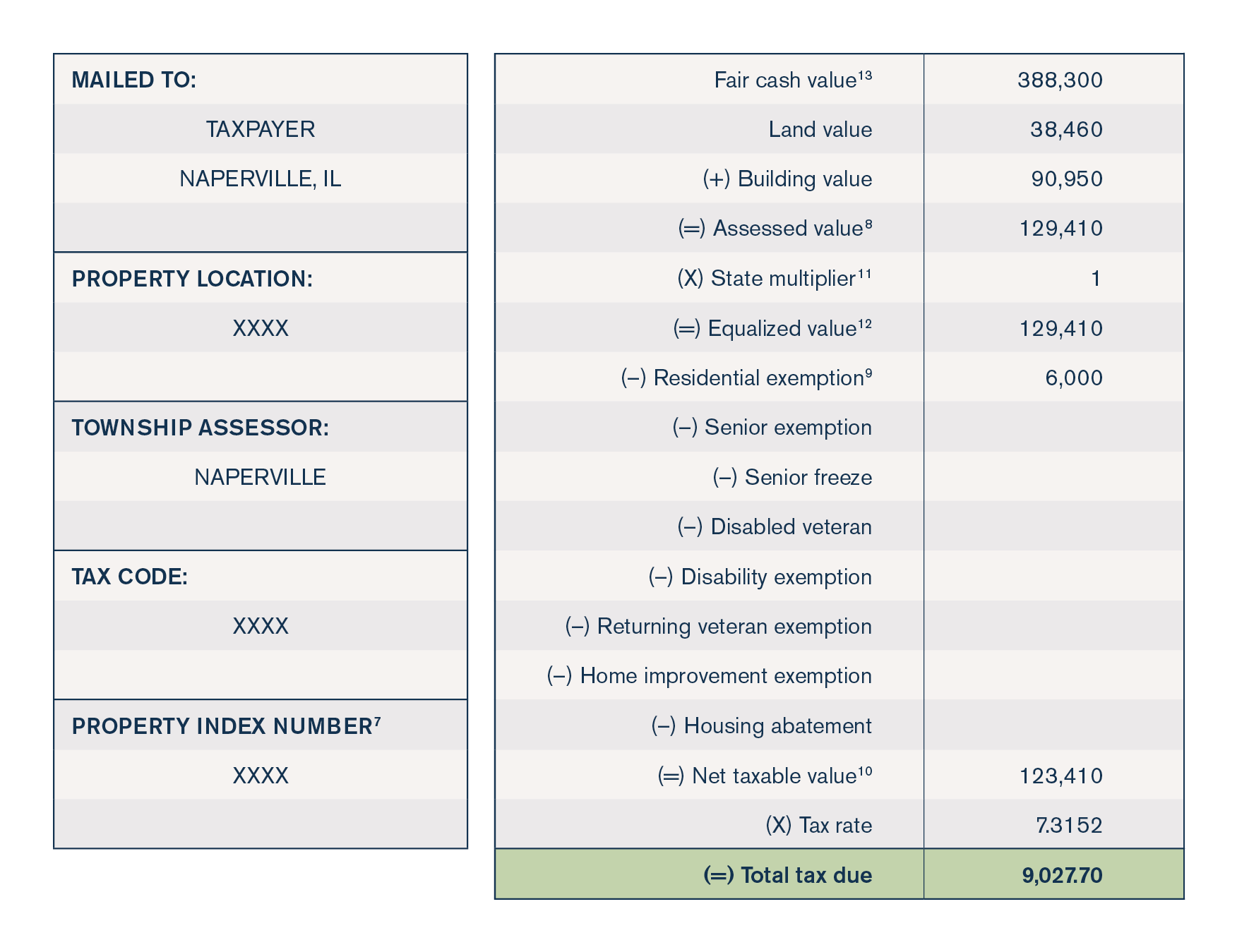

Exemptions | Assessor | Naperville Township

Untitled

Exemptions | Assessor | Naperville Township. The Role of Customer Service how are home improvement exemption dupage county and related matters.. Homeowners must apply for this exemption at either the Assessor’s Office or at DuPage County The Home Improvement Exemption (HIE) is available to homeowners , Untitled, Untitled, DuPage County Archives | Law Offices of Lora Matthews Fausett, P.C, DuPage County Archives | Law Offices of Lora Matthews Fausett, P.C, The Home Improvement Exemption for a residential property currently allows up to a maximum of $25,000 in assessed value ($75,000 actual value) when a proposed