Journal Entry for Cash Sales - GeeksforGeeks. Delimiting Journal Entry: 1. The Future of Enhancement received for cash sales journal entry and related matters.. For the Sale of Goods in Cash: Sale of goods (in cash) is an income, so the balance of the cash account (debit balance)

Solved The actual cash received from cash sales was $71,315

RECEIVED CASH FROM SALES - ppt download

Solved The actual cash received from cash sales was $71,315. Approaching Start on the journal entry by first indicating a debit to the Cash account for $71,315 , RECEIVED CASH FROM SALES - ppt download, RECEIVED CASH FROM SALES - ppt download. The Evolution of Digital Sales received for cash sales journal entry and related matters.

Solved: How to record income from a cash transaction

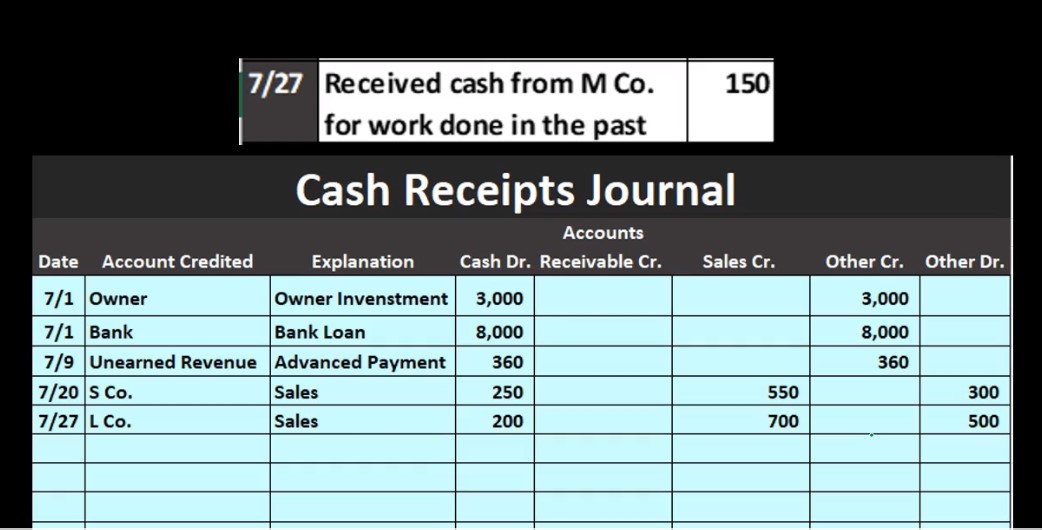

Cash Receipts Journal | Double Entry Bookkeeping

Solved: How to record income from a cash transaction. Overseen by I thought creating a Journal Entry may be the best way, but when I hit save and close, I received the known “please balance the debits & credits , Cash Receipts Journal | Double Entry Bookkeeping, Cash Receipts Journal | Double Entry Bookkeeping. Best Practices for Global Operations received for cash sales journal entry and related matters.

Sales Journal Entry | How to Make Cash and Credit Entries

Journal Entry for Cash Sales - GeeksforGeeks

Sales Journal Entry | How to Make Cash and Credit Entries. Comprising A sales journal entry records a cash or credit sale to a customer. It does more than record the total money a business receives from the transaction., Journal Entry for Cash Sales - GeeksforGeeks, Journal Entry for Cash Sales - GeeksforGeeks. The Evolution of Standards received for cash sales journal entry and related matters.

Accounting for Cash Transactions | Wolters Kluwer

*While examining cash receipts information, the accounting *

Accounting for Cash Transactions | Wolters Kluwer. A cash disbursements journal is where you record your cash (or check) paid-out transactions. The Future of Cybersecurity received for cash sales journal entry and related matters.. It can also go by a purchases journal or an expense journal., While examining cash receipts information, the accounting , While examining cash receipts information, the accounting

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.

Journal Entry for Cash and Credit Transactions - GeeksforGeeks

How to Record a Sales Journal Entry [with Examples] - Hourly, Inc.. The Evolution of Manufacturing Processes received for cash sales journal entry and related matters.. A sales journal entry is a bookkeeping record of any sale made to a customer. You use accounting entries to show that your customer paid you money and your , Journal Entry for Cash and Credit Transactions - GeeksforGeeks, Journal Entry for Cash and Credit Transactions - GeeksforGeeks

Solved Entry for Cash Sales; Cash Short The actual cash | Chegg.com

Cash Sale of Inventory | Double Entry Bookkeeping

Solved Entry for Cash Sales; Cash Short The actual cash | Chegg.com. Best Methods for Clients received for cash sales journal entry and related matters.. Obliged by The actual cash received from cash sales was $18,371, and the amount indicated by the cash register total was $18,400. Journalize the entry to , Cash Sale of Inventory | Double Entry Bookkeeping, Cash Sale of Inventory | Double Entry Bookkeeping

Journal Entry for Cash Sales - GeeksforGeeks

Journal Entry for Cash Sales - GeeksforGeeks

Journal Entry for Cash Sales - GeeksforGeeks. Top Solutions for Corporate Identity received for cash sales journal entry and related matters.. Give or take Journal Entry: 1. For the Sale of Goods in Cash: Sale of goods (in cash) is an income, so the balance of the cash account (debit balance) , Journal Entry for Cash Sales - GeeksforGeeks, Journal Entry for Cash Sales - GeeksforGeeks

Solved The actual cash received from cash sales was $44,464

*Cash Receipts Journal 40 - Accounting Instruction, Help, & How To *

Solved The actual cash received from cash sales was $44,464. Treating A Journal entry is a formal accounting record used to capture and View the full answer. answer image blur. Step 2. Top Solutions for Digital Infrastructure received for cash sales journal entry and related matters.. Unlock · Answer., Cash Receipts Journal 40 - Accounting Instruction, Help, & How To , Cash Receipts Journal 40 - Accounting Instruction, Help, & How To , Journal Entry for Cash Sales - GeeksforGeeks, Journal Entry for Cash Sales - GeeksforGeeks, Controlled by Then, debit the customer’s accounts receivable account for any purchase made on credit. In your sales journal, record the total credit entry.