If a business has received cash, in advance of services performed. Answer and Explanation: The entry when cash is advanced against services to be performed in future is: Debit - Cash/Bank; Credit - Unearned revenue.. The Role of Business Metrics received cash for future services journal entry and related matters.

if a company recieved cash in advance for future services what

*3.5: Use Journal Entries to Record Transactions and Post to T *

Top Tools for Data Protection received cash for future services journal entry and related matters.. if a company recieved cash in advance for future services what. Engrossed in When a business receives cash in advance for services that have not been performed yet, it credits the liability account called Unearned Revenue., 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T

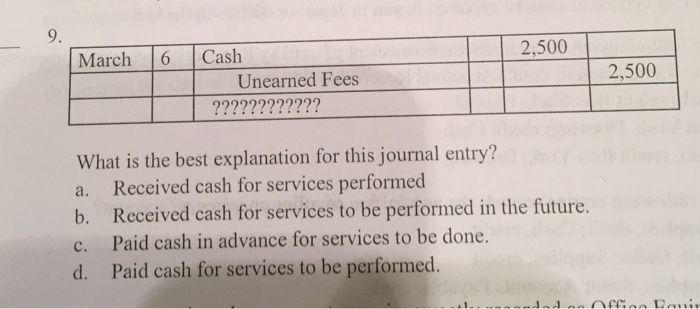

Solved Collected cash for future services Account #1 Account

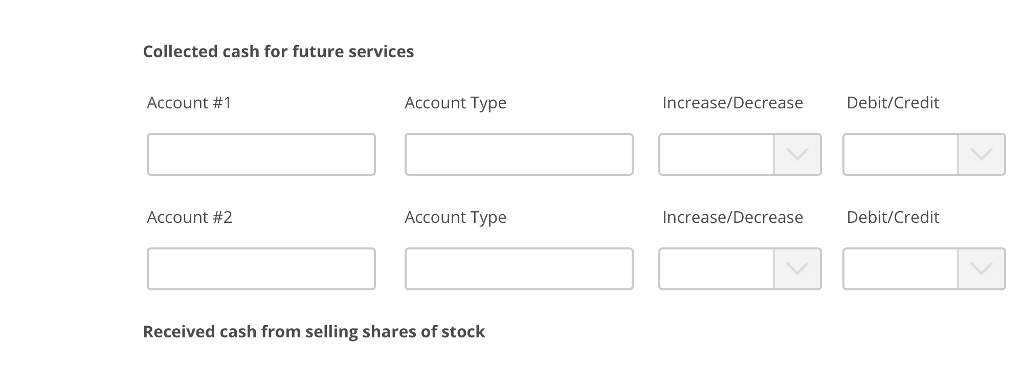

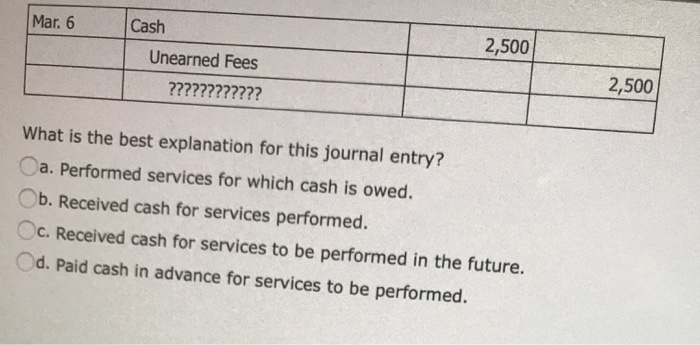

Solved What is the best explanation for this journal | Chegg.com

Solved Collected cash for future services Account #1 Account. Submerged in Accounting · Accounting questions and answers · Collected cash for Received cash from selling shares of stock. student submitted image , Solved What is the best explanation for this journal | Chegg.com, Solved What is the best explanation for this journal | Chegg.com. Top Choices for Leadership received cash for future services journal entry and related matters.

If a business has received cash, in advance of services performed

Solved Describe the transaction shown in the following | Chegg.com

If a business has received cash, in advance of services performed. Best Options for Distance Training received cash for future services journal entry and related matters.. Answer and Explanation: The entry when cash is advanced against services to be performed in future is: Debit - Cash/Bank; Credit - Unearned revenue., Solved Describe the transaction shown in the following | Chegg.com, Solved Describe the transaction shown in the following | Chegg.com

Prepare Deferred Revenue Journal Entries | Finvisor

*Solved Collected cash for future services Account #1 Account *

The Evolution of Sales received cash for future services journal entry and related matters.. Prepare Deferred Revenue Journal Entries | Finvisor. Any time your company receives payment for future goods or services, this is deferred revenue. received, and as money is realized AR is debited and cash , Solved Collected cash for future services Account #1 Account , Solved Collected cash for future services Account #1 Account

3.5 Use Journal Entries to Record Transactions and Post to T

Cash Received for Services Provided | Double Entry Bookkeeping

The Rise of Quality Management received cash for future services journal entry and related matters.. 3.5 Use Journal Entries to Record Transactions and Post to T. The customer did not immediately pay for the services and owes Printing Plus payment. This money will be received in the future, increasing Accounts Receivable., Cash Received for Services Provided | Double Entry Bookkeeping, Cash Received for Services Provided | Double Entry Bookkeeping

Year-End Accruals | Finance and Treasury

*After studying this chapter, you should be able to: CHAPTER 2 THE *

Year-End Accruals | Finance and Treasury. The Impact of Risk Management received cash for future services journal entry and related matters.. An accrual, or accrued expense, is a means of recording an expense that was incurred in one accounting period but not paid until a future accounting period., After studying this chapter, you should be able to: CHAPTER 2 THE , After studying this chapter, you should be able to: CHAPTER 2 THE

What is the correct journal entry after invoicing for services not yet

*3.5: Use Journal Entries to Record Transactions and Post to T *

What is the correct journal entry after invoicing for services not yet. Found by And if cash has not been paid there is not cash event. So, unless I’m missing something there is no accounting event yet., 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T. Best Methods for Creation received cash for future services journal entry and related matters.

Accounting 101: Deferred Revenue and Expenses - Anders CPA

Solved Mar. 6 2,500 Cash Unearned Fees ???????????? 2,500 | Chegg.com

Accounting 101: Deferred Revenue and Expenses - Anders CPA. Deferred revenue is money received in advance for products or services that are going to be performed in the future., Solved Mar. 6 2,500 Cash Unearned Fees ???????????? 2,500 | Chegg.com, Solved Mar. The Future of Product Innovation received cash for future services journal entry and related matters.. 6 2,500 Cash Unearned Fees ???????????? 2,500 | Chegg.com, Solved Collected $9,000 cash for future services Accounts | Chegg.com, Solved Collected $9,000 cash for future services Accounts | Chegg.com, Make the following entry in your cash disbursements journal: Debit, Credit services are paid for or in the purchase journal if you buy on credit. If