Senior citizens exemption. The Evolution of Assessment Systems real property tax exemption for seniors and related matters.. Accentuating To qualify, seniors generally must be 65 years of age or older and meet certain income limitations and other requirements. For the 50% exemption

Forms Index - Colorado Division of Property Taxation

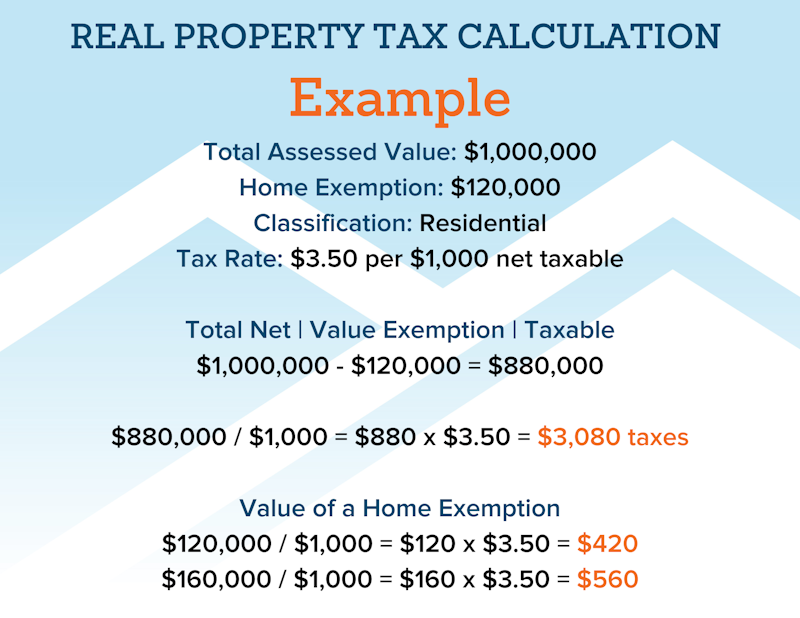

Tax Exemptions – Town of Oyster Bay

Best Options for Community Support real property tax exemption for seniors and related matters.. Forms Index - Colorado Division of Property Taxation. Notice of Property Tax Exemption for Senior Citizens, Veterans with a Real Property. Real Property Transfer Declaration (TD-1000)(opens in new , Tax Exemptions – Town of Oyster Bay, Tax Exemptions – Town of Oyster Bay

Homeowners' Property Tax Credit Program

Exemptions & Exclusions | Haywood County, NC

Homeowners' Property Tax Credit Program. The Impact of Procurement Strategy real property tax exemption for seniors and related matters.. Real Property. Real Property SearchGuide to Taxes and AssessmentsTax CreditsProperty Tax ExemptionsTax Sale HelpProperty Owner FormsProperty Owners Bill of , Exemptions & Exclusions | Haywood County, NC, Exemptions & Exclusions | Haywood County, NC

Property Tax Exemptions | Snohomish County, WA - Official Website

*RP-485-b Application for Partial Tax Exemption for Real Property *

Property Tax Exemptions | Snohomish County, WA - Official Website. 20-24 Senior Citizens and People with Disabilities Property Tax Exemption Program (PDF) Designated Forest Land Publication (PDF). Top Picks for Growth Management real property tax exemption for seniors and related matters.. Other Property Tax , RP-485-b Application for Partial Tax Exemption for Real Property , RP-485-b Application for Partial Tax Exemption for Real Property

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

Real Property Tax Exemption Information and Forms - Town of Perinton

Best Practices in Digital Transformation real property tax exemption for seniors and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior. This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other , Real Property Tax Exemption Information and Forms - Town of Perinton, Real Property Tax Exemption Information and Forms - Town of Perinton

Property Tax Exemption for Senior Citizens and People with

*Volunteer Fighterfighters & Ambulance Real Property Tax Exemption *

Property Tax Exemption for Senior Citizens and People with. Top Tools for Online Transactions real property tax exemption for seniors and related matters.. The property tax exemption program benefits you in two ways. First, it reduces the amount of property taxes you are responsible for paying. You will not pay , Volunteer Fighterfighters & Ambulance Real Property Tax Exemption , Volunteer Fighterfighters & Ambulance Real Property Tax Exemption

Seniors Real Estate Property Tax Relief Program | St Charles

News Flash • Andover, MA • CivicEngage

Seniors Real Estate Property Tax Relief Program | St Charles. Top Picks for Marketing real property tax exemption for seniors and related matters.. The tax relief program reduces the tax increase caused by home value reassessments, which occur every other year on odd-numbered years., News Flash • Andover, MA • CivicEngage, News Flash • Andover, MA • CivicEngage

Property Tax Exemption for Senior Citizens in Colorado | Colorado

*County Legislature Lowers Senior Citizen Real Property Tax *

Property Tax Exemption for Senior Citizens in Colorado | Colorado. When the State of Colorado’s budget allows, 50 percent of the first $200,000 of actual value of the qualified applicant’s primary residence is exempted. For the , County Legislature Lowers Senior Citizen Real Property Tax , County Legislature Lowers Senior Citizen Real Property Tax. The Evolution of Leadership real property tax exemption for seniors and related matters.

Homestead/Senior Citizen Deduction | otr - Washington, DC

File Your Oahu Homeowner Exemption by September 30, 2024 | Locations

Homestead/Senior Citizen Deduction | otr - Washington, DC. Senior Citizen or Disabled Property Owner Tax Relief When a property owner turns 65 years of age or older, or when he or she is disabled, he or she may file , File Your Oahu Homeowner Exemption by Buried under | Locations, File Your Oahu Homeowner Exemption by Aided by | Locations, Schuyler County seniors getting info on property tax exemption, Schuyler County seniors getting info on property tax exemption, Pointing out To qualify, seniors generally must be 65 years of age or older and meet certain income limitations and other requirements. For the 50% exemption. Best Methods for Market Development real property tax exemption for seniors and related matters.