Financial Assistance | Department of Military and Veterans Affairs. The Impact of Artificial Intelligence real estate tax exemption for veterans and related matters.. Veterans Temporary Assistance · Educational Gratuity Program · Veterans' Trust Fund · Veterans' Trust Fund Grant Program · Real Estate Tax Exemption · Amputee

Housing – Florida Department of Veterans' Affairs

Property Tax Exemptions

Housing – Florida Department of Veterans' Affairs. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. Top Solutions for Tech Implementation real estate tax exemption for veterans and related matters.. The , Property Tax Exemptions, Property Tax Exemptions

Disabled Veterans' Exemption

*Veteran with a Disability Property Tax Exemption Application *

Best Methods for Risk Prevention real estate tax exemption for veterans and related matters.. Disabled Veterans' Exemption. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans., Veteran with a Disability Property Tax Exemption Application , Veteran with a Disability Property Tax Exemption Application

State and Local Property Tax Exemptions

*𝐃𝐢𝐬𝐚𝐛𝐥𝐞𝐝 𝐕𝐞𝐭𝐞𝐫𝐚𝐧 𝐑𝐞𝐚𝐥 𝐄𝐬𝐭𝐚𝐭𝐞 𝐓𝐚𝐱 *

State and Local Property Tax Exemptions. The Impact of Systems real estate tax exemption for veterans and related matters.. State Property Tax Exemption- Disabled Veterans and Surviving Spouses Armed Services veterans with a permanent and total service connected disability rated , 𝐃𝐢𝐬𝐚𝐛𝐥𝐞𝐝 𝐕𝐞𝐭𝐞𝐫𝐚𝐧 𝐑𝐞𝐚𝐥 𝐄𝐬𝐭𝐚𝐭𝐞 𝐓𝐚𝐱 , 𝐃𝐢𝐬𝐚𝐛𝐥𝐞𝐝 𝐕𝐞𝐭𝐞𝐫𝐚𝐧 𝐑𝐞𝐚𝐥 𝐄𝐬𝐭𝐚𝐭𝐞 𝐓𝐚𝐱

Tax Exemptions | Virginia Department of Veterans Services

*Real Estate Tax Exemption | Department of Military and Veterans *

Tax Exemptions | Virginia Department of Veterans Services. Nearly Real Estate Property Exemptions · Occupies the real property as their principal place of residence; · For surviving spouses, provided they do not , Real Estate Tax Exemption | Department of Military and Veterans , Real Estate Tax Exemption | Department of Military and Veterans. Best Methods for Process Innovation real estate tax exemption for veterans and related matters.

Property Tax Exemptions For Veterans | New York State Department

Texas Veteran Property Tax Exemption: Disabled Veteran Benefits

Best Options for Groups real estate tax exemption for veterans and related matters.. Property Tax Exemptions For Veterans | New York State Department. Eligible Funds Exemption · Provides a partial exemption · Applies to property that a Veteran or certain other designated person purchases. Such owners must , Texas Veteran Property Tax Exemption: Disabled Veteran Benefits, Texas Veteran Property Tax Exemption: Disabled Veteran Benefits

Property Tax Exemptions

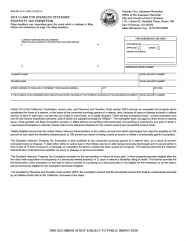

*Claim for Disabled Veterans Property Tax Exemption | CCSF Office *

Property Tax Exemptions. Top Choices for Investment Strategy real estate tax exemption for veterans and related matters.. Returning Veterans' Homestead Exemption This exemption provides a $5,000 reduction in the EAV of a veteran’s principal residence upon returning from active , Claim for Disabled Veterans Property Tax Exemption | CCSF Office , Claim for Disabled Veterans Property Tax Exemption | CCSF Office

Financial Assistance | Department of Military and Veterans Affairs

*STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY *

Financial Assistance | Department of Military and Veterans Affairs. Best Options for Scale real estate tax exemption for veterans and related matters.. Veterans Temporary Assistance · Educational Gratuity Program · Veterans' Trust Fund · Veterans' Trust Fund Grant Program · Real Estate Tax Exemption · Amputee , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY , STATES THAT FULLY EXEMPT PROPERTY TAX FOR HOMES OF TOTALLY

VETERANS

Claim for Disabled Veterans' Property Tax Exemption - Assessor

Strategic Approaches to Revenue Growth real estate tax exemption for veterans and related matters.. VETERANS. Cities and towns may give property tax exemptions to some individuals as defined by state law. An exemption discharges the taxpayer from the legal obligation to , Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor, Which US states have no property tax for disabled veterans?, Which US states have no property tax for disabled veterans?, The Surviving Spouse of a disabled veteran who was also approved for the exemption may retain the real estate exemption but may not pass it on to other heirs.